Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the <strong>account</strong>s 2003<br />

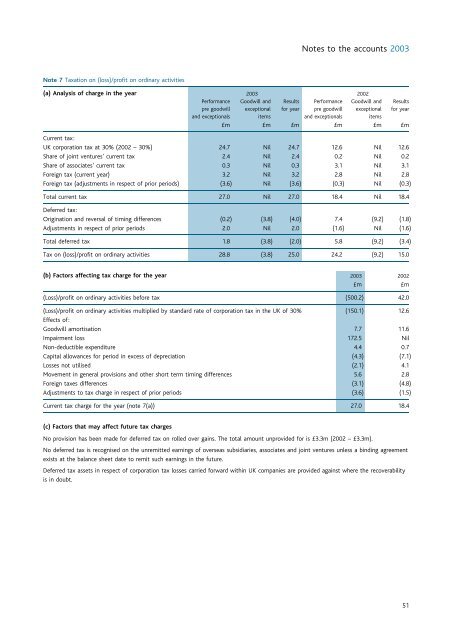

Note 7 Taxation on (<strong>loss</strong>)/<strong>profit</strong> on ordinary activities<br />

(a) Analysis of charge in the year 2003 2002<br />

Performance Goodwill <strong>and</strong> Results Performance Goodwill <strong>and</strong> Results<br />

pre goodwill exceptional for year pre goodwill exceptional for year<br />

<strong>and</strong> exceptionals items <strong>and</strong> exceptionals items<br />

»m »m »m »m »m »m<br />

Current tax:<br />

UK corporation tax at 30% (2002 ^ 30%) 24.7 Nil 24.7 12.6 Nil 12.6<br />

Share of joint ventures’ current tax 2.4 Nil 2.4 0.2 Nil 0.2<br />

Share of associates’ current tax 0.3 Nil 0.3 3.1 Nil 3.1<br />

Foreign tax (current year) 3.2 Nil 3.2 2.8 Nil 2.8<br />

Foreign tax (adjustments in respect of prior periods) (3.6) Nil (3.6) (0.3) Nil (0.3)<br />

Total current tax 27.0 Nil 27.0 18.4 Nil 18.4<br />

Deferred tax:<br />

Origination <strong>and</strong> reversal of timing differences (0.2) (3.8) (4.0) 7.4 (9.2) (1.8)<br />

Adjustments in respect of prior periods 2.0 Nil 2.0 (1.6) Nil (1.6)<br />

Total deferred tax 1.8 (3.8) (2.0) 5.8 (9.2) (3.4)<br />

Tax on (<strong>loss</strong>)/<strong>profit</strong> on ordinary activities 28.8 (3.8) 25.0 24.2 (9.2) 15.0<br />

(b) Factors affecting tax charge for the year 2003 2002<br />

»m »m<br />

(Loss)/<strong>profit</strong> on ordinary activities before tax (500.2) 42.0<br />

(Loss)/<strong>profit</strong> on ordinary activities multiplied by st<strong>and</strong>ard rate of corporation tax in the UK of 30% (150.1) 12.6<br />

Effects of:<br />

Goodwill amortisation 7.7 11.6<br />

Impairment <strong>loss</strong> 172.5 Nil<br />

Non-deductible expenditure 4.4 0.7<br />

Capital allowances for period in excess of depreciation (4.3) (7.1)<br />

Losses not utilised (2.1) 4.1<br />

Movement in general provisions <strong>and</strong> other short term timing differences 5.6 2.8<br />

Foreign taxes differences (3.1) (4.8)<br />

Adjustments to tax charge in respect of prior periods (3.6) (1.5)<br />

Current tax charge for the year (note 7(a)) 27.0 18.4<br />

(c) Factors that may affect future tax charges<br />

No provision has been made for deferred tax on rolled over gains. The total amount unprovided for is »3.3m (2002 ^ »3.3m).<br />

No deferred tax is recognised on the unremitted earnings of overseas subsidiaries, associates <strong>and</strong> joint ventures unless a binding agreement<br />

exists at the balance sheet date to remit such earnings in the future.<br />

Deferred tax assets in respect of corporation tax <strong>loss</strong>es carried forward within UK companies are provided against where the recoverability<br />

is in doubt.<br />

51