Evergreen - Prudential

Evergreen - Prudential

Evergreen - Prudential

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FUND AT A GLANCE<br />

as of December 31, 2006<br />

MANAGEMENT<br />

TEAM<br />

Investment Advisor:<br />

• <strong>Evergreen</strong><br />

Investment<br />

Management<br />

Company, LLC<br />

Sub-Advisor:<br />

• Tattersall Advisory<br />

Group, Inc.<br />

Portfolio Managers:<br />

• Walter T.<br />

McCormick, CFA<br />

• Robert A.<br />

Calhoun, CFA<br />

• Parham M.<br />

Behrooz, CFA<br />

• Mehmet<br />

Camurdan, CFA<br />

• Eric R. Harper, CFA<br />

• Todd C. Kuimjian,<br />

CFA<br />

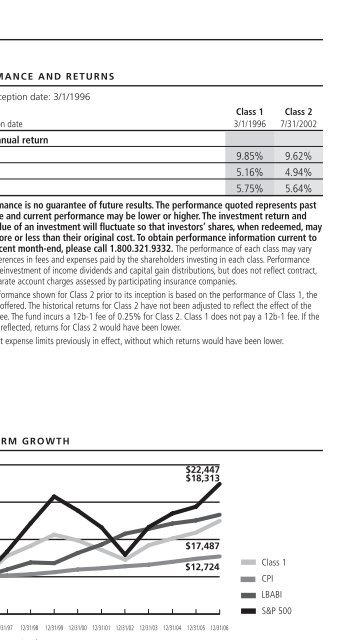

PERFORMANCE AND RETURNS<br />

Portfolio inception date: 3/1/1996<br />

Class 1 Class 2<br />

Class inception date 3/1/1996 7/31/2002<br />

Average annual return<br />

1-year 9.85% 9.62%<br />

5-year 5.16% 4.94%<br />

10-year 5.75% 5.64%<br />

Past performance is no guarantee of future results. The performance quoted represents past<br />

performance and current performance may be lower or higher. The investment return and<br />

principal value of an investment will fluctuate so that investors’ shares, when redeemed, may<br />

be worth more or less than their original cost. To obtain performance information current to<br />

the most recent month-end, please call 1.800.321.9332. The performance of each class may vary<br />

based on differences in fees and expenses paid by the shareholders investing in each class. Performance<br />

includes the reinvestment of income dividends and capital gain distributions, but does not reflect contract,<br />

policy, or separate account charges assessed by participating insurance companies.<br />

Historical performance shown for Class 2 prior to its inception is based on the performance of Class 1, the<br />

original class offered. The historical returns for Class 2 have not been adjusted to reflect the effect of the<br />

class’ 12b-1 fee. The fund incurs a 12b-1 fee of 0.25% for Class 2. Class 1 does not pay a 12b-1 fee. If the<br />

fee had been reflected, returns for Class 2 would have been lower.<br />

Returns reflect expense limits previously in effect, without which returns would have been lower.<br />

LONG-TERM GROWTH<br />

$25,000<br />

$22,447<br />

$18,313<br />

$20,000<br />

$15,000<br />

$10,000<br />

$5,000<br />

$17,487<br />

$12,724<br />

12/31/96 12/31/97 12/31/98 12/31/99 12/31/00 12/31/01 12/31/02 12/31/03 12/31/04 12/31/05 12/31/06<br />

Class 1<br />

LBABI<br />

S&P 500<br />

Comparison of a $10,000 investment in the <strong>Evergreen</strong> VA Balanced Fund Class<br />

1 shares versus a similar investment in the Lehman Brothers Aggregate Bond<br />

Index (LBABI), the S&P 500 Index (S&P 500) and the Consumer Price Index<br />

(CPI).<br />

CPI<br />

6<br />

The LBABI and the S&P 500 are unmanaged market indexes and do not<br />

include transaction costs associated with buying and selling securities, any<br />

mutual fund fees or expenses or any taxes. The CPI is a commonly used<br />

measure of inflation and does not represent an investment return. It is not<br />

possible to invest directly in an index.