EDI format specifications Version 2.0, Revision 4 - APRA

EDI format specifications Version 2.0, Revision 4 - APRA

EDI format specifications Version 2.0, Revision 4 - APRA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

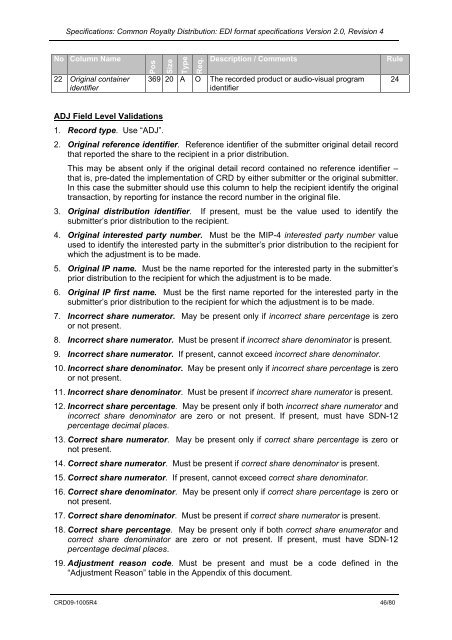

Specifications: Common Royalty Distribution: <strong>EDI</strong> <strong>format</strong> <strong>specifications</strong> <strong>Version</strong> <strong>2.0</strong>, <strong>Revision</strong> 4<br />

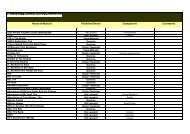

No Column Name<br />

22 Original container<br />

identifier<br />

Pos<br />

Size<br />

Type<br />

Req.<br />

Description / Comments<br />

369 20 A O The recorded product or audio-visual program<br />

identifier<br />

Rule<br />

24<br />

ADJ Field Level Validations<br />

1. Record type. Use “ADJ”.<br />

2. Original reference identifier. Reference identifier of the submitter original detail record<br />

that reported the share to the recipient in a prior distribution.<br />

This may be absent only if the original detail record contained no reference identifier –<br />

that is, pre-dated the implementation of CRD by either submitter or the original submitter.<br />

In this case the submitter should use this column to help the recipient identify the original<br />

transaction, by reporting for instance the record number in the original file.<br />

3. Original distribution identifier. If present, must be the value used to identify the<br />

submitter’s prior distribution to the recipient.<br />

4. Original interested party number. Must be the MIP-4 interested party number value<br />

used to identify the interested party in the submitter’s prior distribution to the recipient for<br />

which the adjustment is to be made.<br />

5. Original IP name. Must be the name reported for the interested party in the submitter’s<br />

prior distribution to the recipient for which the adjustment is to be made.<br />

6. Original IP first name. Must be the first name reported for the interested party in the<br />

submitter’s prior distribution to the recipient for which the adjustment is to be made.<br />

7. Incorrect share numerator. May be present only if incorrect share percentage is zero<br />

or not present.<br />

8. Incorrect share numerator. Must be present if incorrect share denominator is present.<br />

9. Incorrect share numerator. If present, cannot exceed incorrect share denominator.<br />

10. Incorrect share denominator. May be present only if incorrect share percentage is zero<br />

or not present.<br />

11. Incorrect share denominator. Must be present if incorrect share numerator is present.<br />

12. Incorrect share percentage. May be present only if both incorrect share numerator and<br />

incorrect share denominator are zero or not present. If present, must have SDN-12<br />

percentage decimal places.<br />

13. Correct share numerator. May be present only if correct share percentage is zero or<br />

not present.<br />

14. Correct share numerator. Must be present if correct share denominator is present.<br />

15. Correct share numerator. If present, cannot exceed correct share denominator.<br />

16. Correct share denominator. May be present only if correct share percentage is zero or<br />

not present.<br />

17. Correct share denominator. Must be present if correct share numerator is present.<br />

18. Correct share percentage. May be present only if both correct share enumerator and<br />

correct share denominator are zero or not present. If present, must have SDN-12<br />

percentage decimal places.<br />

19. Adjustment reason code. Must be present and must be a code defined in the<br />

“Adjustment Reason” table in the Appendix of this document.<br />

CRD09-1005R4 46/80