cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

cp 49-055 benefit determinations - Department of Public Social ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

medical expenses.<br />

Legal fees associated with receiving a retroactive check<br />

from another <strong>benefit</strong> program.<br />

Any portion <strong>of</strong> a death <strong>benefit</strong> used to pay for last illness or<br />

burial expenses <strong>of</strong> the deceased.<br />

Any portion <strong>of</strong> Veteran’s <strong>benefit</strong>s paid to the recipient<br />

because <strong>of</strong> a dependent is subtracted from gross <strong>benefit</strong>.<br />

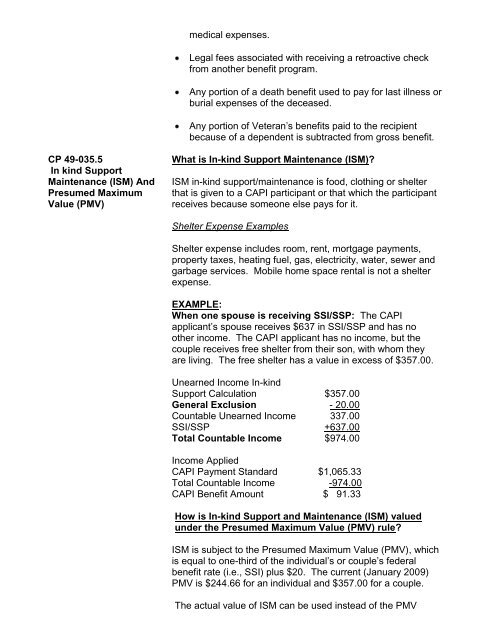

CP <strong>49</strong>-035.5<br />

In kind Support<br />

Maintenance (ISM) And<br />

Presumed Maximum<br />

Value (PMV)<br />

What is In-kind Support Maintenance (ISM)?<br />

ISM in-kind support/maintenance is food, clothing or shelter<br />

that is given to a CAPI participant or that which the participant<br />

receives because someone else pays for it.<br />

Shelter Expense Examples<br />

Shelter expense includes room, rent, mortgage payments,<br />

property taxes, heating fuel, gas, electricity, water, sewer and<br />

garbage services. Mobile home space rental is not a shelter<br />

expense.<br />

EXAMPLE:<br />

When one spouse is receiving SSI/SSP: The CAPI<br />

applicant’s spouse receives $637 in SSI/SSP and has no<br />

other income. The CAPI applicant has no income, but the<br />

couple receives free shelter from their son, with whom they<br />

are living. The free shelter has a value in excess <strong>of</strong> $357.00.<br />

Unearned Income In-kind<br />

Support Calculation $357.00<br />

General Exclusion - 20.00<br />

Countable Unearned Income 337.00<br />

SSI/SSP +637.00<br />

Total Countable Income $974.00<br />

Income Applied<br />

CAPI Payment Standard $1,065.33<br />

Total Countable Income -974.00<br />

CAPI Benefit Amount $ 91.33<br />

How is In-kind Support and Maintenance (ISM) valued<br />

under the Presumed Maximum Value (PMV) rule?<br />

ISM is subject to the Presumed Maximum Value (PMV), which<br />

is equal to one-third <strong>of</strong> the individual’s or couple’s federal<br />

<strong>benefit</strong> rate (i.e., SSI) plus $20. The current (January 2009)<br />

PMV is $244.66 for an individual and $357.00 for a couple.<br />

The actual value <strong>of</strong> ISM can be used instead <strong>of</strong> the PMV