+1 - Solvay

+1 - Solvay

+1 - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial<br />

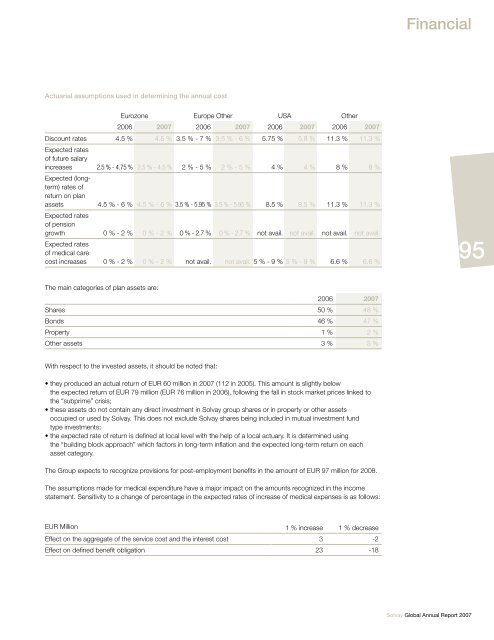

Actuarial assumptions used in determining the annual cost<br />

Eurozone Europe Other USA Other<br />

2006 2007 2006 2007 2006 2007 2006 2007<br />

Discount rates 4.5 % 4.5 % 3.5 % - 7 % 3.5 % - 6 % 5.75 % 5.8 % 11.3 % 11.3 %<br />

Expected rates<br />

of future salary<br />

increases 2.5 % - 4.75 % 2.5 % - 4.5 % 2 % - 5 % 2 % - 5 % 4 % 4 % 8 % 8 %<br />

Expected (longterm)<br />

rates of<br />

return on plan<br />

assets 4.5 % - 6 % 4.5 % - 6 % 3.5 % - 5.95 % 3.5 % - 5.95 % 8.5 % 8.5 % 11.3 % 11.3 %<br />

Expected rates<br />

of pension<br />

growth 0 % - 2 % 0 % - 2 % 0 % - 2.7 % 0 % - 2.7 % not avail. not avail. not avail. not avail.<br />

Expected rates<br />

of medical care<br />

cost increases 0 % - 2 % 0 % - 2 % not avail. not avail. 5 % - 9 % 5 % - 9 % 6.6 % 6.6 %<br />

95<br />

The main categories of plan assets are:<br />

2006 2007<br />

Shares 50 % 48 %<br />

Bonds 46 % 47 %<br />

Property 1 % 2 %<br />

Other assets 3 % 3 %<br />

With respect to the invested assets, it should be noted that:<br />

• they produced an actual return of EUR 60 million in 2007 (112 in 2005). This amount is slightly below<br />

the expected return of EUR 79 million (EUR 76 million in 2006), following the fall in stock market prices linked to<br />

the “subprime” crisis;<br />

• these assets do not contain any direct investment in <strong>Solvay</strong> group shares or in property or other assets<br />

occupied or used by <strong>Solvay</strong>. This does not exclude <strong>Solvay</strong> shares being included in mutual investment fund<br />

type investments;<br />

• the expected rate of return is defined at local level with the help of a local actuary. It is determined using<br />

the “building block approach” which factors in long-term inflation and the expected long-term return on each<br />

asset category.<br />

The Group expects to recognize provisions for post-employment benefits in the amount of EUR 97 million for 2008.<br />

The assumptions made for medical expenditure have a major impact on the amounts recognized in the income<br />

statement. Sensitivity to a change of percentage in the expected rates of increase of medical expenses is as follows:<br />

EUR Million 1 % increase 1 % decrease<br />

Effect on the aggregate of the service cost and the interest cost 3 -2<br />

Effect on defined benefit obligation 23 -18<br />

<strong>Solvay</strong> Global Annual Report 2007