DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Demand<br />

Occupational demand continued to improve over the second and third quarter of<br />

2007. In prime locations, the demand is being driven almost exclusively by<br />

multiple clothing retailers. Especially retail parks, shopping centres (new and<br />

existing), higher-yielding small-sized retail parks and DIY stores, are very much<br />

looked for by tenants.<br />

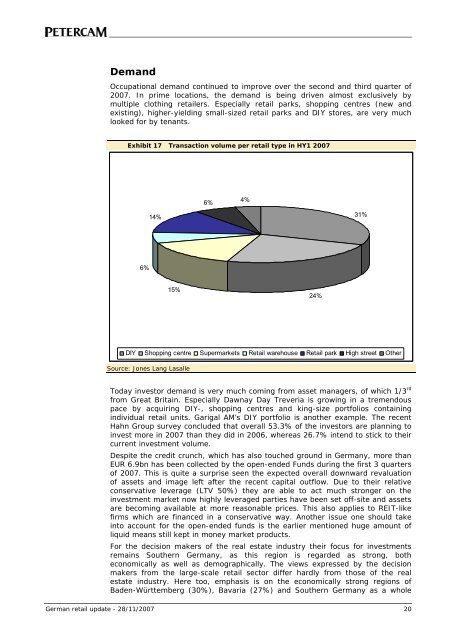

Exhibit 17 Transaction volume per retail type in HY1 2007<br />

6%<br />

14%<br />

15%<br />

6%<br />

German retail update - 28/11/2007 20<br />

4%<br />

DIY Shopping centre Supermarkets Retail warehouse Retail park High street Other<br />

Source: Jones Lang Lasalle<br />

Today investor demand is very much coming from asset managers, of which 1/3 rd<br />

from Great Britain. Especially Dawnay Day Treveria is growing in a tremendous<br />

pace by acquiring DIY-, shopping centres and king-size portfolios containing<br />

individual retail units. Garigal AM’s DIY portfolio is another example. The recent<br />

Hahn Group survey concluded that overall 53.3% of the investors are planning to<br />

invest more in 2007 than they did in 2006, whereas 26.7% intend to stick to their<br />

current investment volume.<br />

Despite the credit crunch, which has also touched ground in Germany, more than<br />

EUR 6.9bn has been collected by the open-ended Funds during the first 3 quarters<br />

of 2007. This is quite a surprise seen the expected overall downward revaluation<br />

of assets and image left after the recent capital outflow. Due to their relative<br />

conservative leverage (LTV 50%) they are able to act much stronger on the<br />

investment market now highly leveraged parties have been set off-site and assets<br />

are becoming available at more reasonable prices. This also applies to REIT-like<br />

firms which are financed in a conservative way. Another issue one should take<br />

into account for the open-ended funds is the earlier mentioned huge amount of<br />

liquid means still kept in money market products.<br />

For the decision makers of the real estate industry their focus for investments<br />

remains Southern Germany, as this region is regarded as strong, both<br />

economically as well as demographically. The views expressed by the decision<br />

makers from the large-scale retail sector differ hardly from those of the real<br />

estate industry. Here too, emphasis is on the economically strong regions of<br />

Baden-Württemberg (30%), Bavaria (27%) and Southern Germany as a whole<br />

24%<br />

31%