Cost of coffee.indd - RISC

Cost of coffee.indd - RISC

Cost of coffee.indd - RISC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

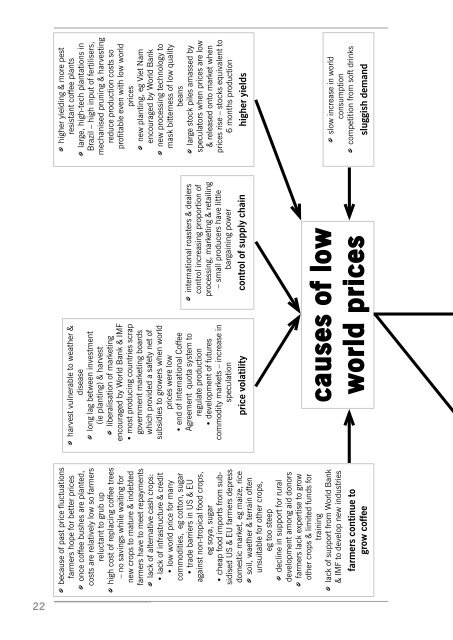

• because <strong>of</strong> past price fluctuations<br />

farmers hope for better prices<br />

• once c<strong>of</strong>fee bushes are planted,<br />

costs are relatively low so farmers<br />

reluctant to grub up<br />

• high cost <strong>of</strong> replacing c<strong>of</strong>fee trees<br />

– no savings while waiting for<br />

new crops to mature & indebted<br />

farmers have to meet repayments<br />

• lack <strong>of</strong> alternative cash crops:<br />

• lack <strong>of</strong> infrastructure & credit<br />

• low world price for many<br />

commodities, eg cotton, sugar<br />

• trade barriers in US & EU<br />

against non-tropical food crops,<br />

eg soya, sugar<br />

• cheap food imports from subsidised<br />

US & EU farmers depress<br />

domestic market, eg maize, rice<br />

• soil, waether & terrain <strong>of</strong>ten<br />

unsuitable for other crops,<br />

eg too steep<br />

• decline in support for rural<br />

development among aid donors<br />

• farmers lack expertise to grow<br />

other crops & limited funds for<br />

training<br />

• lack <strong>of</strong> support from World Bank<br />

& IMF to develop new industries<br />

farmers continue to<br />

grow c<strong>of</strong>fee<br />

• harvest vulnerable to weather &<br />

disease<br />

• long lag between investment<br />

(ie planting) & harvest<br />

• liberalisation <strong>of</strong> marketing<br />

encouraged by World Bank & IMF<br />

• most producing countries scrap<br />

government marketing boards<br />

which provided a safety net <strong>of</strong><br />

subsidies to growers when world<br />

prices were low<br />

• end <strong>of</strong> International C<strong>of</strong>fee<br />

Agreement quota system to<br />

regulate production<br />

• development <strong>of</strong> futures<br />

commodity markets – increase in<br />

speculation<br />

price volatility<br />

• international roasters & dealers<br />

control increasing proportion <strong>of</strong><br />

processing, marketing & retailing<br />

– small producers have little<br />

bargaining power<br />

control <strong>of</strong> supply chain<br />

causes <strong>of</strong> low<br />

world prices<br />

• higher yielding & more pest<br />

resistant c<strong>of</strong>fee plants<br />

• large, high-tech plantations in<br />

Brazil – high input <strong>of</strong> fertilisers,<br />

mechanised pruning & harvesting<br />

reduce production costs so<br />

pr<strong>of</strong>itable even with low world<br />

prices<br />

• new planting, eg Viet Nam<br />

encouraged by World Bank<br />

• new processing technology to<br />

mask bitterness <strong>of</strong> low quality<br />

beans<br />

• large stock piles amassed by<br />

speculators when prices are low<br />

& released onto market when<br />

prices rise – stocks equivalent to<br />

6 months production<br />

higher yields<br />

• slow increase in world<br />

consumption<br />

• competition from s<strong>of</strong>t drinks<br />

sluggish demand<br />

22