Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

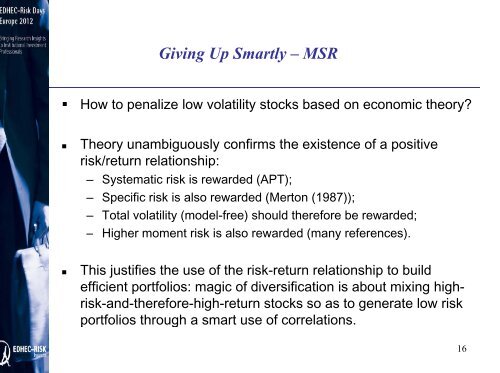

Giving Up Smartly – MSR<br />

• How to penalize low volatility stocks based on economic theory?<br />

• Theory unambiguously confirms the existence of a positive<br />

risk/return relationship:<br />

– Systematic risk is rewarded (APT);<br />

– Specific risk is also rewarded (Merton (1987));<br />

– Total volatility (model-free) should therefore be rewarded;<br />

– Higher moment risk is also rewarded (many references).<br />

• This justifies the use of the risk-return relationship to build<br />

efficient portfolios: magic of diversification is about mixing highrisk-and-therefore-high-return<br />

stocks so as to generate low risk<br />

portfolios through a smart use of correlations.<br />

16