+1 - Solvay

+1 - Solvay

+1 - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial<br />

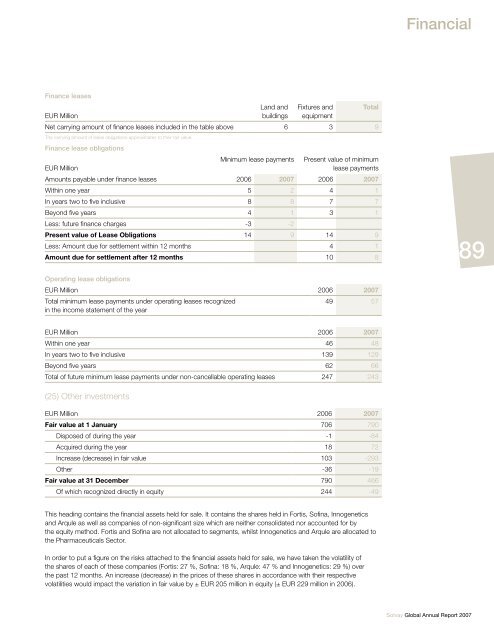

Finance leases<br />

EUR Million<br />

Land and<br />

buildings<br />

Fixtures and<br />

equipment<br />

Net carrying amount of finance leases included in the table above 6 3 9<br />

The carrying amount of lease obligations approximates to their fair value.<br />

Finance lease obligations<br />

EUR Million<br />

Minimum lease payments<br />

Total<br />

Present value of minimum<br />

lease payments<br />

Amounts payable under finance leases 2006 2007 2006 2007<br />

Within one year 5 2 4 1<br />

In years two to five inclusive 8 8 7 7<br />

Beyond five years 4 1 3 1<br />

Less: future finance charges -3 -2<br />

Present value of Lease Obligations 14 9 14 9<br />

Less: Amount due for settlement within 12 months 4 1<br />

Amount due for settlement after 12 months 10 8<br />

89<br />

Operating lease obligations<br />

EUR Million 2006 2007<br />

Total minimum lease payments under operating leases recognized<br />

49 57<br />

in the income statement of the year<br />

EUR Million 2006 2007<br />

Within one year 46 48<br />

In years two to five inclusive 139 129<br />

Beyond five years 62 66<br />

Total of future minimum lease payments under non-cancellable operating leases 247 243<br />

(25) Other investments<br />

EUR Million 2006 2007<br />

Fair value at 1 January 706 790<br />

Disposed of during the year -1 -84<br />

Acquired during the year 18 72<br />

Increase (decrease) in fair value 103 -293<br />

Other -36 -19<br />

Fair value at 31 December 790 466<br />

Of which recognized directly in equity 244 -49<br />

This heading contains the financial assets held for sale. It contains the shares held in Fortis, Sofina, Innogenetics<br />

and Arqule as well as companies of non-significant size which are neither consolidated nor accounted for by<br />

the equity method. Fortis and Sofina are not allocated to segments, whilst Innogenetics and Arqule are allocated to<br />

the Pharmaceuticals Sector.<br />

In order to put a figure on the risks attached to the financial assets held for sale, we have taken the volatility of<br />

the shares of each of these companies (Fortis: 27 %, Sofina: 18 %, Arqule: 47 % and Innogenetics: 29 %) over<br />

the past 12 months. An increase (decrease) in the prices of these shares in accordance with their respective<br />

volatilities would impact the variation in fair value by ± EUR 205 million in equity (± EUR 229 million in 2006).<br />

<strong>Solvay</strong> Global Annual Report 2007