Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Consolidated profit and loss account - Stagecoach Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>account</strong>s 2003<br />

Note 17 Creditors (continued)<br />

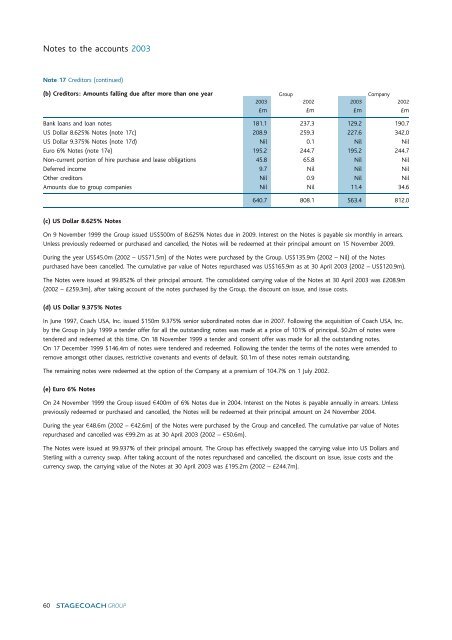

(b) Creditors: Amounts falling due after more than one year <strong>Group</strong> Company<br />

2003 2002 2003 2002<br />

»m »m »m »m<br />

Bank loans <strong>and</strong> loan notes 181.1 237.3 129.2 190.7<br />

US Dollar 8.625% Notes (note 17c) 208.9 259.3 227.6 342.0<br />

US Dollar 9.375% Notes (note 17d) Nil 0.1 Nil Nil<br />

Euro 6% Notes (note 17e) 195.2 244.7 195.2 244.7<br />

Non-current portion of hire purchase <strong>and</strong> lease obligations 45.8 65.8 Nil Nil<br />

Deferred income 9.7 Nil Nil Nil<br />

Other creditors Nil 0.9 Nil Nil<br />

Amounts due to group companies Nil Nil 11.4 34.6<br />

640.7 808.1 563.4 812.0<br />

(c) US Dollar 8.625% Notes<br />

On 9 November 1999 the <strong>Group</strong> issued US$500m of 8.625% Notes due in 2009. Interest on the Notes is payable six monthly in arrears.<br />

Unless previously redeemed or purchased <strong>and</strong> cancelled, the Notes will be redeemed at their principal amount on 15 November 2009.<br />

During the year US$45.0m (2002 ^ US$71.5m) of the Notes were purchased by the <strong>Group</strong>. US$135.9m (2002 ^ Nil) of the Notes<br />

purchased have been cancelled. The cumulative par value of Notes repurchased was US$165.9m as at 30 April 2003 (2002 ^ US$120.9m).<br />

The Notes were issued at 99.852% of their principal amount. The consolidated carrying value of the Notes at 30 April 2003 was »208.9m<br />

(2002 ^ »259.3m), after taking <strong>account</strong> of the notes purchased by the <strong>Group</strong>, the discount on issue, <strong>and</strong> issue costs.<br />

(d) US Dollar 9.375% Notes<br />

In June 1997, Coach USA, Inc. issued $150m 9.375% senior subordinated notes due in 2007. Following the acquisition of Coach USA, Inc.<br />

by the <strong>Group</strong> in July 1999 a tender offer for all the outst<strong>and</strong>ing notes was made at a price of 101% of principal. $0.2m of notes were<br />

tendered <strong>and</strong> redeemed at this time. On 18 November 1999 a tender <strong>and</strong> consent offer was made for all the outst<strong>and</strong>ing notes.<br />

On 17 December 1999 $146.4m of notes were tendered <strong>and</strong> redeemed. Following the tender the terms of the notes were amended to<br />

remove amongst other clauses, restrictive covenants <strong>and</strong> events of default. $0.1m of these notes remain outst<strong>and</strong>ing.<br />

The remaining notes were redeemed at the option of the Company at a premium of 104.7% on 1 July 2002.<br />

(e) Euro 6% Notes<br />

On 24 November 1999 the <strong>Group</strong> issued e400m of 6% Notes due in 2004. Interest on the Notes is payable annually in arrears. Unless<br />

previously redeemed or purchased <strong>and</strong> cancelled, the Notes will be redeemed at their principal amount on 24 November 2004.<br />

During the year e48.6m (2002 ^ e42.6m) of the Notes were purchased by the <strong>Group</strong> <strong>and</strong> cancelled. The cumulative par value of Notes<br />

repurchased <strong>and</strong> cancelled was e99.2m as at 30 April 2003 (2002 ^ e50.6m).<br />

The Notes were issued at 99.937% of their principal amount. The <strong>Group</strong> has effectively swapped the carrying value into US Dollars <strong>and</strong><br />

Sterling with a currency swap. After taking <strong>account</strong> of the notes repurchased <strong>and</strong> cancelled, the discount on issue, issue costs <strong>and</strong> the<br />

currency swap, the carrying value of the Notes at 30 April 2003 was »195.2m (2002 ^ »244.7m).<br />

60