Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

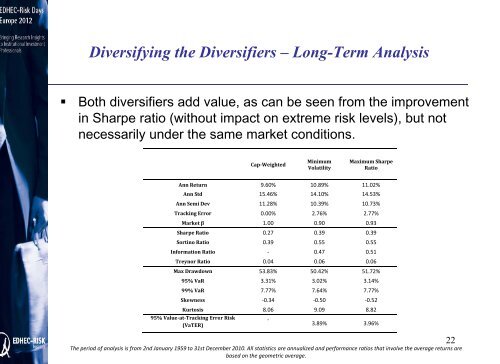

Diversifying the Diversifiers – Long-Term Analysis<br />

• Both diversifiers add value, as can be seen from the improvement<br />

in Sharpe ratio (without impact on extreme risk levels), but not<br />

necessarily under the same market conditions.<br />

CapWeighted<br />

Minimum<br />

Volatility<br />

Maximum Sharpe<br />

Ratio<br />

Ann Return 9.60% 10.89% 11.02%<br />

Ann Std 15.46% 14.10% 14.53%<br />

Ann Semi Dev 11.28% 10.39% 10.73%<br />

Tracking Error 0.00% 2.76% 2.77%<br />

Market β 1.00 0.90 0.93<br />

Sharpe Ratio 0.27 0.39 0.39<br />

Sortino Ratio 0.39 0.55 0.55<br />

Information Ratio ‐ 0.47 0.51<br />

Treynor Ratio 0.04 0.06 0.06<br />

Max Drawdown 53.83% 50.42% 51.72%<br />

95% VaR 3.31% 3.02% 3.14%<br />

99% VaR 7.77% 7.64% 7.77%<br />

Skewness ‐0.34 ‐0.50 ‐0.52<br />

Kurtosis 8.06 9.09 8.82<br />

95% ValueatTracking at Error <strong>Risk</strong><br />

(VaTER)<br />

‐<br />

3.89% 3.96%<br />

The period of analysis is from 2nd January 1959 to 31st December 2010. All statistics are annualized and performance ratios that involve the average returns are<br />

based on the geometric average.<br />

22