DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

DIRECT MARKET REPORT GERMAN RETAIL - Europe Real Estate

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5 covered by Petercam Research<br />

Available products<br />

Not many dedicated German retail players are on our radar screen. The best<br />

known listed players are Deutsche EuroShop, Hahn Group, Dawnay Day Treveria,<br />

BBI Immobilien and GWB. All have quite a distinctive business model. Vastned<br />

Retail left the German market in 2004, Eurocommercial Properties is looking<br />

passively for opportunities.<br />

Deutsche EuroShop 5<br />

• Bloomberg ticker: DEQ GY Eq.<br />

• Market cap: EUR 941.8m<br />

• Free float: 81%<br />

Deutsche EuroShop buys & holds foremost shopping centres and currently has<br />

equity interests in 16 <strong>Europe</strong>an shopping centres in Germany, Austria, Hungary<br />

and Poland. The market value of these shopping centres, which are predominantly<br />

in city centre locations, amounts to EUR2.6bn (1,650 shops, 643,000m 2 GLA). The<br />

occupancy rate has been in excess of 99% for quite some time now. Leases have<br />

10 year duration, no break-up options are in place, turnover-linked rents and a<br />

CPI threshold. Rent to sales is 6.5-8.5%. Major tenants are the Metro Group,<br />

Douglas, Peek & Cloppenburg, H&M, New Yorker and Zara. Fashion is still king<br />

with 47% of all tenants from that sector.<br />

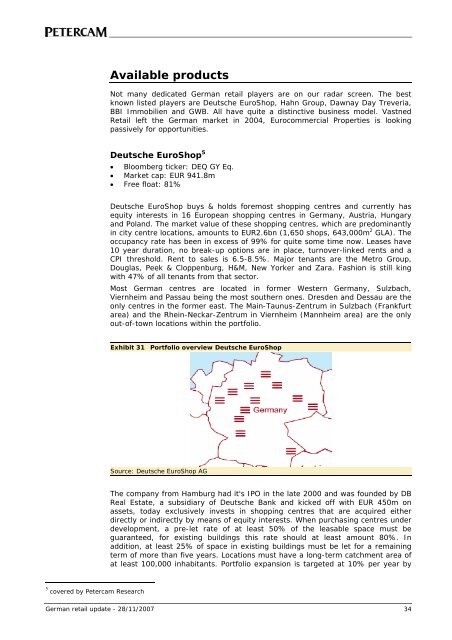

Most German centres are located in former Western Germany, Sulzbach,<br />

Viernheim and Passau being the most southern ones. Dresden and Dessau are the<br />

only centres in the former east. The Main-Taunus-Zentrum in Sulzbach (Frankfurt<br />

area) and the Rhein-Neckar-Zentrum in Viernheim (Mannheim area) are the only<br />

out-of-town locations within the portfolio.<br />

Exhibit 31 Portfolio overview Deutsche EuroShop<br />

Source: Deutsche EuroShop AG<br />

The company from Hamburg had it's IPO in the late 2000 and was founded by DB<br />

<strong>Real</strong> <strong>Estate</strong>, a subsidiary of Deutsche Bank and kicked off with EUR 450m on<br />

assets, today exclusively invests in shopping centres that are acquired either<br />

directly or indirectly by means of equity interests. When purchasing centres under<br />

development, a pre-let rate of at least 50% of the leasable space must be<br />

guaranteed, for existing buildings this rate should at least amount 80%. In<br />

addition, at least 25% of space in existing buildings must be let for a remaining<br />

term of more than five years. Locations must have a long-term catchment area of<br />

at least 100,000 inhabitants. Portfolio expansion is targeted at 10% per year by<br />

German retail update - 28/11/2007 34