Estimating Distributions of Counterfactuals with an Application ... - UCL

Estimating Distributions of Counterfactuals with an Application ... - UCL

Estimating Distributions of Counterfactuals with an Application ... - UCL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

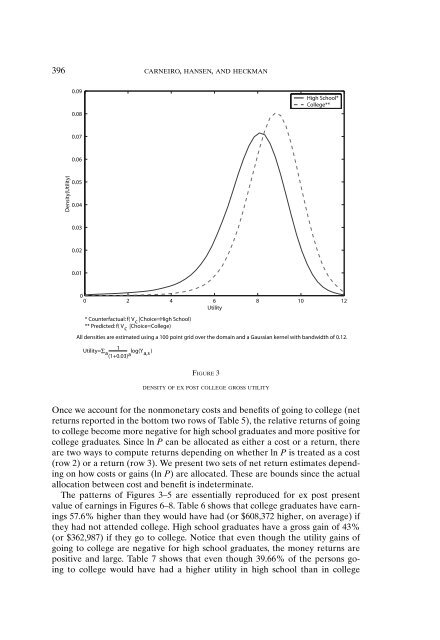

396 CARNEIRO, HANSEN, AND HECKMAN<br />

0.09<br />

0.08<br />

High School*<br />

College**<br />

0.07<br />

0.06<br />

Density(Utility)<br />

0.05<br />

0.04<br />

0.03<br />

0.02<br />

0.01<br />

0<br />

0 2 4 6 8 10 12<br />

Utility<br />

* Counterfactual: f( V c |Choice=High School)<br />

** Predicted: f( V c |Choice=College)<br />

All densities are estimated using a 100 point grid over the domain <strong>an</strong>d a Gaussi<strong>an</strong> kernel <strong>with</strong> b<strong>an</strong>dwidth <strong>of</strong> 0.12.<br />

Utility=<br />

1<br />

Σ a(1+0.03) a log(Y a,s )<br />

FIGURE 3<br />

DENSITY OF EX POST COLLEGE GROSS UTILITY<br />

Once we account for the nonmonetary costs <strong>an</strong>d benefits <strong>of</strong> going to college (net<br />

returns reported in the bottom two rows <strong>of</strong> Table 5), the relative returns <strong>of</strong> going<br />

to college become more negative for high school graduates <strong>an</strong>d more positive for<br />

college graduates. Since ln P c<strong>an</strong> be allocated as either a cost or a return, there<br />

are two ways to compute returns depending on whether ln P is treated as a cost<br />

(row 2) or a return (row 3). We present two sets <strong>of</strong> net return estimates depending<br />

on how costs or gains (ln P) are allocated. These are bounds since the actual<br />

allocation between cost <strong>an</strong>d benefit is indeterminate.<br />

The patterns <strong>of</strong> Figures 3–5 are essentially reproduced for ex post present<br />

value <strong>of</strong> earnings in Figures 6–8. Table 6 shows that college graduates have earnings<br />

57.6% higher th<strong>an</strong> they would have had (or $608,372 higher, on average) if<br />

they had not attended college. High school graduates have a gross gain <strong>of</strong> 43%<br />

(or $362,987) if they go to college. Notice that even though the utility gains <strong>of</strong><br />

going to college are negative for high school graduates, the money returns are<br />

positive <strong>an</strong>d large. Table 7 shows that even though 39.66% <strong>of</strong> the persons going<br />

to college would have had a higher utility in high school th<strong>an</strong> in college