+1 - Solvay

+1 - Solvay

+1 - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial<br />

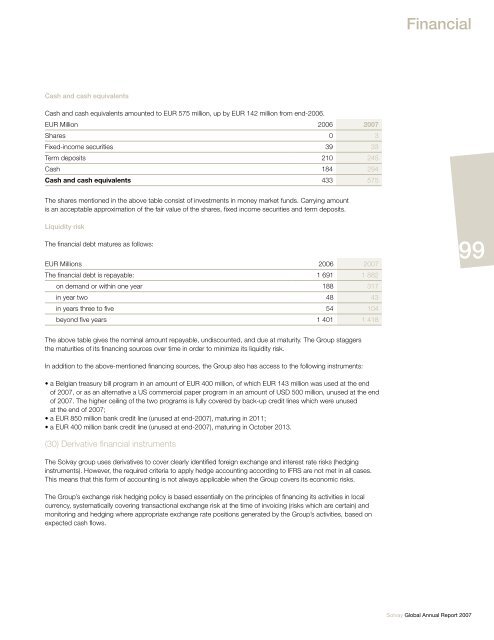

Cash and cash equivalents<br />

Cash and cash equivalents amounted to EUR 575 million, up by EUR 142 million from end-2006.<br />

EUR Million 2006 2007<br />

Shares 0 3<br />

Fixed-income securities 39 33<br />

Term deposits 210 245<br />

Cash 184 294<br />

Cash and cash equivalents 433 575<br />

The shares mentioned in the above table consist of investments in money market funds. Carrying amount<br />

is an acceptable approximation of the fair value of the shares, fixed income securities and term deposits.<br />

Liquidity risk<br />

The financial debt matures as follows:<br />

EUR Millions 2006 2007<br />

The financial debt is repayable: 1 691 1 882<br />

on demand or within one year 188 317<br />

in year two 48 43<br />

in years three to five 54 104<br />

beyond five years 1 401 1 418<br />

99<br />

The above table gives the nominal amount repayable, undiscounted, and due at maturity. The Group staggers<br />

the maturities of its financing sources over time in order to minimize its liquidity risk.<br />

In addition to the above-mentioned financing sources, the Group also has access to the following instruments:<br />

• a Belgian treasury bill program in an amount of EUR 400 million, of which EUR 143 million was used at the end<br />

of 2007, or as an alternative a US commercial paper program in an amount of USD 500 million, unused at the end<br />

of 2007. The higher ceiling of the two programs is fully covered by back-up credit lines which were unused<br />

at the end of 2007;<br />

• a EUR 850 million bank credit line (unused at end-2007), maturing in 2011;<br />

• a EUR 400 million bank credit line (unused at end-2007), maturing in October 2013.<br />

(30) Derivative financial instruments<br />

The <strong>Solvay</strong> group uses derivatives to cover clearly identified foreign exchange and interest rate risks (hedging<br />

instruments). However, the required criteria to apply hedge accounting according to IFRS are not met in all cases.<br />

This means that this form of accounting is not always applicable when the Group covers its economic risks.<br />

The Group’s exchange risk hedging policy is based essentially on the principles of financing its activities in local<br />

currency, systematically covering transactional exchange risk at the time of invoicing (risks which are certain) and<br />

monitoring and hedging where appropriate exchange rate positions generated by the Group’s activities, based on<br />

expected cash flows.<br />

<strong>Solvay</strong> Global Annual Report 2007