2012 TPSEA Annual Report - Serena Hotels

2012 TPSEA Annual Report - Serena Hotels

2012 TPSEA Annual Report - Serena Hotels

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Financial Statements (continued)<br />

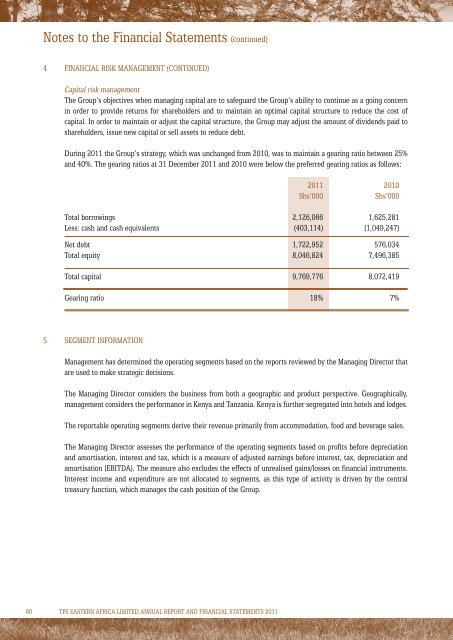

4 Financial risk management (continued)<br />

Capital risk management<br />

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern<br />

in order to provide returns for shareholders and to maintain an optimal capital structure to reduce the cost of<br />

capital. In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to<br />

shareholders, issue new capital or sell assets to reduce debt.<br />

During 2011 the Group’s strategy, which was unchanged from 2010, was to maintain a gearing ratio between 25%<br />

and 40%. The gearing ratios at 31 December 2011 and 2010 were below the preferred gearing ratios as follows:<br />

2011 2010<br />

Shs’000<br />

Shs’000<br />

Total borrowings 2,126,066 1,625,281<br />

Less: cash and cash equivalents (403,114) (1,049,247)<br />

Net debt 1,722,952 576,034<br />

Total equity 8,046,824 7,496,385<br />

Total capital 9,769,776 8,072,419<br />

Gearing ratio 18% 7%<br />

5 Segment information<br />

Management has determined the operating segments based on the reports reviewed by the Managing Director that<br />

are used to make strategic decisions.<br />

The Managing Director considers the business from both a geographic and product perspective. Geographically,<br />

management considers the performance in Kenya and Tanzania. Kenya is further segregated into hotels and lodges.<br />

The reportable operating segments derive their revenue primarily from accommodation, food and beverage sales.<br />

The Managing Director assesses the performance of the operating segments based on profits before depreciation<br />

and amortisation, interest and tax, which is a measure of adjusted earnings before interest, tax, depreciation and<br />

amortisation (EBITDA). The measure also excludes the effects of unrealised gains/losses on financial instruments.<br />

Interest income and expenditure are not allocated to segments, as this type of activity is driven by the central<br />

treasury function, which manages the cash position of the Group.<br />

60 TPS EASTERN AFRICA LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS 2011