The Pork Industry at a Glance - National Pork Board

The Pork Industry at a Glance - National Pork Board

The Pork Industry at a Glance - National Pork Board

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Pork</strong> Production<br />

Public<br />

<strong>Pork</strong><br />

Names and<br />

Environment<br />

St<strong>at</strong>s<br />

Glossary<br />

Today Health Safety Numbers<br />

Quick Facts<br />

Quick Facts<br />

<strong>Pork</strong> St<strong>at</strong>s<br />

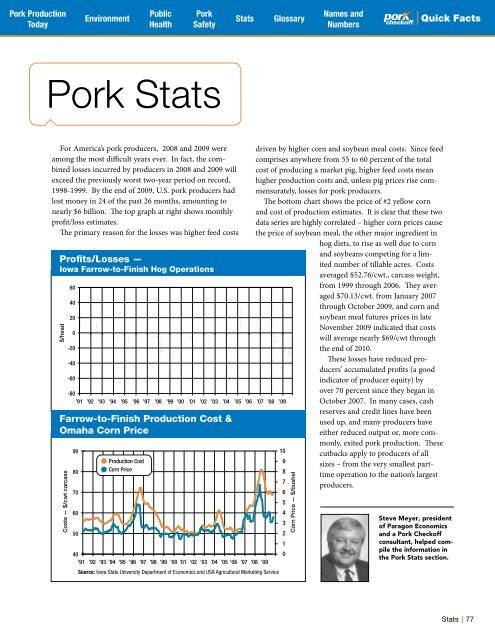

For America’s pork producers, 2008 and 2009 were<br />

among the most difficult years ever. In fact, the combined<br />

losses incurred by producers in 2008 and 2009 will<br />

exceed the previously worst two-year period on record,<br />

1998-1999. By the end of 2009, U.S. pork producers had<br />

lost money in 24 of the past 26 months, amounting to<br />

nearly $6 billion. <strong>The</strong> top graph <strong>at</strong> right shows monthly<br />

profit/loss estim<strong>at</strong>es.<br />

<strong>The</strong> primary reason for the losses was higher feed costs<br />

Profits/Losses —<br />

Iowa Farrow-to-Finish Hog Oper<strong>at</strong>ions<br />

$/head<br />

$/head<br />

Costs — $/cwt carcass<br />

Costs — $/cwt carcass<br />

60<br />

60<br />

40<br />

40<br />

20<br />

20<br />

0<br />

0<br />

-20<br />

-20<br />

-40<br />

-40<br />

-60<br />

-60<br />

-80<br />

-80<br />

’91 ’92 ’93 ’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09<br />

’91 ’92 ’93 ’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09<br />

Farrow-to-Finish Production Cost &<br />

Omaha Corn Price<br />

90<br />

90<br />

80<br />

80<br />

Production Cost<br />

Production Cost<br />

Corn Price<br />

Corn Price<br />

70<br />

6<br />

70<br />

6<br />

5<br />

5<br />

60<br />

4<br />

60<br />

4<br />

3<br />

3<br />

50<br />

2<br />

50<br />

2<br />

1<br />

1<br />

40<br />

0<br />

40<br />

0<br />

’91 ’92 ’93 ’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09<br />

’91 ’92 ’93 ’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09<br />

Source: Iowa St<strong>at</strong>e University Department of Economics and USA Agricultural Marketing Service<br />

driven by higher corn and soybean meal costs. Since feed<br />

comprises anywhere from 55 to 60 percent of the total<br />

cost of producing a market pig, higher feed costs mean<br />

higher production costs and, unless pig prices rise commensur<strong>at</strong>ely,<br />

losses for pork producers.<br />

<strong>The</strong> bottom chart shows the price of #2 yellow corn<br />

and cost of production estim<strong>at</strong>es. It is clear th<strong>at</strong> these two<br />

d<strong>at</strong>a series are highly correl<strong>at</strong>ed – higher corn prices cause<br />

the price of soybean meal, the other major ingredient in<br />

hog diets, to rise as well due to corn<br />

and soybeans competing for a limited<br />

number of tillable acres. Costs<br />

averaged $52.76/cwt., carcass weight,<br />

from 1999 through 2006. <strong>The</strong>y averaged<br />

$70.13/cwt. from January 2007<br />

through October 2009, and corn and<br />

soybean meal futures prices in l<strong>at</strong>e<br />

November 2009 indic<strong>at</strong>ed th<strong>at</strong> costs<br />

will average nearly $69/cwt through<br />

the end of 2010.<br />

<strong>The</strong>se losses have reduced producers’<br />

accumul<strong>at</strong>ed profits (a good<br />

indic<strong>at</strong>or of producer equity) by<br />

over 70 percent since they began in<br />

October 2007. In many cases, cash<br />

reserves and credit lines have been<br />

used up, and many producers have<br />

either reduced output or, more commonly,<br />

exited pork production. <strong>The</strong>se<br />

10<br />

10<br />

cutbacks apply to producers of all<br />

9<br />

9<br />

sizes – from the very smallest parttime<br />

oper<strong>at</strong>ion to the n<strong>at</strong>ion’s largest<br />

8<br />

8<br />

7<br />

7<br />

producers.<br />

Corn Price — $/bushel<br />

Corn Price — $/bushel<br />

Steve Meyer, president<br />

of Paragon Economics<br />

and a <strong>Pork</strong> Checkoff<br />

consultant, helped compile<br />

the inform<strong>at</strong>ion in<br />

the <strong>Pork</strong> St<strong>at</strong>s section.<br />

St<strong>at</strong>s<br />

77