Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

Portfolios - EDHEC-Risk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

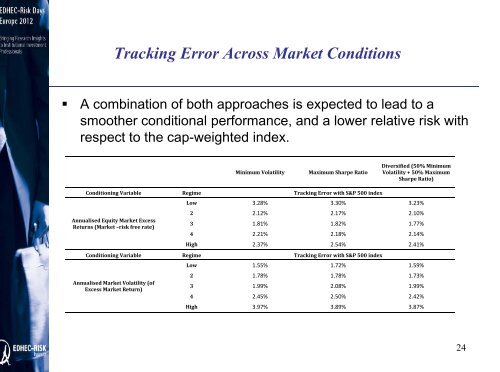

Tracking Error Across Market Conditions<br />

• A combination of both approaches is expected to lead to a<br />

smoother conditional performance, and a lower relative risk with<br />

respect to the cap-weighted index.<br />

Minimum Volatility<br />

Maximum Sharpe Ratio<br />

Diversified (50% Minimum<br />

Volatility + 50% Maximum<br />

Sharpe Ratio)<br />

Conditioning Variable Regime Tracking Error with S&P 500 index<br />

Annualised Equity Market Excess<br />

Returns (Market –risk free rate)<br />

Low 3.28% 3.30% 3.23%<br />

2 2.12% 2.17% 2.10%<br />

3 1.81% 1.82% 1.77%<br />

4 2.21% 21% 2.18% 2.14%<br />

High 2.37% 2.54% 2.41%<br />

Conditioning Variable Regime Tracking Error with S&P 500 index<br />

Annualised Market Volatility (of<br />

Excess Market Return)<br />

Low 1.55% 1.72% 1.59%<br />

2 1.78% 1.78% 1.73%<br />

3 1.99% 2.08% 1.99%<br />

4 2.45% 2.50% 2.42%<br />

High 3.97% 3.89% 3.87%<br />

24