+1 - Solvay

+1 - Solvay

+1 - Solvay

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The balance consists of provisions for termination benefits (EUR 170 million, EUR 236 million in 2006), provisions<br />

for other long-term benefits (EUR 49 million, EUR 50 million in 2006) and provisions for benefits not valued<br />

in accordance with IAS 19 (EUR 12 million, the same as in 2006).<br />

The sharp decrease in provisions for termination benefits is mainly linked to payments made to persons leaving<br />

the Group following the restructuring of the Pharmaceuticals Sector (“INSPIRE” project) (EUR 103 million).<br />

On the other hand, new provisions were set up for the Fluor and Pharmaceuticals activities (EUR 82 million).<br />

The largest pension plans are in Belgium, France, Germany, the Netherlands, the United Kingdom and the United<br />

States. Certain companies provide post-employment health or life insurance cover to their employees and related<br />

beneficiaries. This cover is either financed under insurance contracts or is covered by provisions<br />

for post-employment benefits.<br />

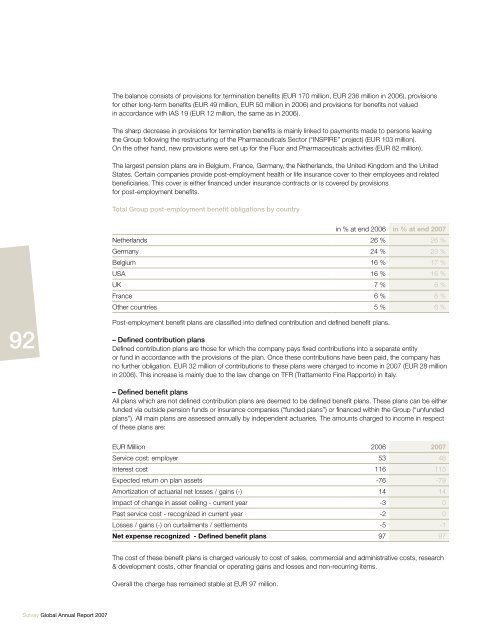

Total Group post-employment benefit obligations by country<br />

in % at end 2006 in % at end 2007<br />

Netherlands 26 % 26 %<br />

Germany 24 % 23 %<br />

Belgium 16 % 17 %<br />

USA 16 % 16 %<br />

UK 7 % 6 %<br />

France 6 % 6 %<br />

Other countries 5 % 6 %<br />

92<br />

Post-employment benefit plans are classified into defined contribution and defined benefit plans.<br />

– Defined contribution plans<br />

Defined contribution plans are those for which the company pays fixed contributions into a separate entity<br />

or fund in accordance with the provisions of the plan. Once these contributions have been paid, the company has<br />

no further obligation. EUR 32 million of contributions to these plans were charged to income in 2007 (EUR 28 million<br />

in 2006). This increase is mainly due to the law change on TFR (Trattamento Fine Rapporto) in Italy.<br />

– Defined benefit plans<br />

All plans which are not defined contribution plans are deemed to be defined benefit plans. These plans can be either<br />

funded via outside pension funds or insurance companies (“funded plans”) or financed within the Group (“unfunded<br />

plans”). All main plans are assessed annually by independent actuaries. The amounts charged to income in respect<br />

of these plans are:<br />

EUR Million 2006 2007<br />

Service cost: employer 53 48<br />

Interest cost 116 115<br />

Expected return on plan assets -76 -79<br />

Amortization of actuarial net losses / gains (-) 14 14<br />

Impact of change in asset ceiling - current year -3 0<br />

Past service cost - recognized in current year -2 0<br />

Losses / gains (-) on curtailments / settlements -5 -1<br />

Net expense recognized - Defined benefit plans 97 97<br />

The cost of these benefit plans is charged variously to cost of sales, commercial and administrative costs, research<br />

& development costs, other financial or operating gains and losses and non-recurring items.<br />

Overall the charge has remained stable at EUR 97 million.<br />

<strong>Solvay</strong> Global Annual Report 2007