Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

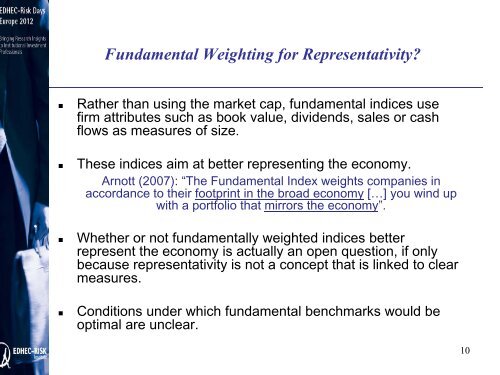

Fundamental Weighting for Representativity?<br />

• Rather than using the market cap, fundamental indices use<br />

firm attributes such as book value, dividends, sales or cash<br />

flows as measures of size.<br />

• These indices aim at better representing the economy.<br />

Arnott (2007): “The Fundamental Index weights companies in<br />

accordance to their footprint in the broad economy […] you wind up<br />

with a portfolio that mirrors the economy”.<br />

• Whether or not fundamentally weighted indices better<br />

represent the economy is actually an open question, if only<br />

because representativity is not a concept that is linked to clear<br />

measures.<br />

• Conditions under which fundamental benchmarks would be<br />

optimal are unclear.<br />

10