The ABCs of systemic healthcare reform - Cerner Corporation

The ABCs of systemic healthcare reform - Cerner Corporation

The ABCs of systemic healthcare reform - Cerner Corporation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

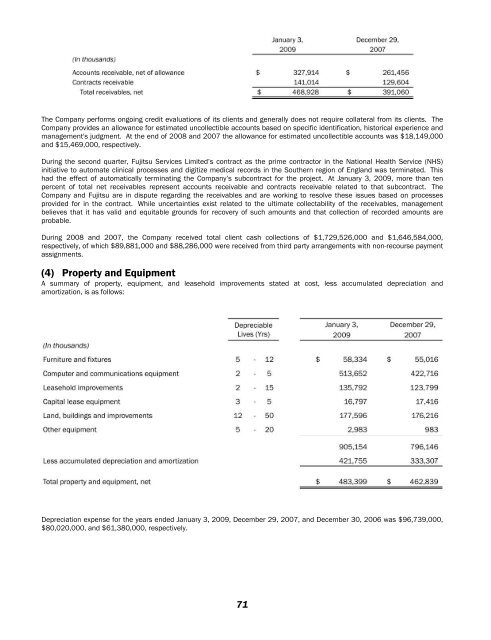

<strong>The</strong> Company performs ongoing credit evaluations <strong>of</strong> its clients and generally does not require collateral from its clients. <strong>The</strong><br />

Company provides an allowance for estimated uncollectible accounts based on specific identification, historical experience and<br />

management's judgment. At the end <strong>of</strong> 2008 and 2007 the allowance for estimated uncollectible accounts was $18,149,000<br />

and $15,469,000, respectively.<br />

During the second quarter, Fujitsu Services Limited’s contract as the prime contractor in the National Health Service (NHS)<br />

initiative to automate clinical processes and digitize medical records in the Southern region <strong>of</strong> England was terminated. This<br />

had the effect <strong>of</strong> automatically terminating the Company’s subcontract for the project. At January 3, 2009, more than ten<br />

percent <strong>of</strong> total net receivables represent accounts receivable and contracts receivable related to that subcontract. <strong>The</strong><br />

Company and Fujitsu are in dispute regarding the receivables and are working to resolve these issues based on processes<br />

provided for in the contract. While uncertainties exist related to the ultimate collectability <strong>of</strong> the receivables, management<br />

believes that it has valid and equitable grounds for recovery <strong>of</strong> such amounts and that collection <strong>of</strong> recorded amounts are<br />

probable.<br />

During 2008 and 2007, the Company received total client cash collections <strong>of</strong> $1,729,526,000 and $1,646,584,000,<br />

respectively, <strong>of</strong> which $89,881,000 and $88,286,000 were received from third party arrangements with non-recourse payment<br />

assignments.<br />

(4) Property and Equipment<br />

A summary <strong>of</strong> property, equipment, and leasehold improvements stated at cost, less accumulated depreciation and<br />

amortization, is as follows:<br />

Depreciation expense for the years ended January 3, 2009, December 29, 2007, and December 30, 2006 was $96,739,000,<br />

$80,020,000, and $61,380,000, respectively.<br />

71