Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>account</strong>s 2003<br />

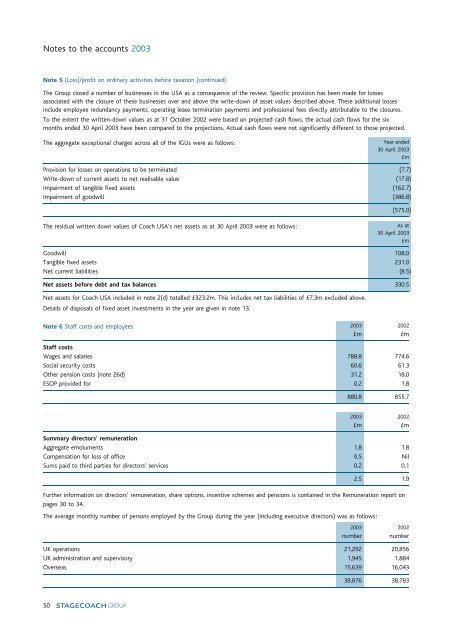

Note 5 (Loss)/<strong>profit</strong> on ordinary activities before taxation (continued)<br />

The <strong>Group</strong> closed a number of businesses in the USA as a consequence of the review. Specific provision has been made for <strong>loss</strong>es<br />

associated with the closure of these businesses over <strong>and</strong> above the write-down of asset values described above. These additional <strong>loss</strong>es<br />

include employee redundancy payments, operating lease termination payments <strong>and</strong> professional fees directly attributable to the closures.<br />

To the extent the written-down values as at 31 October 2002 were based on projected cash flows, the actual cash flows for the six<br />

months ended 30 April 2003 have been compared to the projections. Actual cash flows were not significantly different to those projected.<br />

The aggregate exceptional charges across all of the IGUs were as follows:<br />

Year ended<br />

30 April 2003<br />

»m<br />

Provision for <strong>loss</strong>es on operations to be terminated (7.7)<br />

Write-down of current assets to net realisable value (17.8)<br />

Impairment of tangible fixed assets (162.7)<br />

Impairment of goodwill (386.8)<br />

(575.0)<br />

The residual written down values of Coach USA’s net assets as at 30 April 2003 were as follows:<br />

As at<br />

30 April 2003<br />

»m<br />

Goodwill 108.0<br />

Tangible fixed assets 231.0<br />

Net current liabilities (8.5)<br />

Net assets before debt <strong>and</strong> tax balances 330.5<br />

Net assets for Coach USA included in note 2(d) totalled »323.2m. This includes net tax liabilities of »7.3m excluded above.<br />

Details of disposals of fixed asset investments in the year are given in note 13.<br />

Note 6 Staff costs <strong>and</strong> employees 2003 2002<br />

»m »m<br />

Staff costs<br />

Wages <strong>and</strong> salaries 788.8 774.6<br />

Social security costs 60.6 61.3<br />

Other pension costs (note 26d) 31.2 18.0<br />

ESOP provided for 0.2 1.8<br />

880.8 855.7<br />

2003 2002<br />

»m »m<br />

Summary directors’ remuneration<br />

Aggregate emoluments 1.8 1.8<br />

Compensation for <strong>loss</strong> of office 0.5 Nil<br />

Sums paid to third parties for directors’ services 0.2 0.1<br />

2.5 1.9<br />

Further information on directors’ remuneration, share options, incentive schemes <strong>and</strong> pensions is contained in the Remuneration report on<br />

pages 30 to 34.<br />

The average monthly number of persons employed by the <strong>Group</strong> during the year (including executive directors) was as follows:<br />

2003 2002<br />

number number<br />

UK operations 21,292 20,856<br />

UK administration <strong>and</strong> supervisory 1,945 1,884<br />

Overseas 15,639 16,043<br />

38,876 38,783<br />

50