+1 - Solvay

+1 - Solvay

+1 - Solvay

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

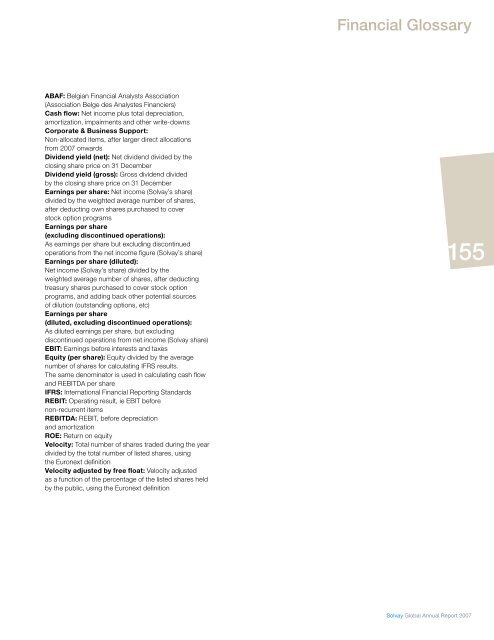

Financial Glossary<br />

ABAF: Belgian Financial Analysts Association<br />

(Association Belge des Analystes Financiers)<br />

Cash flow: Net income plus total depreciation,<br />

amortization, impairments and other write-downs<br />

Corporate & Business Support:<br />

Non-allocated items, after larger direct allocations<br />

from 2007 onwards<br />

Dividend yield (net): Net dividend divided by the<br />

closing share price on 31 December<br />

Dividend yield (gross): Gross dividend divided<br />

by the closing share price on 31 December<br />

Earnings per share: Net income (<strong>Solvay</strong>’s share)<br />

divided by the weighted average number of shares,<br />

after deducting own shares purchased to cover<br />

stock option programs<br />

Earnings per share<br />

(excluding discontinued operations):<br />

As earnings per share but excluding discontinued<br />

operations from the net income figure (<strong>Solvay</strong>’s share)<br />

Earnings per share (diluted):<br />

Net income (<strong>Solvay</strong>’s share) divided by the<br />

weighted average number of shares, after deducting<br />

treasury shares purchased to cover stock option<br />

programs, and adding back other potential sources<br />

of dilution (outstanding options, etc)<br />

Earnings per share<br />

(diluted, excluding discontinued operations):<br />

As diluted earnings per share, but excluding<br />

discontinued operations from net income (<strong>Solvay</strong> share)<br />

EBIT: Earnings before interests and taxes<br />

Equity (per share): Equity divided by the average<br />

number of shares for calculating IFRS results.<br />

The same denominator is used in calculating cash flow<br />

and REBITDA per share<br />

IFRS: International Financial Reporting Standards<br />

REBIT: Operating result, ie EBIT before<br />

non-recurrent items<br />

REBITDA: REBIT, before depreciation<br />

and amortization<br />

ROE: Return on equity<br />

Velocity: Total number of shares traded during the year<br />

divided by the total number of listed shares, using<br />

the Euronext definition<br />

Velocity adjusted by free float: Velocity adjusted<br />

as a function of the percentage of the listed shares held<br />

by the public, using the Euronext definition<br />

155<br />

<strong>Solvay</strong> Global Annual Report 2007