Evergreen - Prudential

Evergreen - Prudential

Evergreen - Prudential

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO FINANCIAL STATEMENTS continued<br />

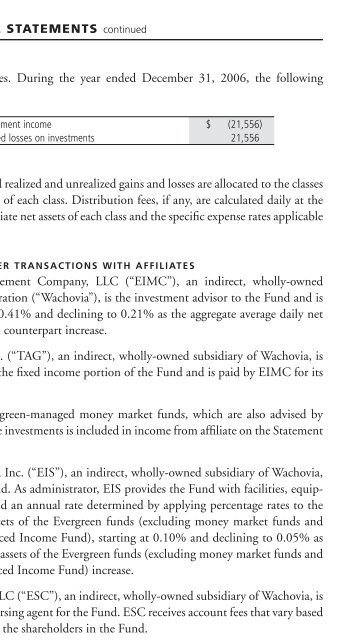

gage paydown gains and losses. During the year ended December 31, 2006, the following<br />

amounts were reclassified:<br />

Undistributed net investment income $ (21,556)<br />

Accumulated net realized losses on investments 21,556<br />

h. Class allocations<br />

Income, common expenses and realized and unrealized gains and losses are allocated to the classes<br />

based on the relative net assets of each class. Distribution fees, if any, are calculated daily at the<br />

class level based on the appropriate net assets of each class and the specific expense rates applicable<br />

to each class.<br />

3. ADVISORY FEE AND OTHER TRANSACTIONS WITH AFFILIATES<br />

<strong>Evergreen</strong> Investment Management Company, LLC (“EIMC”), an indirect, wholly-owned<br />

subsidiary of Wachovia Corporation (“Wachovia”), is the investment advisor to the Fund and is<br />

paid an annual fee starting at 0.41% and declining to 0.21% as the aggregate average daily net<br />

assets of the Fund and its retail counterpart increase.<br />

Tattersall Advisory Group, Inc. (“TAG”), an indirect, wholly-owned subsidiary of Wachovia, is<br />

the investment sub-advisor to the fixed income portion of the Fund and is paid by EIMC for its<br />

services to the Fund.<br />

The Fund may invest in <strong>Evergreen</strong>-managed money market funds, which are also advised by<br />

EIMC. Income earned on these investments is included in income from affiliate on the Statement<br />

of Operations.<br />

<strong>Evergreen</strong> Investment Services, Inc. (“EIS”), an indirect, wholly-owned subsidiary of Wachovia,<br />

is the administrator to the Fund. As administrator, EIS provides the Fund with facilities, equipment<br />

and personnel and is paid an annual rate determined by applying percentage rates to the<br />

aggregate average daily net assets of the <strong>Evergreen</strong> funds (excluding money market funds and<br />

<strong>Evergreen</strong> Institutional Enhanced Income Fund), starting at 0.10% and declining to 0.05% as<br />

the aggregate average daily net assets of the <strong>Evergreen</strong> funds (excluding money market funds and<br />

<strong>Evergreen</strong> Institutional Enhanced Income Fund) increase.<br />

<strong>Evergreen</strong> Service Company, LLC (“ESC”), an indirect, wholly-owned subsidiary of Wachovia, is<br />

the transfer and dividend disbursing agent for the Fund. ESC receives account fees that vary based<br />

on the type of account held by the shareholders in the Fund.<br />

The Fund has placed a portion of its portfolio transactions with brokerage firms that are affiliates<br />

of Wachovia. During the year ended December 31, 2006, the Fund paid brokerage commissions<br />

of $9,921 to Wachovia Securities, LLC.<br />

26