FINANCIAL SECTION - School District U-46

FINANCIAL SECTION - School District U-46

FINANCIAL SECTION - School District U-46

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

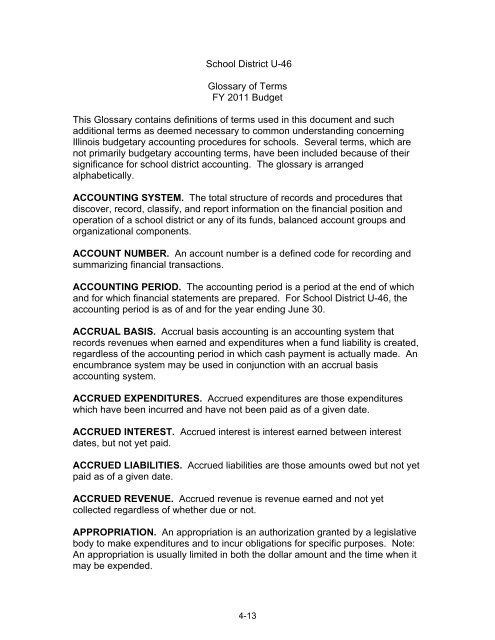

<strong>School</strong> <strong>District</strong> U-<strong>46</strong><br />

Glossary of Terms<br />

FY 2011 Budget<br />

This Glossary contains definitions of terms used in this document and such<br />

additional terms as deemed necessary to common understanding concerning<br />

Illinois budgetary accounting procedures for schools. Several terms, which are<br />

not primarily budgetary accounting terms, have been included because of their<br />

significance for school district accounting. The glossary is arranged<br />

alphabetically.<br />

ACCOUNTING SYSTEM. The total structure of records and procedures that<br />

discover, record, classify, and report information on the financial position and<br />

operation of a school district or any of its funds, balanced account groups and<br />

organizational components.<br />

ACCOUNT NUMBER. An account number is a defined code for recording and<br />

summarizing financial transactions.<br />

ACCOUNTING PERIOD. The accounting period is a period at the end of which<br />

and for which financial statements are prepared. For <strong>School</strong> <strong>District</strong> U-<strong>46</strong>, the<br />

accounting period is as of and for the year ending June 30.<br />

ACCRUAL BASIS. Accrual basis accounting is an accounting system that<br />

records revenues when earned and expenditures when a fund liability is created,<br />

regardless of the accounting period in which cash payment is actually made. An<br />

encumbrance system may be used in conjunction with an accrual basis<br />

accounting system.<br />

ACCRUED EXPENDITURES. Accrued expenditures are those expenditures<br />

which have been incurred and have not been paid as of a given date.<br />

ACCRUED INTEREST. Accrued interest is interest earned between interest<br />

dates, but not yet paid.<br />

ACCRUED LIABILITIES. Accrued liabilities are those amounts owed but not yet<br />

paid as of a given date.<br />

ACCRUED REVENUE. Accrued revenue is revenue earned and not yet<br />

collected regardless of whether due or not.<br />

APPROPRIATION. An appropriation is an authorization granted by a legislative<br />

body to make expenditures and to incur obligations for specific purposes. Note:<br />

An appropriation is usually limited in both the dollar amount and the time when it<br />

may be expended.<br />

4-13