Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

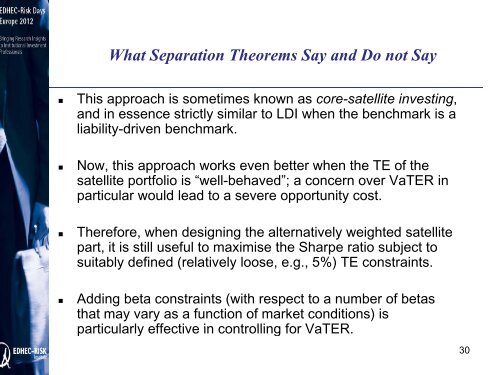

What Separation Theorems Say and Do not Say<br />

• This approach is sometimes known as core-satellite investing,<br />

and in essence strictly similar to LDI when the benchmark is a<br />

liability-driven benchmark.<br />

• Now, this approach works even better when the TE of the<br />

satellite portfolio is “well-behaved”; a concern over VaTER in<br />

particular would lead to a severe opportunity cost.<br />

• Therefore, when designing the alternatively weighted satellite<br />

part, it is still useful to maximise the Sharpe ratio subject to<br />

suitably defined (relatively loose, e.g., 5%) TE constraints.<br />

• Adding beta constraints (with respect to a number of betas<br />

that may vary as a function of market conditions) is<br />

particularly effective in controlling for VaTER.<br />

30