Evergreen - Prudential

Evergreen - Prudential

Evergreen - Prudential

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

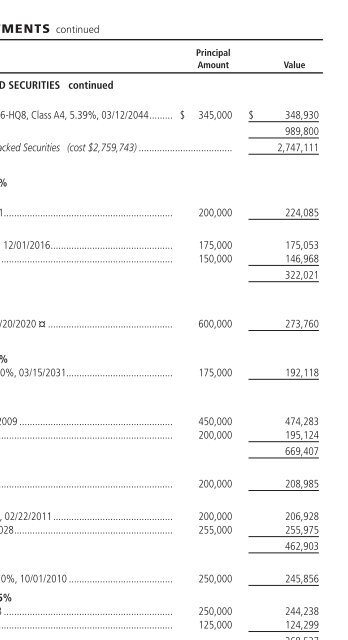

SCHEDULE OF INVESTMENTS continued<br />

December 31, 2006<br />

Principal<br />

Amount<br />

Value<br />

COMMERCIAL MORTGAGE-BACKED SECURITIES continued<br />

FLOATING-RATE continued<br />

Morgan Stanley Capital I, Inc., Ser. 2006-HQ8, Class A4, 5.39%, 03/12/2044......... $ 345,000 $ 348,930<br />

989,800<br />

Total Commercial Mortgage-Backed Securities (cost $2,759,743) .................................... 2,747,111<br />

CORPORATE BONDS 5.6%<br />

CONSUMER DISCRETIONARY 0.7%<br />

Media 0.3%<br />

Time Warner, Inc., 7.625%, 04/15/2031................................................................. 200,000 224,085<br />

Specialty Retail 0.4%<br />

Federated Retail Holdings, Inc., 5.90%, 12/01/2016............................................... 175,000 175,053<br />

Home Depot, Inc., 5.40%, 03/01/2016 .................................................................. 150,000 146,968<br />

322,021<br />

CONSUMER STAPLES 0.3%<br />

Beverages 0.3%<br />

Coca-Cola Enterprises, Inc., 0.00%, 06/20/2020 G ................................................ 600,000 273,760<br />

ENERGY 0.2%<br />

Oil, Gas & Consumable Fuels 0.2%<br />

Kinder Morgan Energy Partners, LP, 7.40%, 03/15/2031......................................... 175,000 192,118<br />

FINANCIALS 2.5%<br />

Capital Markets 0.8%<br />

Bank of New York Co., 7.30%, 12/01/2009 ........................................................... 450,000 474,283<br />

Morgan Stanley, 3.875%, 01/15/2009................................................................... 200,000 195,124<br />

669,407<br />

Commercial Banks 0.3%<br />

U.S. Bancorp, 6.375%, 08/01/2011 ....................................................................... 200,000 208,985<br />

Consumer Finance 0.6%<br />

General Electric Capital Corp., 6.125%, 02/22/2011.............................................. 200,000 206,928<br />

Sprint Capital Corp., 6.875%, 11/15/2028............................................................. 255,000 255,975<br />

462,903<br />

Insurance 0.3%<br />

American International Group, Inc., 4.70%, 10/01/2010 ........................................ 250,000 245,856<br />

Real Estate Investment Trusts 0.5%<br />

Duke Realty Corp., 3.35%, 01/15/2008 ................................................................. 250,000 244,238<br />

ProLogis, 5.625%, 11/15/2016.............................................................................. 125,000 124,299<br />

368,537<br />

HEALTH CARE 0.7%<br />

Health Care Providers & Services 0.3%<br />

UnitedHealth Group, Inc., 5.375%, 03/15/2016..................................................... 200,000 198,410<br />

See Notes to Financial Statements<br />

13