DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Yields<br />

As stated before, from an investment point of view 2006 was one of the best<br />

years ever for retail, very much supported by the low interest rates. Total<br />

investment volume in retail only was EUR 15.5bn, i.e. 1/3 rd of total real estate<br />

volume in Germany and 182% higher than 2005. However, the Karstadt deal only<br />

made up for 29%. Demand of Anglo-Saxon investors remained very high.<br />

In June 2007 yields were unchanged on March 2007 across all sub sectors,<br />

following the downward yield shift in the first quarter. There is a little sign of<br />

investor interest diminishing and the second quarter recorded numerous<br />

transactions. However, we have to take into account that –due to the credit<br />

crunch perils- higher financing costs have led to a withdrawal of financially driven<br />

investors which made up for 65% of total commercial property transactions last<br />

year. During last 3 months yields for retail premises have increased by 50 basis<br />

points on average.<br />

In order to put things in perspective we have to look back however. Net initial<br />

yields of western German retail property in city centres have risen over the past<br />

ten years by 30 basis points to roughly 6.5%. In the east of Germany initial yields<br />

have climbed since 1995 by 80 basis points and are currently about one<br />

percentage point above the level in the west. Here, too, there are marked regional<br />

differences. In Dresden the initial yield, close to 6%, is well below the average<br />

East German level, in Görlitz, at almost 10%, is clearly above. Both the trend and<br />

the yield differential between East and West German cities are plausible in the<br />

light of the market developments described. They clearly reflect the higher risk in<br />

the weaker retail markets, some of which post high vacancy rates. It speaks for<br />

itself that the risk premium for the eastern part has always been in place,<br />

although a certain conversion has taken place lately.<br />

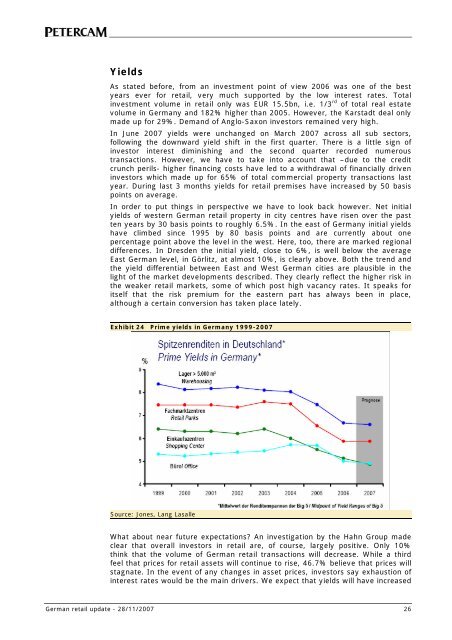

Exhibit 24 Prime yields in Germany 1999-2007<br />

Source: Jones, Lang Lasalle<br />

What about near future expectations? An investigation by the Hahn Group made<br />

clear that overall investors in retail are, of course, largely positive. Only 10%<br />

think that the volume of German retail transactions will decrease. While a third<br />

feel that prices for retail assets will continue to rise, 46.7% believe that prices will<br />

stagnate. In the event of any changes in asset prices, investors say exhaustion of<br />

interest rates would be the main drivers. We expect that yields will have increased<br />

German retail update - 28/11/2007 26