Annual Reports - RTÃ

Annual Reports - RTÃ

Annual Reports - RTÃ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT & GROUP FINANCIAL STATEMENTS 2007<br />

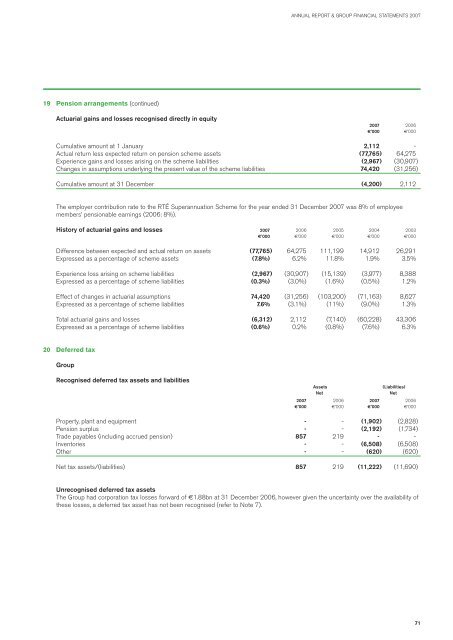

19 Pension arrangements (continued)<br />

Actuarial gains and losses recognised directly in equity<br />

2007 2006<br />

€’000 €’000<br />

Cumulative amount at 1 January 2,112 -<br />

Actual return less expected return on pension scheme assets (77,765) 64,275<br />

Experience gains and losses arising on the scheme liabilities (2,967) (30,907)<br />

Changes in assumptions underlying the present value of the scheme liabilities 74,420 (31,256)<br />

Cumulative amount at 31 December (4,200) 2,112<br />

The employer contribution rate to the RTÉ Superannuation Scheme for the year ended 31 December 2007 was 8% of employee<br />

members’ pensionable earnings (2006: 8%).<br />

History of actuarial gains and losses 2007 2006 2005 2004 2003<br />

€’000 €’000 €’000 €’000 €’000<br />

Difference between expected and actual return on assets (77,765) 64,275 111,199 14,912 26,291<br />

Expressed as a percentage of scheme assets (7.8%) 6.2% 11.8% 1.9% 3.5%<br />

Experience loss arising on scheme liabilities (2,967) (30,907) (15,139) (3,977) 8,388<br />

Expressed as a percentage of scheme liabilities (0.3%) (3.0%) (1.6%) (0.5%) 1.2%<br />

Effect of changes in actuarial assumptions 74,420 (31,256) (103,200) (71,163) 8,627<br />

Expressed as a percentage of scheme liabilities 7.6% (3.1%) (11%) (9.0%) 1.3%<br />

Total actuarial gains and losses (6,312) 2,112 (7,140) (60,228) 43,306<br />

Expressed as a percentage of scheme liabilities (0.6%) 0.2% (0.8%) (7.6%) 6.3%<br />

20 Deferred tax<br />

Group<br />

Recognised deferred tax assets and liabilities<br />

Assets<br />

(Liabilities)<br />

Net<br />

Net<br />

2007 2006 2007 2006<br />

€’000 €’000 €’000 €’000<br />

Property, plant and equipment - - (1,902) (2,828)<br />

Pension surplus - - (2,192) (1,734)<br />

Trade payables (including accrued pension) 857 219 - -<br />

Inventories - - (6,508) (6,508)<br />

Other - - (620) (620)<br />

Net tax assets/(liabilities) 857 219 (11,222) (11,690)<br />

Unrecognised deferred tax assets<br />

The Group had corporation tax losses forward of €1.88bn at 31 December 2006, however given the uncertainty over the availability of<br />

these losses, a deferred tax asset has not been recognised (refer to Note 7).<br />

71