Evergreen - Prudential

Evergreen - Prudential

Evergreen - Prudential

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

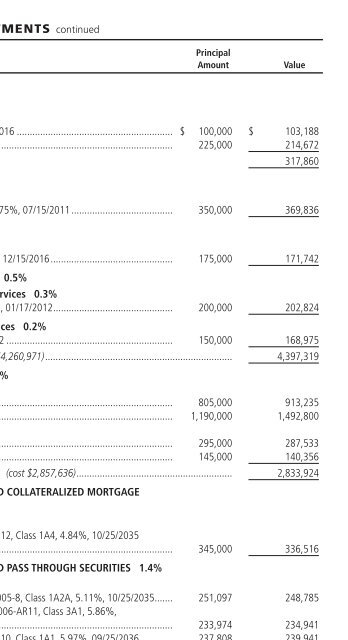

SCHEDULE OF INVESTMENTS continued<br />

December 31, 2006<br />

Principal<br />

Amount<br />

Value<br />

CORPORATE BONDS continued<br />

HEALTH CARE continued<br />

Pharmaceuticals 0.4%<br />

Abbott Laboratories, 5.875%, 05/15/2016 ............................................................ $ 100,000 $ 103,188<br />

Merck & Co., Inc., 4.75%, 03/01/2015 .................................................................. 225,000 214,672<br />

317,860<br />

INDUSTRIALS 0.5%<br />

Road & Rail 0.5%<br />

Burlington Northern Santa Fe Corp., 6.75%, 07/15/2011 ....................................... 350,000 369,836<br />

MATERIALS 0.2%<br />

Chemicals 0.2%<br />

E.I. DuPont de Nemours & Co., 5.25%, 12/15/2016............................................... 175,000 171,742<br />

TELECOMMUNICATION SERVICES 0.5%<br />

Diversified Telecommunication Services 0.3%<br />

Verizon Communications, Inc., 5.875%, 01/17/2012.............................................. 200,000 202,824<br />

Wireless Telecommunication Services 0.2%<br />

Cingular Wireless, 8.125%, 05/01/2012 ................................................................ 150,000 168,975<br />

Total Corporate Bonds (cost $4,260,971)........................................................................ 4,397,319<br />

U.S. TREASURY OBLIGATIONS 3.6%<br />

U.S. Treasury Bonds:<br />

6.00%, 02/15/2026 ##................................................................................... 805,000 913,235<br />

7.25%, 08/15/2022........................................................................................ 1,190,000 1,492,800<br />

U.S. Treasury Notes:<br />

3.375%, 11/15/2008...................................................................................... 295,000 287,533<br />

4.25%, 08/15/2015........................................................................................ 145,000 140,356<br />

Total U.S. Treasury Obligations (cost $2,857,636)............................................................ 2,833,924<br />

WHOLE LOAN MORTGAGE-BACKED COLLATERALIZED MORTGAGE<br />

OBLIGATIONS 0.4%<br />

FLOATING-RATE 0.4%<br />

Washington Mutual, Inc., Ser. 2005-AR12, Class 1A4, 4.84%, 10/25/2035<br />

(cost $340,861) .............................................................................................. 345,000 336,516<br />

WHOLE LOAN MORTGAGE-BACKED PASS THROUGH SECURITIES 1.4%<br />

FLOATING-RATE 1.4%<br />

Citigroup Mtge. Loan Trust, Inc., Ser. 2005-8, Class 1A2A, 5.11%, 10/25/2035....... 251,097 248,785<br />

IndyMac INDX Mtge. Loan Trust, Ser. 2006-AR11, Class 3A1, 5.86%,<br />

06/25/2036 .................................................................................................... 233,974 234,941<br />

Washington Mutual, Inc., Ser. 2006-AR10, Class 1A1, 5.97%, 09/25/2036 ............ 237,808 239,941<br />

Wells Fargo Mtge. Backed Securities Trust, Ser. 2006-AR10, Class 5A1, 5.61%,<br />

07/25/2036 .................................................................................................... 367,305 367,891<br />

Total Whole Loan Mortgage-Backed Pass Through Securities<br />

(cost $1,083,157)......................................................................................................... 1,091,558<br />

See Notes to Financial Statements<br />

14