2012 TPSEA Annual Report - Serena Hotels

2012 TPSEA Annual Report - Serena Hotels

2012 TPSEA Annual Report - Serena Hotels

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements (continued)<br />

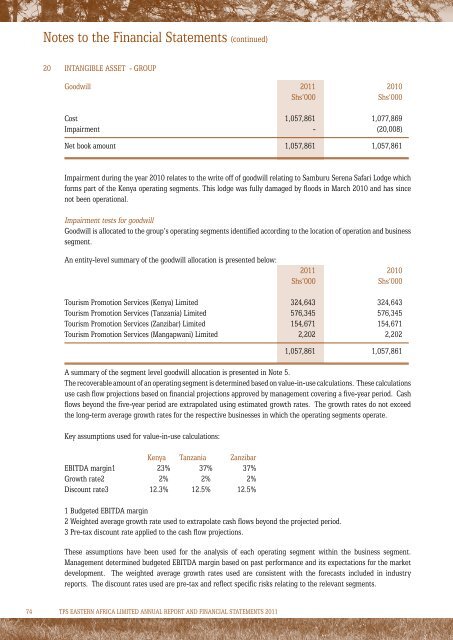

20 Intangible asset - Group<br />

Goodwill 2011 2010<br />

Shs’000<br />

Shs’000<br />

Cost 1,057,861 1,077,869<br />

Impairment - (20,008)<br />

Net book amount 1,057,861 1,057,861<br />

Impairment during the year 2010 relates to the write off of goodwill relating to Samburu <strong>Serena</strong> Safari Lodge which<br />

forms part of the Kenya operating segments. This lodge was fully damaged by floods in March 2010 and has since<br />

not been operational.<br />

Impairment tests for goodwill<br />

Goodwill is allocated to the group’s operating segments identified according to the location of operation and business<br />

segment.<br />

An entity-level summary of the goodwill allocation is presented below:<br />

2011 2010<br />

Shs’000<br />

Shs’000<br />

Tourism Promotion Services (Kenya) Limited 324,643 324,643<br />

Tourism Promotion Services (Tanzania) Limited 576,345 576,345<br />

Tourism Promotion Services (Zanzibar) Limited 154,671 154,671<br />

Tourism Promotion Services (Mangapwani) Limited 2,202 2,202<br />

1,057,861 1,057,861<br />

A summary of the segment level goodwill allocation is presented in Note 5.<br />

The recoverable amount of an operating segment is determined based on value-in-use calculations. These calculations<br />

use cash flow projections based on financial projections approved by management covering a five-year period. Cash<br />

flows beyond the five-year period are extrapolated using estimated growth rates. The growth rates do not exceed<br />

the long-term average growth rates for the respective businesses in which the operating segments operate.<br />

Key assumptions used for value-in-use calculations:<br />

Kenya Tanzania Zanzibar<br />

EBITDA margin1 23% 37% 37%<br />

Growth rate2 2% 2% 2%<br />

Discount rate3 12.3% 12.5% 12.5%<br />

1 Budgeted EBITDA margin<br />

2 Weighted average growth rate used to extrapolate cash flows beyond the projected period.<br />

3 Pre-tax discount rate applied to the cash flow projections.<br />

These assumptions have been used for the analysis of each operating segment within the business segment.<br />

Management determined budgeted EBITDA margin based on past performance and its expectations for the market<br />

development. The weighted average growth rates used are consistent with the forecasts included in industry<br />

reports. The discount rates used are pre-tax and reflect specific risks relating to the relevant segments.<br />

74 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS 2011