Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>account</strong>s 2003<br />

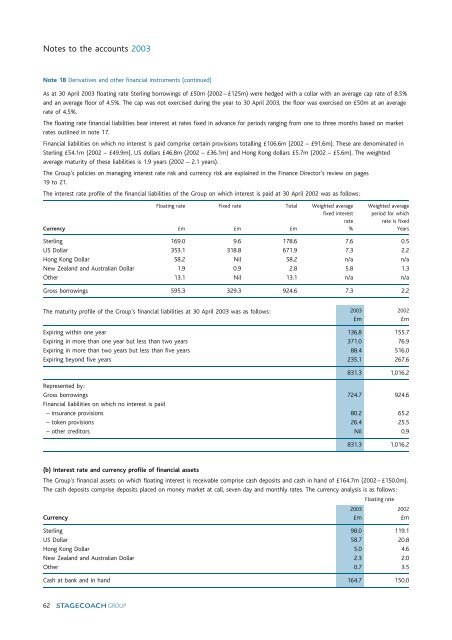

Note 18 Derivatives <strong>and</strong> other financial instruments (continued)<br />

As at 30 April 2003 floating rate Sterling borrowings of »50m (2002 ^ »125m) were hedged with a collar with an average cap rate of 8.5%<br />

<strong>and</strong> an average floor of 4.5%. The cap was not exercised during the year to 30 April 2003, the floor was exercised on »50m at an average<br />

rate of 4.5%.<br />

The floating rate financial liabilities bear interest at rates fixed in advance for periods ranging from one to three months based on market<br />

rates outlined in note 17.<br />

Financial liabilities on which no interest is paid comprise certain provisions totalling »106.6m (2002 ^ »91.6m). These are denominated in<br />

Sterling »54.1m (2002 ^ »49.9m), US dollars »46.8m (2002 ^ »36.1m) <strong>and</strong> Hong Kong dollars »5.7m (2002 ^ »5.6m). The weighted<br />

average maturity of these liabilities is 1.9 years (2002 ^ 2.1 years).<br />

The <strong>Group</strong>’s policies on managing interest rate risk <strong>and</strong> currency risk are explained in the Finance Director’s review on pages<br />

19 to 21.<br />

The interest rate profile of the financial liabilities of the <strong>Group</strong> on which interest is paid at 30 April 2002 was as follows:<br />

Floating rate Fixed rate Total Weighted average Weighted average<br />

fixed interest period for which<br />

rate<br />

rate is fixed<br />

Currency »m »m »m % Years<br />

Sterling 169.0 9.6 178.6 7.6 0.5<br />

US Dollar 353.1 318.8 671.9 7.3 2.2<br />

Hong Kong Dollar 58.2 Nil 58.2 n/a n/a<br />

New Zeal<strong>and</strong> <strong>and</strong> Australian Dollar 1.9 0.9 2.8 5.8 1.3<br />

Other 13.1 Nil 13.1 n/a n/a<br />

Gross borrowings 595.3 329.3 924.6 7.3 2.2<br />

The maturity profile of the <strong>Group</strong>’s financial liabilities at 30 April 2003 was as follows: 2003 2002<br />

»m »m<br />

Expiring within one year 136.8 155.7<br />

Expiring in more than one year but less than two years 371.0 76.9<br />

Expiring in more than two years but less than five years 88.4 516.0<br />

Expiring beyond five years 235.1 267.6<br />

831.3 1,016.2<br />

Represented by:<br />

Gross borrowings 724.7 924.6<br />

Financial liabilities on which no interest is paid<br />

^ insurance provisions 80.2 65.2<br />

^ token provisions 26.4 25.5<br />

^ other creditors Nil 0.9<br />

831.3 1,016.2<br />

(b) Interest rate <strong>and</strong> currency profile of financial assets<br />

The <strong>Group</strong>’s financial assets on which floating interest is receivable comprise cash deposits <strong>and</strong> cash in h<strong>and</strong> of »164.7m (2002 ^ »150.0m).<br />

The cash deposits comprise deposits placed on money market at call, seven day <strong>and</strong> monthly rates. The currency analysis is as follows:<br />

Floating rate<br />

2003 2002<br />

Currency »m »m<br />

Sterling 98.0 119.1<br />

US Dollar 58.7 20.8<br />

Hong Kong Dollar 5.0 4.6<br />

New Zeal<strong>and</strong> <strong>and</strong> Australian Dollar 2.3 2.0<br />

Other 0.7 3.5<br />

Cash at bank <strong>and</strong> in h<strong>and</strong> 164.7 150.0<br />

62