World of Work Report 2013 - International Labour Organization

World of Work Report 2013 - International Labour Organization

World of Work Report 2013 - International Labour Organization

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A. Global patterns and trends in investment<br />

Investment patterns are uneven…<br />

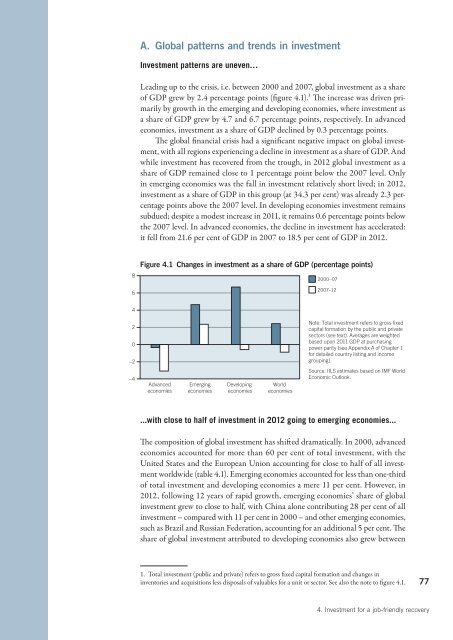

Leading up to the crisis, i.e. between 2000 and 2007, global investment as a share<br />

<strong>of</strong> GDP grew by 2.4 percentage points (fi gure 4.1).1 The increase was driven primarily<br />

by growth in the emerging and developing economies, where investment as<br />

a share <strong>of</strong> GDP grew by 4.7 and 6.7 percentage points, respectively. In advanced<br />

economies, investment as a share <strong>of</strong> GDP declined by 0.3 percentage points.<br />

The global fi nancial crisis had a significant negative impact on global investment,<br />

with all regions experiencing a decline in investment as a share <strong>of</strong> GDP. And<br />

while investment has recovered from the trough, in 2012 global investment as a<br />

share <strong>of</strong> GDP remained close to 1 percentage point below the 2007 level. Only<br />

in emerging economies was the fall in investment relatively short lived; in 2012,<br />

investment as a share <strong>of</strong> GDP in this group (at 34.3 per cent) was already 2.3 percentage<br />

points above the 2007 level. In developing economies investment remains<br />

subdued; despite a modest increase in 2011, it remains 0.6 percentage points below<br />

the 2007 level. In advanced economies, the decline in investment has accelerated:<br />

it fell from 21.6 per cent <strong>of</strong> GDP in 2007 to 18.5 per cent <strong>of</strong> GDP in 2012.<br />

8<br />

6<br />

Figure 4.1 Changes in investment as a share <strong>of</strong> GDP (percentage points)<br />

2000–07<br />

2007–12<br />

4<br />

2<br />

0<br />

–2<br />

<br />

capital formation by the public and private<br />

<br />

based upon 2011 GDP at purchasing<br />

<br />

for detailed country listing and income<br />

<br />

Source: IILS estimates based on IMF <strong>World</strong><br />

<br />

–4<br />

Advanced<br />

economies<br />

Emerging<br />

economies<br />

Developing<br />

economies<br />

<strong>World</strong><br />

economies<br />

...with close to half <strong>of</strong> investment in 2012 going to emerging economies...<br />

The composition <strong>of</strong> global investment has shifted dramatically. In 2000, advanced<br />

economies accounted for more than 60 per cent <strong>of</strong> total investment, with the<br />

United States and the European Union accounting for close to half <strong>of</strong> all investment<br />

worldwide (table 4.1). Emerging economies accounted for less than one-third<br />

<strong>of</strong> total investment and developing economies a mere 11 per cent. However, in<br />

2012, following 12 years <strong>of</strong> rapid growth, emerging economies’ share <strong>of</strong> global<br />

investment grew to close to half, with China alone contributing 28 per cent <strong>of</strong> all<br />

investment – compared with 11 per cent in 2000 – and other emerging economies,<br />

such as Brazil and Russian Federation, accounting for an additional 5 per cent. The<br />

share <strong>of</strong> global investment attributed to developing economies also grew between<br />

1. Total investment (public and private) refers to gross fi xed capital formation and changes in<br />

inventories and acquisitions less disposals <strong>of</strong> valuables for a unit or sector. See also the note to figure 4.1.<br />

77<br />

4. Investment for a job-friendly recovery