CEMENT PRODUCTS Everest Industries Ltd. - Myiris.com

CEMENT PRODUCTS Everest Industries Ltd. - Myiris.com

CEMENT PRODUCTS Everest Industries Ltd. - Myiris.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Everest</strong> <strong>Industries</strong> <strong>Ltd</strong>.<br />

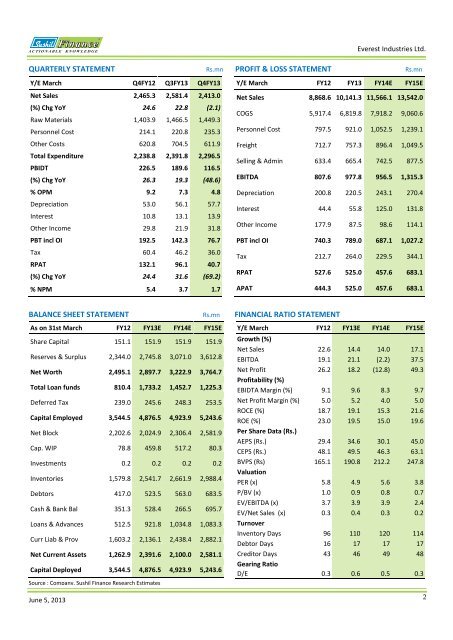

QUARTERLY STATEMENT<br />

Rs.mn<br />

Y/E March Q4FY12 Q3FY13 Q4FY13<br />

Net Sales 2,465.3 2,581.4 2,413.0<br />

(%) Chg YoY 24.6 22.8 (2.1)<br />

Raw Materials 1,403.9 1,466.5 1,449.3<br />

Personnel Cost 214.1 220.8 235.3<br />

Other Costs 620.8 704.5 611.9<br />

Total Expenditure 2,238.8 2,391.8 2,296.5<br />

PBIDT 226.5 189.6 116.5<br />

(%) Chg YoY 26.3 19.3 (48.6)<br />

% OPM 9.2 7.3 4.8<br />

Depreciation 53.0 56.1 57.7<br />

Interest 10.8 13.1 13.9<br />

Other In<strong>com</strong>e 29.8 21.9 31.8<br />

PBT incl OI 192.5 142.3 76.7<br />

Tax 60.4 46.2 36.0<br />

RPAT 132.1 96.1 40.7<br />

(%) Chg YoY 24.4 31.6 (69.2)<br />

% NPM 5.4 3.7 1.7<br />

PROFIT & LOSS STATEMENT<br />

Rs.mn<br />

Y/E March FY12 FY13 FY14E FY15E<br />

Net Sales 8,868.6 10,141.3 11,566.1 13,542.0<br />

COGS 5,917.4 6,819.8 7,918.2 9,060.6<br />

Personnel Cost 797.5 921.0 1,052.5 1,239.1<br />

Freight 712.7 757.3 896.4 1,049.5<br />

Selling & Admin 633.4 665.4 742.5 877.5<br />

EBITDA 807.6 977.8 956.5 1,315.3<br />

Depreciation 200.8 220.5 243.1 270.4<br />

Interest 44.4 55.8 125.0 131.8<br />

Other In<strong>com</strong>e 177.9 87.5 98.6 114.1<br />

PBT incl OI 740.3 789.0 687.1 1,027.2<br />

Tax 212.7 264.0 229.5 344.1<br />

RPAT 527.6 525.0 457.6 683.1<br />

APAT 444.3 525.0 457.6 683.1<br />

BALANCE SHEET STATEMENT<br />

Rs.mn<br />

As on 31st March FY12 FY13E FY14E FY15E<br />

Share Capital 151.1 151.9 151.9 151.9<br />

Reserves & Surplus 2,344.0 2,745.8 3,071.0 3,612.8<br />

Net Worth 2,495.1 2,897.7 3,222.9 3,764.7<br />

Total Loan funds 810.4 1,733.2 1,452.7 1,225.3<br />

Deferred Tax 239.0 245.6 248.3 253.5<br />

Capital Employed 3,544.5 4,876.5 4,923.9 5,243.6<br />

Net Block 2,202.6 2,024.9 2,306.4 2,581.9<br />

Cap. WIP 78.8 459.8 517.2 80.3<br />

Investments 0.2 0.2 0.2 0.2<br />

Inventories 1,579.8 2,541.7 2,661.9 2,988.4<br />

Debtors 417.0 523.5 563.0 683.5<br />

Cash & Bank Bal 351.3 528.4 266.5 695.7<br />

Loans & Advances 512.5 921.8 1,034.8 1,083.3<br />

Curr Liab & Prov 1,603.2 2,136.1 2,438.4 2,882.1<br />

Net Current Assets 1,262.9 2,391.6 2,100.0 2,581.1<br />

Capital Deployed 3,544.5 4,876.5 4,923.9 5,243.6<br />

Source : Company, Sushil Finance Research Estimates<br />

June 5, 2013<br />

FINANCIAL RATIO STATEMENT<br />

Y/E March FY12 FY13E FY14E FY15E<br />

Growth (%)<br />

Net Sales 22.6 14.4 14.0 17.1<br />

EBITDA 19.1 21.1 (2.2) 37.5<br />

Net Profit 26.2 18.2 (12.8) 49.3<br />

Profitability (%)<br />

EBIDTA Margin (%) 9.1 9.6 8.3 9.7<br />

Net Profit Margin (%) 5.0 5.2 4.0 5.0<br />

ROCE (%) 18.7 19.1 15.3 21.6<br />

ROE (%) 23.0 19.5 15.0 19.6<br />

Per Share Data (Rs.)<br />

AEPS (Rs.) 29.4 34.6 30.1 45.0<br />

CEPS (Rs.) 48.1 49.5 46.3 63.1<br />

BVPS (Rs) 165.1 190.8 212.2 247.8<br />

Valuation<br />

PER (x) 5.8 4.9 5.6 3.8<br />

P/BV (x) 1.0 0.9 0.8 0.7<br />

EV/EBITDA (x) 3.7 3.9 3.9 2.4<br />

EV/Net Sales (x) 0.3 0.4 0.3 0.2<br />

Turnover<br />

Inventory Days 96 110 120 114<br />

Debtor Days 16 17 17 17<br />

Creditor Days 43 46 49 48<br />

Gearing Ratio<br />

D/E 0.3 0.6 0.5 0.3<br />

2