NASDAQ OMX - Nordic Securities Markets Bjørn Sibbern

NASDAQ OMX - Nordic Securities Markets Bjørn Sibbern

NASDAQ OMX - Nordic Securities Markets Bjørn Sibbern

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

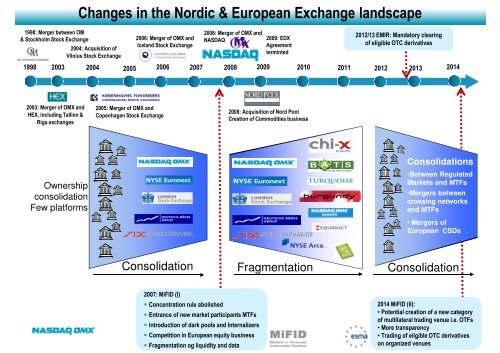

Changes in the <strong>Nordic</strong> & European Exchange landscape<br />

1998: Merger between OM<br />

& Stockholm Stock Exchange<br />

2004: Acquisition of<br />

Vilnius Stock Exchange<br />

2006: Merger of <strong>OMX</strong> and<br />

Iceland Stock Exchange<br />

2008: Merger of <strong>OMX</strong> and<br />

<strong>NASDAQ</strong><br />

2009: EDX<br />

Agreement<br />

terminted<br />

2012/13 EMIR: Mandatory clearing<br />

of eligible OTC derivatives<br />

1998 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014<br />

2003: Merger of <strong>OMX</strong> and<br />

HEX, including Tallinn &<br />

Riga exchanges<br />

2005: Merger of <strong>OMX</strong> and<br />

Copenhagen Stock Exchange<br />

2008: Acquisition of Nord Pool<br />

Creation of Commodities business<br />

Ownership<br />

consolidation<br />

Few platforms<br />

Consolidations<br />

•Between Regulated<br />

<strong>Markets</strong> and MTFs<br />

•Mergers between<br />

crossing networks<br />

and MTFs<br />

• Mergers of<br />

European CSDs<br />

Consolidation<br />

Fragmentation<br />

Consolidation<br />

2007: MiFID (I)<br />

Concentration rule abolished<br />

Entrance of new market participants MTFs<br />

Introduction of dark pools and Internalizers<br />

Competition in European equity business<br />

Fragmentation og liquidity and data<br />

2014 MiFID (II):<br />

• Potential creation of a new category<br />

of multilateral trading venue i.e. OTFs<br />

• More transparency<br />

• Trading of eligible OTC derivatives<br />

on organized venues