Evergreen - Prudential

Evergreen - Prudential

Evergreen - Prudential

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

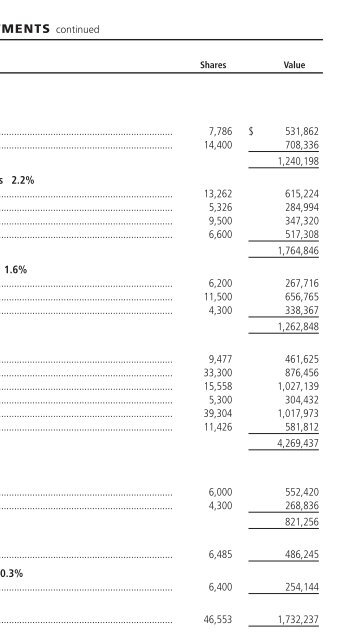

SCHEDULE OF INVESTMENTS continued<br />

December 31, 2006<br />

Shares<br />

Value<br />

COMMON STOCKS continued<br />

HEALTH CARE 10.8%<br />

Biotechnology 1.6%<br />

Amgen, Inc. *........................................................................................................ 7,786 $ 531,862<br />

Biogen Idec, Inc. *................................................................................................. 14,400 708,336<br />

1,240,198<br />

Health Care Equipment & Supplies 2.2%<br />

Baxter International, Inc. ...................................................................................... 13,262 615,224<br />

Medtronic, Inc. ..................................................................................................... 5,326 284,994<br />

St. Jude Medical, Inc. *.......................................................................................... 9,500 347,320<br />

Zimmer Holdings, Inc. * ......................................................................................... 6,600 517,308<br />

1,764,846<br />

Health Care Providers & Services 1.6%<br />

Aetna, Inc. ........................................................................................................... 6,200 267,716<br />

Caremark Rx, Inc. ................................................................................................. 11,500 656,765<br />

WellPoint, Inc. * .................................................................................................... 4,300 338,367<br />

1,262,848<br />

Pharmaceuticals 5.4%<br />

Abbott Laboratories .............................................................................................. 9,477 461,625<br />

Bristol-Myers Co. .................................................................................................. 33,300 876,456<br />

Johnson & Johnson ............................................................................................... 15,558 1,027,139<br />

Novartis AG, ADR .................................................................................................. 5,300 304,432<br />

Pfizer, Inc. ............................................................................................................ 39,304 1,017,973<br />

Wyeth................................................................................................................... 11,426 581,812<br />

4,269,437<br />

INDUSTRIALS 5.5%<br />

Aerospace & Defense 1.1%<br />

Lockheed Martin Corp. ......................................................................................... 6,000 552,420<br />

United Technologies Corp. .................................................................................... 4,300 268,836<br />

821,256<br />

Air Freight & Logistics 0.6%<br />

United Parcel Service, Inc., Class B ......................................................................... 6,485 486,245<br />

Commercial Services & Supplies 0.3%<br />

Cintas Corp. ......................................................................................................... 6,400 254,144<br />

Industrial Conglomerates 2.2%<br />

General Electric Co. .............................................................................................. 46,553 1,732,237<br />

Machinery 1.3%<br />

Deere & Co. ......................................................................................................... 3,271 310,974<br />

Pall Corp. ............................................................................................................. 21,300 735,915<br />

1,046,889<br />

See Notes to Financial Statements<br />

17