DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Hahn Group<br />

• Bloomberg ticker: H4I GR Eq.<br />

• Market cap: EUR 125m<br />

• Free float: 18.6%<br />

For the past 25 years the Hahn Group has specialized itself in large-scale retail<br />

real estate. They perform investments for own account, asset management for<br />

third parties and fund management. Currently it has 1.4 million m 2 under<br />

management spread out over 150 locations and a total volume of around EUR<br />

2.1bn. The specific retail properties managed by Hahn are superstores,<br />

hypermarkets, DIY stores and shopping centres. The company is particularly<br />

active in smaller and medium-sized cities and towns as the objects offer a specific<br />

competitive advantage. Major tenants are the Metro Group, Edeka, REWE,<br />

Tengelmann and Kaufland. The average yield on properties is estimated to be<br />

around 6.9%. Following the IPO in October 2006 (General Standard in Frankfurt),<br />

the Hahn Group is listed on all German stock exchanges. In 2008 they will apply<br />

for the Prime Standard. Founding father Michael Hahn –today chairman of the<br />

supervisory board- still owns 78.9%.<br />

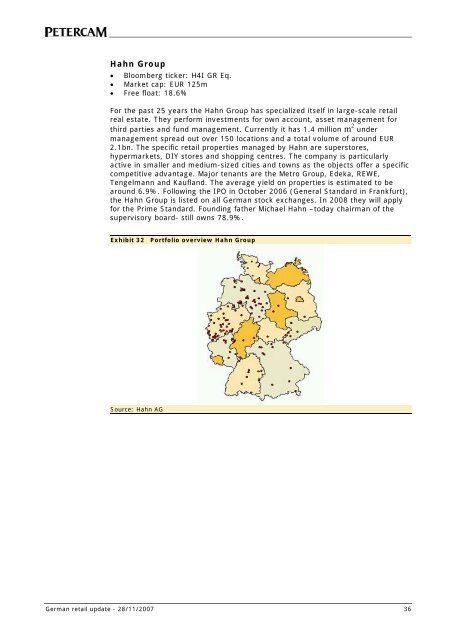

Exhibit 32 Portfolio overview Hahn Group<br />

Source: Hahn AG<br />

German retail update - 28/11/2007 36