Annual Report 2004 - HL Display

Annual Report 2004 - HL Display

Annual Report 2004 - HL Display

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

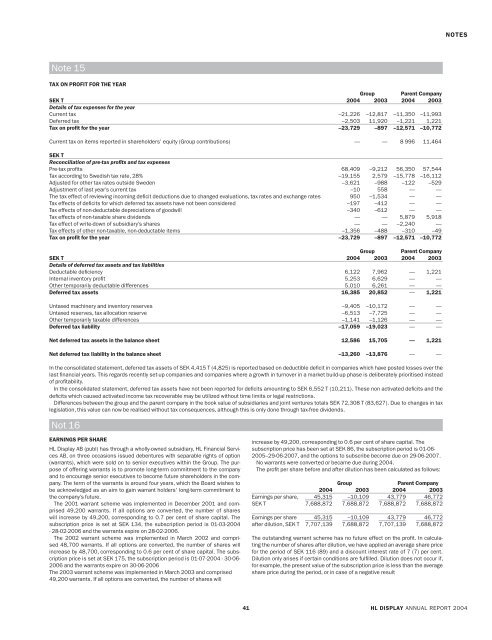

Note 15<br />

TAX ON PROFIT FOR THE YEAR<br />

Group Parent Company<br />

SEK T<br />

Details of tax expenses for the year<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Current tax –21,226 –12,817 –11,350 –11,993<br />

Deferred tax –2,503 11,920 –1,221 1,221<br />

Tax on profit for the year –23,729 –897 –12,571 –10,772<br />

Current tax on items reported in shareholders’ equity (Group contributions) — — 8 996 11,464<br />

SEK T<br />

Reconciliation of pre-tax profits and tax expenses<br />

Pre-tax profits 68,409 –9,212 56,350 57,544<br />

Tax according to Swedish tax rate, 28% –19,155 2,579 –15,778 –16,112<br />

Adjusted for other tax rates outside Sweden –3,621 –988 –122 –529<br />

Adjustment of last year’s current tax –10 558 — —<br />

The tax effect of reviewing incoming deficit deductions due to changed evaluations, tax rates and exchange rates 950 –1,534 — —<br />

Tax effects of deficits for which deferred tax assets have not been considered –197 –412 — —<br />

Tax effects of non-deductable depreciations of goodwill –340 –612 — —<br />

Tax effects of non-taxable share dividends — — 5,879 5,918<br />

Tax effect of write-down of subsidiary’s shares — — –2,240 —<br />

Tax effects of other non-taxable, non-deductable items –1,356 –488 –310 –49<br />

Tax on profit for the year –23,729 –897 –12,571 –10,772<br />

Group Parent Company<br />

SEK T <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Details of deferred tax assets and tax liabilities<br />

Deductable deficiency 6,122 7,962 — 1,221<br />

Internal inventory profit 5,253 6,629 — —<br />

Other temporarily deductable differences 5,010 6,261 — —<br />

Deferred tax assets 16,385 20,852 — 1,221<br />

Untaxed machinery and inventory reserves –9,405 –10,172 — —<br />

Untaxed reserves, tax allocation reserve –6,513 –7,725 — —<br />

Other temporarily taxable differences –1,141 –1,126 — —<br />

Deferred tax liability –17,059 –19,023 — —<br />

Net deferred tax assets in the balance sheet 12,586 15,705 — 1,221<br />

Net deferred tax liability in the balance sheet –13,260 –13,876 — —<br />

In the consolidated statement, deferred tax assets of SEK 4,415 T (4,825) is reported based on deductible deficit in companies which have posted losses over the<br />

last financial years. This regards recently set-up companies and companies where a growth in turnover in a market build-up phase is deliberately prioritised instead<br />

of profitability.<br />

In the consolidated statement, deferred tax assets have not been reported for deficits amounting to SEK 6,552 T (10,211). These non activated deficits and the<br />

deficits which caused activated income tax recoverable may be utilized without time limits or legal restrictions.<br />

Differences between the group and the parent company in the book value of subsidiaries and joint ventures totals SEK 72,308 T (83,627). Due to changes in tax<br />

legislation, this value can now be realised without tax consequences, although this is only done through tax-free dividends.<br />

Not 16<br />

EARNINGS PER SHARE<br />

<strong>HL</strong> <strong>Display</strong> AB (publ) has through a wholly-owned subsidiary, <strong>HL</strong> Financial Services<br />

AB, on three occasions issued debentures with separable rights of option<br />

(warrants), which were sold on to senior executives within the Group. The purpose<br />

of offering warrants is to promote long-term commitment to the company<br />

and to encourage senior executives to become future shareholders in the company.<br />

The term of the warrants is around four years, which the Board wishes to<br />

be acknowledged as an aim to gain warrant holders’ long-term commitment to<br />

the company’s future.<br />

The 2001 warrant scheme was implemented in December 2001 and comprised<br />

49,200 warrants. If all options are converted, the number of shares<br />

will increase by 49,200, corresponding to 0.7 per cent of share capital. The<br />

subscription price is set at SEK 134, the subscription period is 01-03-<strong>2004</strong><br />

- 28-02-2006 and the warrants expire on 28-02-2006.<br />

The 2002 warrant scheme was implemented in March 2002 and comprised<br />

48,700 warrants. If all options are converted, the number of shares will<br />

increase by 48,700, corresponding to 0.6 per cent of share capital. The subscription<br />

price is set at SEK 175, the subscription period is 01-07-<strong>2004</strong> - 30-06-<br />

2006 and the warrants expire on 30-06-2006<br />

The 2003 warrant scheme was implemented in March 2003 and comprised<br />

49,200 warrants. If all options are converted, the number of shares will<br />

41<br />

increase by 49,200, corresponding to 0.6 per cent of share capital. The<br />

subscription price has been set at SEK 86, the subscription period is 01-06-<br />

2005–29-06-2007, and the options to subscribe become due on 29-06-2007.<br />

No warrants were converted or became due during <strong>2004</strong>.<br />

The profit per share before and after dilution has been calculated as follows:<br />

Group Parent Company<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Earnings per share, 45,315 –10,109 43,779 46,772<br />

SEK T 7,688,872 7,688,872 7,688,872 7,688,872<br />

Earnings per share 45,315 –10,109 43,779 46,772<br />

after dilution, SEK T 7,707,139 7,688,872 7,707,139 7,688,872<br />

The outstanding warrant scheme has no future effect on the profit. In calculating<br />

the number of shares after dilution, we have applied an average share price<br />

for the period of SEK 116 (89) and a discount interest rate of 7 (7) per cent.<br />

Dilution only arises if certain conditions are fulfilled. Dilution does not occur if,<br />

for example, the present value of the subscription price is less than the average<br />

share price during the period, or in case of a negative result<br />

NOTES<br />

<strong>HL</strong> DISPLAY ANNUAL REPORT <strong>2004</strong>