NASDAQ OMX - Nordic Securities Markets Bjørn Sibbern

NASDAQ OMX - Nordic Securities Markets Bjørn Sibbern

NASDAQ OMX - Nordic Securities Markets Bjørn Sibbern

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

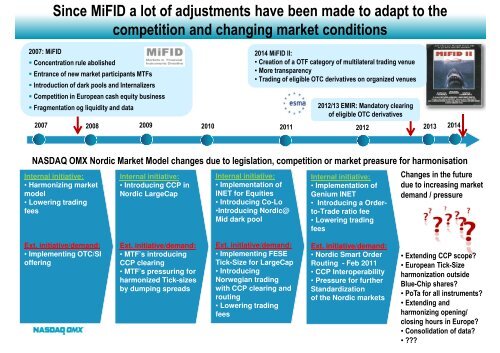

Since MiFID a lot of adjustments have been made to adapt to the<br />

competition and changing market conditions<br />

2007: MiFID<br />

Concentration rule abolished<br />

Entrance of new market participants MTFs<br />

Introduction of dark pools and Internalizers<br />

Competition in European cash equity business<br />

Fragmentation og liquidity and data<br />

2014 MiFID II:<br />

• Creation of a OTF category of multilateral trading venue<br />

• More transparency<br />

• Trading of eligible OTC derivatives on organized venues<br />

2012/13 EMIR: Mandatory clearing<br />

of eligible OTC derivatives<br />

2007 2008 2009<br />

2010 2011 2012<br />

2013 2014<br />

<strong>NASDAQ</strong> <strong>OMX</strong> <strong>Nordic</strong> Market Model changes due to legislation, competition or market preasure for harmonisation<br />

Internal initiative:<br />

• Harmonizing market<br />

model<br />

• Lowering trading<br />

fees<br />

Internal initiative:<br />

• Introducing CCP in<br />

<strong>Nordic</strong> LargeCap<br />

Internal initiative:<br />

• Implementation of<br />

INET for Equities<br />

• Introducing Co-Lo<br />

•Introducing <strong>Nordic</strong>@<br />

Mid dark pool<br />

Internal initiative:<br />

• Implementation of<br />

Genium INET<br />

• Introducing a Orderto-Trade<br />

ratio fee<br />

• Lowering trading<br />

fees<br />

Changes in the future<br />

due to increasing market<br />

demand / pressure<br />

Ext. initiative/demand:<br />

• Implementing OTC/SI<br />

offering<br />

Ext. initiative/demand:<br />

• MTF’s introducing<br />

CCP clearing<br />

• MTF’s pressuring for<br />

harmonized Tick-sizes<br />

by dumping spreads<br />

Ext. initiative/demand:<br />

• Implementing FESE<br />

Tick-Size for LargeCap<br />

• Introducing<br />

Norwegian trading<br />

with CCP clearing and<br />

routing<br />

• Lowering trading<br />

fees<br />

Ext. initiative/demand:<br />

• <strong>Nordic</strong> Smart Order<br />

Routing - Feb 2011<br />

• CCP Interoperability<br />

• Pressure for further<br />

Standardization<br />

of the <strong>Nordic</strong> markets<br />

• Extending CCP scope?<br />

• European Tick-Size<br />

harmonization outside<br />

Blue-Chip shares?<br />

• PoTa for all instruments?<br />

• Extending and<br />

harmonizing opening/<br />

closing hours in Europe?<br />

• Consolidation of data?<br />

• ???