2012 TPSEA Annual Report - Serena Hotels

2012 TPSEA Annual Report - Serena Hotels

2012 TPSEA Annual Report - Serena Hotels

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

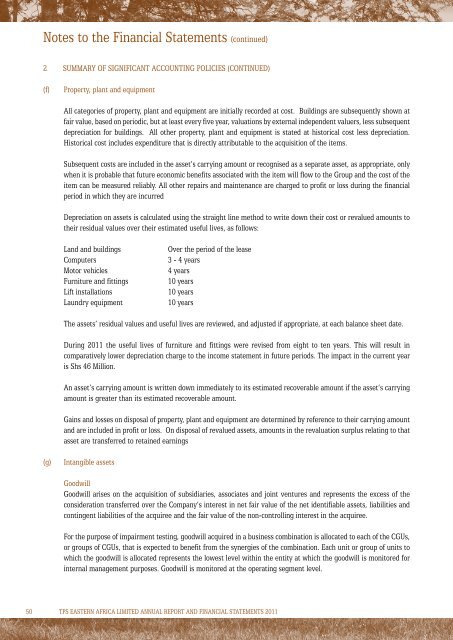

Notes to the Financial Statements (continued)<br />

2 Summary of significant accounting policies (continued)<br />

(f)<br />

Property, plant and equipment<br />

All categories of property, plant and equipment are initially recorded at cost. Buildings are subsequently shown at<br />

fair value, based on periodic, but at least every five year, valuations by external independent valuers, less subsequent<br />

depreciation for buildings. All other property, plant and equipment is stated at historical cost less depreciation.<br />

Historical cost includes expenditure that is directly attributable to the acquisition of the items.<br />

Subsequent costs are included in the asset’s carrying amount or recognised as a separate asset, as appropriate, only<br />

when it is probable that future economic benefits associated with the item will flow to the Group and the cost of the<br />

item can be measured reliably. All other repairs and maintenance are charged to profit or loss during the financial<br />

period in which they are incurred<br />

Depreciation on assets is calculated using the straight line method to write down their cost or revalued amounts to<br />

their residual values over their estimated useful lives, as follows:<br />

Land and buildings<br />

Computers<br />

Motor vehicles<br />

Furniture and fittings<br />

Lift installations<br />

Laundry equipment<br />

Over the period of the lease<br />

3 - 4 years<br />

4 years<br />

10 years<br />

10 years<br />

10 years<br />

The assets’ residual values and useful lives are reviewed, and adjusted if appropriate, at each balance sheet date.<br />

During 2011 the useful lives of furniture and fittings were revised from eight to ten years. This will result in<br />

comparatively lower depreciation charge to the income statement in future periods. The impact in the current year<br />

is Shs 46 Million.<br />

An asset’s carrying amount is written down immediately to its estimated recoverable amount if the asset’s carrying<br />

amount is greater than its estimated recoverable amount.<br />

Gains and losses on disposal of property, plant and equipment are determined by reference to their carrying amount<br />

and are included in profit or loss. On disposal of revalued assets, amounts in the revaluation surplus relating to that<br />

asset are transferred to retained earnings<br />

(g)<br />

Intangible assets<br />

Goodwill<br />

Goodwill arises on the acquisition of subsidiaries, associates and joint ventures and represents the excess of the<br />

consideration transferred over the Company’s interest in net fair value of the net identifiable assets, liabilities and<br />

contingent liabilities of the acquiree and the fair value of the non-controlling interest in the acquiree.<br />

For the purpose of impairment testing, goodwill acquired in a business combination is allocated to each of the CGUs,<br />

or groups of CGUs, that is expected to benefit from the synergies of the combination. Each unit or group of units to<br />

which the goodwill is allocated represents the lowest level within the entity at which the goodwill is monitored for<br />

internal management purposes. Goodwill is monitored at the operating segment level.<br />

50 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS 2011