The ABCs of systemic healthcare reform - Cerner Corporation

The ABCs of systemic healthcare reform - Cerner Corporation

The ABCs of systemic healthcare reform - Cerner Corporation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

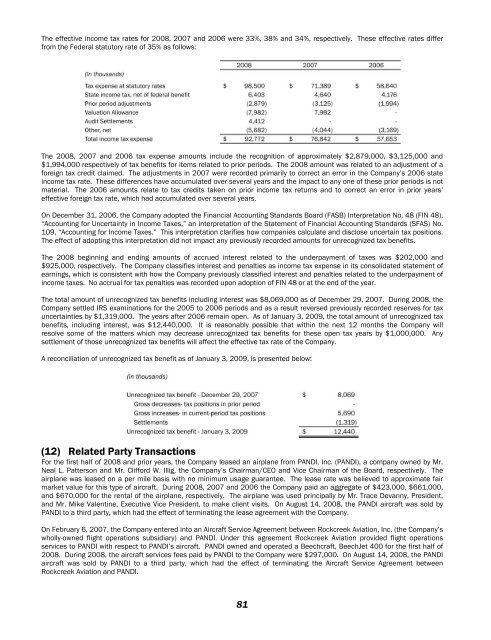

<strong>The</strong> effective income tax rates for 2008, 2007 and 2006 were 33%, 38% and 34%, respectively. <strong>The</strong>se effective rates differ<br />

from the Federal statutory rate <strong>of</strong> 35% as follows:<br />

<strong>The</strong> 2008, 2007 and 2006 tax expense amounts include the recognition <strong>of</strong> approximately $2,879,000, $3,125,000 and<br />

$1,994,000 respectively <strong>of</strong> tax benefits for items related to prior periods. <strong>The</strong> 2008 amount was related to an adjustment <strong>of</strong> a<br />

foreign tax credit claimed. <strong>The</strong> adjustments in 2007 were recorded primarily to correct an error in the Company’s 2006 state<br />

income tax rate. <strong>The</strong>se differences have accumulated over several years and the impact to any one <strong>of</strong> these prior periods is not<br />

material. <strong>The</strong> 2006 amounts relate to tax credits taken on prior income tax returns and to correct an error in prior years’<br />

effective foreign tax rate, which had accumulated over several years.<br />

On December 31, 2006, the Company adopted the Financial Accounting Standards Board (FASB) Interpretation No. 48 (FIN 48),<br />

“Accounting for Uncertainty in Income Taxes,” an interpretation <strong>of</strong> the Statement <strong>of</strong> Financial Accounting Standards (SFAS) No.<br />

109, “Accounting for Income Taxes.” This interpretation clarifies how companies calculate and disclose uncertain tax positions.<br />

<strong>The</strong> effect <strong>of</strong> adopting this interpretation did not impact any previously recorded amounts for unrecognized tax benefits.<br />

<strong>The</strong> 2008 beginning and ending amounts <strong>of</strong> accrued interest related to the underpayment <strong>of</strong> taxes was $202,000 and<br />

$925,000, respectively. <strong>The</strong> Company classifies interest and penalties as income tax expense in its consolidated statement <strong>of</strong><br />

earnings, which is consistent with how the Company previously classified interest and penalties related to the underpayment <strong>of</strong><br />

income taxes. No accrual for tax penalties was recorded upon adoption <strong>of</strong> FIN 48 or at the end <strong>of</strong> the year.<br />

<strong>The</strong> total amount <strong>of</strong> unrecognized tax benefits including interest was $8,069,000 as <strong>of</strong> December 29, 2007. During 2008, the<br />

Company settled IRS examinations for the 2005 to 2006 periods and as a result reversed previously recorded reserves for tax<br />

uncertainties by $1,319,000. <strong>The</strong> years after 2006 remain open. As <strong>of</strong> January 3, 2009, the total amount <strong>of</strong> unrecognized tax<br />

benefits, including interest, was $12,440,000. It is reasonably possible that within the next 12 months the Company will<br />

resolve some <strong>of</strong> the matters which may decrease unrecognized tax benefits for these open tax years by $1,000,000. Any<br />

settlement <strong>of</strong> those unrecognized tax benefits will affect the effective tax rate <strong>of</strong> the Company.<br />

A reconciliation <strong>of</strong> unrecognized tax benefit as <strong>of</strong> January 3, 2009, is presented below:<br />

(12) Related Party Transactions<br />

For the first half <strong>of</strong> 2008 and prior years, the Company leased an airplane from PANDI, Inc. (PANDI), a company owned by Mr.<br />

Neal L. Patterson and Mr. Clifford W. Illig, the Company’s Chairman/CEO and Vice Chairman <strong>of</strong> the Board, respectively. <strong>The</strong><br />

airplane was leased on a per mile basis with no minimum usage guarantee. <strong>The</strong> lease rate was believed to approximate fair<br />

market value for this type <strong>of</strong> aircraft. During 2008, 2007 and 2006 the Company paid an aggregate <strong>of</strong> $423,000, $661,000,<br />

and $670,000 for the rental <strong>of</strong> the airplane, respectively. <strong>The</strong> airplane was used principally by Mr. Trace Devanny, President,<br />

and Mr. Mike Valentine, Executive Vice President, to make client visits. On August 14, 2008, the PANDI aircraft was sold by<br />

PANDI to a third party, which had the effect <strong>of</strong> terminating the lease agreement with the Company.<br />

On February 6, 2007, the Company entered into an Aircraft Service Agreement between Rockcreek Aviation, Inc. (the Company’s<br />

wholly-owned flight operations subsidiary) and PANDI. Under this agreement Rockcreek Aviation provided flight operations<br />

services to PANDI with respect to PANDI’s aircraft. PANDI owned and operated a Beechcraft, BeechJet 400 for the first half <strong>of</strong><br />

2008. During 2008, the aircraft services fees paid by PANDI to the Company were $297,000. On August 14, 2008, the PANDI<br />

aircraft was sold by PANDI to a third party, which had the effect <strong>of</strong> terminating the Aircraft Service Agreement between<br />

Rockcreek Aviation and PANDI.<br />

81