Annual Reports - RTÃ

Annual Reports - RTÃ

Annual Reports - RTÃ

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT & GROUP FINANCIAL STATEMENTS 2007<br />

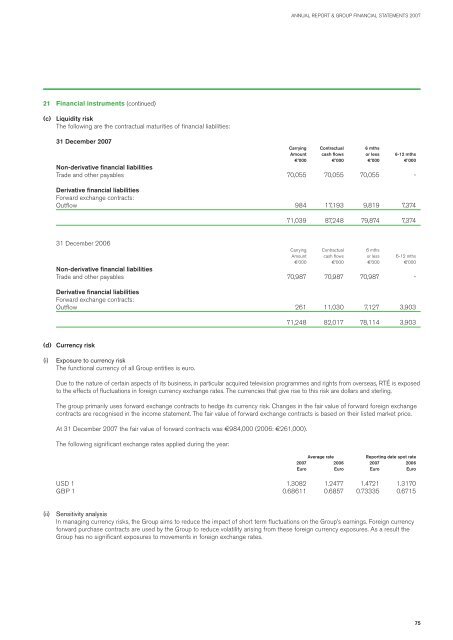

21 Financial instruments (continued)<br />

(c) Liquidity risk<br />

The following are the contractual maturities of financial liabilities:<br />

31 December 2007<br />

Carrying Contractual 6 mths<br />

Amount cash flows or less 6-12 mths<br />

€’000 €’000 €’000 €’000<br />

Non-derivative financial liabilities<br />

Trade and other payables 70,055 70,055 70,055 -<br />

Derivative financial liabilities<br />

Forward exchange contracts:<br />

Outflow 984 17,193 9,819 7,374<br />

71,039 87,248 79,874 7,374<br />

31 December 2006<br />

Carrying Contractual 6 mths<br />

Amount cash flows or less 6-12 mths<br />

€’000 €’000 €’000 €’000<br />

Non-derivative financial liabilities<br />

Trade and other payables 70,987 70,987 70,987 -<br />

Derivative financial liabilities<br />

Forward exchange contracts:<br />

Outflow 261 11,030 7,127 3,903<br />

71,248 82,017 78,114 3,903<br />

(d) Currency risk<br />

(i)<br />

Exposure to currency risk<br />

The functional currency of all Group entities is euro.<br />

Due to the nature of certain aspects of its business, in particular acquired television programmes and rights from overseas, RTÉ is exposed<br />

to the effects of fluctuations in foreign currency exchange rates. The currencies that give rise to this risk are dollars and sterling.<br />

The group primarily uses forward exchange contracts to hedge its currency risk. Changes in the fair value of forward foreign exchange<br />

contracts are recognised in the income statement. The fair value of forward exchange contracts is based on their listed market price.<br />

At 31 December 2007 the fair value of forward contracts was €984,000 (2006: €261,000).<br />

The following significant exchange rates applied during the year:<br />

Average rate<br />

Reporting date spot rate<br />

2007 2006 2007 2006<br />

Euro Euro Euro Euro<br />

USD 1 1.3082 1.2477 1.4721 1.3170<br />

GBP 1 0.68611 0.6857 0.73335 0.6715<br />

(ii) Sensitivity analysis<br />

In managing currency risks, the Group aims to reduce the impact of short term fluctuations on the Group’s earnings. Foreign currency<br />

forward purchase contracts are used by the Group to reduce volatility arising from these foreign currency exposures. As a result the<br />

Group has no significant exposures to movements in foreign exchange rates.<br />

75