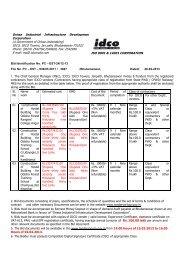

ESTIMATED COST RS.31.50 LAKH (RUPEES THIRTY-ONE ... - IDCO

ESTIMATED COST RS.31.50 LAKH (RUPEES THIRTY-ONE ... - IDCO

ESTIMATED COST RS.31.50 LAKH (RUPEES THIRTY-ONE ... - IDCO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

50<br />

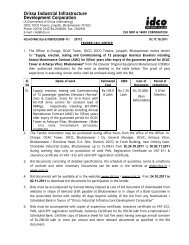

9. The tenderer shall also furnish a work schedule in the form of a bar chart for approval by<br />

the Corporation which shall also form part of agreement.<br />

10. When a tender is selected for acceptance, the tenderer shall deposit in the<br />

Corporation Office the required amount of the security money in shape of Bank<br />

Guarantee in the prescribed form on any nationalized bank located in the State of<br />

Orissa or Bank Draft in favour of the ‘Orissa Industrial Infrastructure Development<br />

Corporation’ on any nationalized Bank payable at Bhubaneswar. No tender shall be<br />

finally accepted until the required amount of the security money has been deposited.<br />

11. The amount of initial security deposit money to be deposited by the tenderer whose<br />

tender is selected for acceptance shall be 2(two) percent (including EMD already<br />

deposited) of the tendered amount of the work. The security money shall be<br />

deposited by the selected tenderer within such time as may be notified to him in<br />

writing by the Corporation, failing which tender shall be liable for rejection and<br />

Earnest money may be forfeited.<br />

12. In addition to the earnest money deposit (at the time of submission of tender) and<br />

security money (to be deposited by the selected tenderer before drawal of<br />

agreement) a further deduction of 5(Five) percent will be made from each and every<br />

bill of the Contractor towards performance security by the Corporation. The entire<br />

security money so deducted will be refunded to the Contractor after one calendar<br />

year from the date of completion of the work, i.e. after one year of successful testing<br />

& commissioning of the work.<br />

13. Besides, deductions towards Sales Tax (VAT) on works contact, and Income Tax<br />

will be made from each and every bill of the contractor as per statutory orders of the<br />

competent/appropriate authority and credited to the concerned Departments of<br />

State/Central Governments. Necessary certificate towards such deduction will be<br />

furnished by the Corporation to the contractor.<br />

14. Royalties on minor minerals used in the contract work shall be deducted from the<br />

contractors bill at source at rates prescribed as per statutory rules. However, the<br />

amount deducted towards royalty charges can be refunded to the contractor if<br />

clearance certificate from the concerned Departme1nt is produced by the Contractor<br />

establishing payment of the royality.<br />

15. The tenderer has to furnish attested copies copy of valid document showing <strong>IDCO</strong><br />

vendor /Valid license, PAN, Experience certificate, Clearance certificate on VAT –<br />

612, EPF Registration Certificate , Service Tax Registration Certificate , proof of<br />

ownership of machineries both in self possession or hire with company profile,