Ali Pejman, CA - Institute of Chartered Accountants of BC

Ali Pejman, CA - Institute of Chartered Accountants of BC

Ali Pejman, CA - Institute of Chartered Accountants of BC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Employment Tax Traps & Opportunities<br />

Tips<br />

for dispositions that occur after February<br />

27 th , 2000. The Budget also proposes<br />

to increase the deduction under paragraphs<br />

110(1)(d) and (d.1) from ¼ to 1/3 <strong>of</strong><br />

the share option benefit, to keep the<br />

treatment <strong>of</strong> share options consistent<br />

with that <strong>of</strong> capital gains.<br />

The result <strong>of</strong> these changes is an<br />

income inclusion <strong>of</strong> 2/3 <strong>of</strong> the value <strong>of</strong><br />

the benefit on eligible options in the<br />

year the shares are actually disposed.<br />

With proper planning, and due regard to<br />

fluctuations in market prices for their<br />

shares, employees may be able to defer<br />

the income inclusion <strong>of</strong> the option<br />

benefits until later years, or years where<br />

their other sources <strong>of</strong> income are<br />

limited. This may allow employees to<br />

defer and reduce their taxes by using<br />

lower rates <strong>of</strong> tax and tax credits, and<br />

optimize their earned income for the<br />

purposes <strong>of</strong> computing their RRSP<br />

contribution room.<br />

Partial Dispositions <strong>of</strong> Identical<br />

Properties:<br />

Some employees who have share<br />

options may also own shares <strong>of</strong> their<br />

employer from purchases in the<br />

market or participation in employee<br />

share purchase plans. The Act contains<br />

rules that affect the computation <strong>of</strong><br />

the ACB <strong>of</strong> identical properties, such as<br />

shares <strong>of</strong> a corporation. The ACB <strong>of</strong><br />

identical properties is averaged over<br />

all the identical properties, and no<br />

specific identification <strong>of</strong> lots, and<br />

corresponding allocation <strong>of</strong> ACB, is<br />

allowed where the Grantor <strong>of</strong> the<br />

option was not a CCPC at the time the<br />

option was granted.<br />

In the past, the disposition <strong>of</strong> a<br />

portion <strong>of</strong> the shares held would be<br />

considered as a prorata disposition <strong>of</strong><br />

all identical properties held. Where an<br />

employee acquires additional securities<br />

<strong>of</strong> the Grantor under a share<br />

option plan, the paragraph 53(1)(j)<br />

increase in the ACB in respect <strong>of</strong> the<br />

share option benefit is, upon disposition<br />

<strong>of</strong> any <strong>of</strong> the identical properties,<br />

effectively averaged over the cost <strong>of</strong><br />

all the identical properties. Because an<br />

employee may hold a number <strong>of</strong><br />

identical properties (other shares <strong>of</strong><br />

the Grantor) with a lower adjusted<br />

cost base, a significant capital gain<br />

could result from the application <strong>of</strong><br />

this position. The CCRA has recently<br />

stated, in Income Tax Technical News<br />

No. 19, that<br />

where it would seem obvious to conclude<br />

that the particular securities acquired under a<br />

Section 7 option are in fact the securities that<br />

are being disposed <strong>of</strong> by the employee, we have<br />

concluded that the current legislation permits<br />

an employee to instead identify the securities<br />

acquired under the option as those being<br />

disposed <strong>of</strong>. In order to support specific<br />

identification, the employee would have to show<br />

the correlation between the particular acquisition<br />

and disposition <strong>of</strong> securities.<br />

This change to the administrative<br />

policy means that employees who hold<br />

shares acquired outside the option plan<br />

can, with a modicum <strong>of</strong> planning, sell<br />

shares at the exercise and avoid any<br />

dilution <strong>of</strong> the increase in the cost base<br />

in their shares as a consequence <strong>of</strong> the<br />

Section 7 benefit.<br />

It will be interesting to see how the<br />

Department <strong>of</strong> Finance considers the<br />

identical properties question when<br />

drafting the law on the $100,00 deferral.<br />

Many employees will have options<br />

that exceed the $100,000 threshold, and<br />

will therefore require two “pools” <strong>of</strong><br />

shares exercised, one that includes a<br />

53(1)(j) bump as a result <strong>of</strong> the Section 7<br />

benefit, and one that does not.<br />

Conclusion:<br />

The recent changes illustrate the<br />

Department <strong>of</strong> Finance’s recognition <strong>of</strong><br />

the key role that share options play in<br />

attracting and retaining the skilled<br />

work force that Canada needs to move<br />

into the future successfully. The<br />

taxation <strong>of</strong> share options is one <strong>of</strong> the<br />

few areas where Canada is becoming<br />

competitive with the United States,<br />

largely as a result <strong>of</strong> the 2000 Budget<br />

measures, and share options will<br />

continue to be an important method <strong>of</strong><br />

compensation for the employees <strong>of</strong><br />

new ventures and established businesses<br />

in Canada.<br />

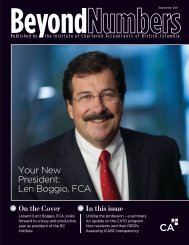

26 Beyond Numbers / September 2000