Evergreen - Prudential

Evergreen - Prudential

Evergreen - Prudential

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

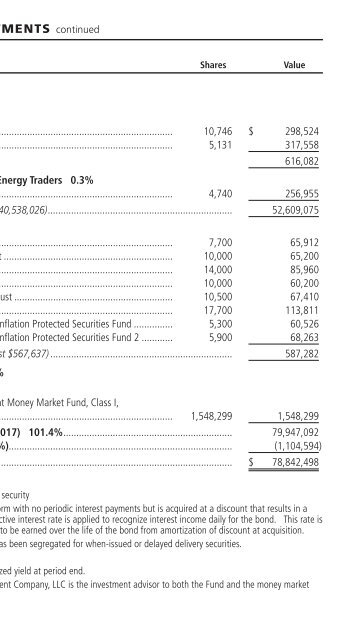

SCHEDULE OF INVESTMENTS continued<br />

December 31, 2006<br />

Shares<br />

Value<br />

COMMON STOCKS continued<br />

UTILITIES 1.1%<br />

Electric Utilities 0.8%<br />

DPL, Inc. ............................................................................................................... 10,746 $ 298,524<br />

Exelon Corp. ......................................................................................................... 5,131 317,558<br />

616,082<br />

Independent Power Producers & Energy Traders 0.3%<br />

TXU Corp. ............................................................................................................ 4,740 256,955<br />

Total Common Stocks (cost $40,538,026)....................................................................... 52,609,075<br />

MUTUAL FUND SHARES 0.7%<br />

MFS Charter Income Trust...................................................................................... 7,700 65,912<br />

MFS Government Markets Income Trust ................................................................. 10,000 65,200<br />

MFS Intermediate Income Trust.............................................................................. 14,000 85,960<br />

MFS Multimarket Income Trust............................................................................... 10,000 60,200<br />

Putnam Master Intermediate Income Trust ............................................................. 10,500 67,410<br />

Putnam Premier Income Trust ................................................................................ 17,700 113,811<br />

Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund ............... 5,300 60,526<br />

Western Asset/Claymore U.S. Treasury Inflation Protected Securities Fund 2 ............ 5,900 68,263<br />

Total Mutual Fund Shares (cost $567,637) ...................................................................... 587,282<br />

SHORT-TERM INVESTMENTS 2.0%<br />

MUTUAL FUND SHARES 2.0%<br />

<strong>Evergreen</strong> Institutional U.S. Government Money Market Fund, Class I,<br />

5.01% q ø ## (cost $1,548,299)................................................................... 1,548,299 1,548,299<br />

Total Investments (cost $67,898,017) 101.4%................................................................. 79,947,092<br />

Other Assets and Liabilities (1.4%)...................................................................................... (1,104,594)<br />

Net Assets 100.0%................................................................................................................. $ 78,842,498<br />

# When-issued or delayed delivery security<br />

G Security issued in zero coupon form with no periodic interest payments but is acquired at a discount that results in a<br />

current yield to maturity. An effective interest rate is applied to recognize interest income daily for the bond. This rate is<br />

based on total expected income to be earned over the life of the bond from amortization of discount at acquisition.<br />

## All or a portion of this security has been segregated for when-issued or delayed delivery securities.<br />

* Non-income producing security<br />

q Rate shown is the 7-day annualized yield at period end.<br />

ø <strong>Evergreen</strong> Investment Management Company, LLC is the investment advisor to both the Fund and the money market<br />

fund.<br />

Summary of Abbreviations<br />

ADR American Depository Receipt<br />

FHLMC Federal Home Loan Mortgage Corp.<br />

FNMA Federal National Mortgage Association<br />

GNMA Government National Mortgage Association<br />

MASTR Mortgage Asset Securitization Transactions, Inc.<br />

TBA To Be Announced<br />

See Notes to Financial Statements<br />

19