Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>account</strong>s 2003<br />

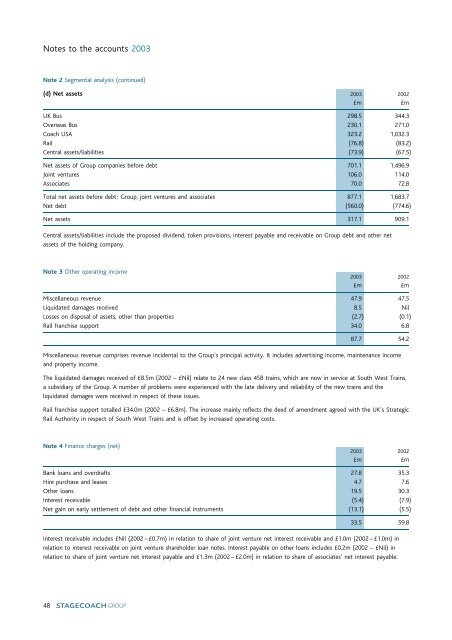

Note 2 Segmental analysis (continued)<br />

(d) Net assets 2003 2002<br />

»m »m<br />

UK Bus 298.5 344.3<br />

Overseas Bus 230.1 271.0<br />

Coach USA 323.2 1,032.3<br />

Rail (76.8) (83.2)<br />

Central assets/liabilities (73.9) (67.5)<br />

Net assets of <strong>Group</strong> companies before debt 701.1 1,496.9<br />

Joint ventures 106.0 114.0<br />

Associates 70.0 72.8<br />

Total net assets before debt: <strong>Group</strong>, joint ventures <strong>and</strong> associates 877.1 1,683.7<br />

Net debt (560.0) (774.6)<br />

Net assets 317.1 909.1<br />

Central assets/liabilities include the proposed dividend, token provisions, interest payable <strong>and</strong> receivable on <strong>Group</strong> debt <strong>and</strong> other net<br />

assets of the holding company.<br />

Note 3 Other operating income<br />

2003 2002<br />

»m »m<br />

Miscellaneous revenue 47.9 47.5<br />

Liquidated damages received 8.5 Nil<br />

Losses on disposal of assets, other than properties (2.7) (0.1)<br />

Rail franchise support 34.0 6.8<br />

87.7 54.2<br />

Miscellaneous revenue comprises revenue incidental to the <strong>Group</strong>’s principal activity. It includes advertising income, maintenance income<br />

<strong>and</strong> property income.<br />

The liquidated damages received of »8.5m (2002 ^ »Nil) relate to 24 new class 458 trains, which are now in service at South West Trains,<br />

a subsidiary of the <strong>Group</strong>. A number of problems were experienced with the late delivery <strong>and</strong> reliability of the new trains <strong>and</strong> the<br />

liquidated damages were received in respect of these issues.<br />

Rail franchise support totalled »34.0m (2002 ^ »6.8m). The increase mainly reflects the deed of amendment agreed with the UK’s Strategic<br />

Rail Authority in respect of South West Trains <strong>and</strong> is offset by increased operating costs.<br />

Note 4 Finance charges (net)<br />

2003 2002<br />

»m »m<br />

Bank loans <strong>and</strong> overdrafts 27.8 35.3<br />

Hire purchase <strong>and</strong> leases 4.7 7.6<br />

Other loans 19.5 30.3<br />

Interest receivable (5.4) (7.9)<br />

Net gain on early settlement of debt <strong>and</strong> other financial instruments (13.1) (5.5)<br />

33.5 59.8<br />

Interest receivable includes »Nil (2002 ^ »0.7m) in relation to share of joint venture net interest receivable <strong>and</strong> »1.0m (2002 ^ »1.0m) in<br />

relation to interest receivable on joint venture shareholder loan notes. Interest payable on other loans includes »0.2m (2002 ^ »Nil) in<br />

relation to share of joint venture net interest payable <strong>and</strong> »1.3m (2002 ^ »2.0m) in relation to share of associates’ net interest payable.<br />

48