+1 - Solvay

+1 - Solvay

+1 - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial<br />

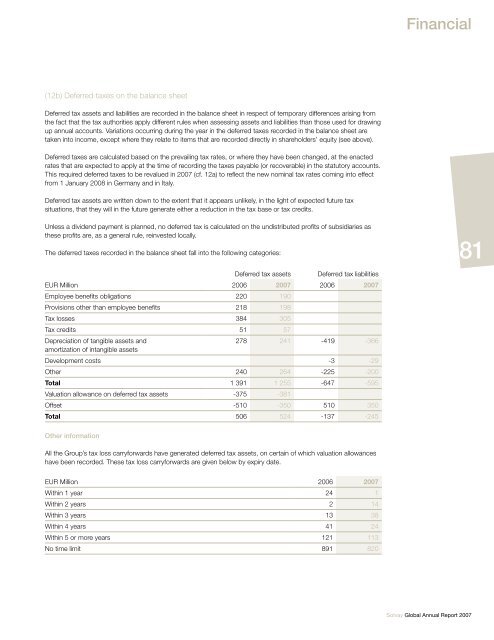

(12b) Deferred taxes on the balance sheet<br />

Deferred tax assets and liabilities are recorded in the balance sheet in respect of temporary differences arising from<br />

the fact that the tax authorities apply different rules when assessing assets and liabilities than those used for drawing<br />

up annual accounts. Variations occurring during the year in the deferred taxes recorded in the balance sheet are<br />

taken into income, except where they relate to items that are recorded directly in shareholders’ equity (see above).<br />

Deferred taxes are calculated based on the prevailing tax rates, or where they have been changed, at the enacted<br />

rates that are expected to apply at the time of recording the taxes payable (or recoverable) in the statutory accounts.<br />

This required deferred taxes to be revalued in 2007 (cf. 12a) to reflect the new nominal tax rates coming into effect<br />

from 1 January 2008 in Germany and in Italy.<br />

Deferred tax assets are written down to the extent that it appears unlikely, in the light of expected future tax<br />

situations, that they will in the future generate either a reduction in the tax base or tax credits.<br />

Unless a dividend payment is planned, no deferred tax is calculated on the undistributed profits of subsidiaries as<br />

these profits are, as a general rule, reinvested locally.<br />

The deferred taxes recorded in the balance sheet fall into the following categories:<br />

81<br />

Deferred tax assets<br />

Deferred tax liabilities<br />

EUR Million 2006 2007 2006 2007<br />

Employee benefits obligations 220 190<br />

Provisions other than employee benefits 218 198<br />

Tax losses 384 305<br />

Tax credits 51 57<br />

Depreciation of tangible assets and<br />

278 241 -419 -366<br />

amortization of intangible assets<br />

Development costs -3 -29<br />

Other 240 264 -225 -200<br />

Total 1 391 1 255 -647 -595<br />

Valuation allowance on deferred tax assets -375 -381<br />

Offset -510 -350 510 350<br />

Total 506 524 -137 -245<br />

Other information<br />

All the Group’s tax loss carryforwards have generated deferred tax assets, on certain of which valuation allowances<br />

have been recorded. These tax loss carryforwards are given below by expiry date.<br />

EUR Million 2006 2007<br />

Within 1 year 24 1<br />

Within 2 years 2 14<br />

Within 3 years 13 38<br />

Within 4 years 41 24<br />

Within 5 or more years 121 113<br />

No time limit 891 820<br />

<strong>Solvay</strong> Global Annual Report 2007