Department of Accounting SWOT Analysis - College of Business ...

Department of Accounting SWOT Analysis - College of Business ...

Department of Accounting SWOT Analysis - College of Business ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Appendix 1 - <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> <strong>SWOT</strong> <strong>Analysis</strong><br />

<strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Meeting Minutes<br />

1:00PM – 3:30 PM<br />

February 28, 2007<br />

Revised April 20, 2007 by AAC<br />

Otto Martinson led the department in a “<strong>SWOT</strong>” analysis that resulted in the following<br />

list <strong>of</strong> Strengths, Weaknesses, Opportunities, and Threats:<br />

Strengths<br />

• Dedicated Hard Working Faculty<br />

• High Quality Faculty in terms <strong>of</strong> teaching/research/practice<br />

• Wide range <strong>of</strong> faculty expertise<br />

• Relatively newly renovated Buildings<br />

• Mediated Classrooms<br />

• Hampton Roads Metropolitan Areas – good climate, high quality <strong>of</strong> life/family<br />

friendly, diverse populations<br />

• Strong relationships with alumni<br />

• Good relationships with Firms based in this Metropolitan area<br />

• Diverse student population<br />

• <strong>Accounting</strong> Accreditation<br />

• <strong>Accounting</strong> Student clubs – Beta Alpha Psi and Managerial <strong>Accounting</strong> and<br />

Auditing Club<br />

Weaknesses<br />

• University Admissions standards<br />

• Lack <strong>of</strong> separate <strong>College</strong>/<strong>Department</strong> Admissions standards<br />

• Lack <strong>of</strong> endowed chairs<br />

• PQ/AQ coverage<br />

• <strong>Accounting</strong> faculty are thinly spread to cover courses<br />

• Sufficiency <strong>of</strong> faculty particularly the lack <strong>of</strong> a bone fide academic tax researcher<br />

• Relatively low faculty salaries<br />

• Lack <strong>of</strong> a wider <strong>of</strong>fering <strong>of</strong> graduate tax classes<br />

• Distance learning in terms <strong>of</strong> benefits received versus resources expended<br />

• Lack <strong>of</strong> some research databases<br />

• Lack <strong>of</strong> true qualified research assistants who can truly assist faculty in<br />

completing <strong>Accounting</strong> Academic research.<br />

Opportunities<br />

• Graduate program<br />

• Former military students<br />

• CPA review course<br />

• Graduate admission for pr<strong>of</strong>essionals (waive GMAT requirement)

• Opportunity <strong>of</strong> research<br />

• Executive program/education<br />

• Hire additional AQ faculty particularly in Tax<br />

• Develop Tax courses/curriculum in MSA program<br />

• Fund raising/endorsements<br />

• Faculty internships<br />

Threats<br />

• Maintaining adequate PQ/AQ ratio<br />

• Research support particularly as it relates to graduate assistants.<br />

• Faculty eligible for retirement.<br />

• Distance learning ED terms <strong>of</strong> lack <strong>of</strong> rewards/penalties<br />

• Maintaining or improving student quality<br />

• Asynchronous programs<br />

• Regulators-NASBA<br />

• Maintaining information technology to support our mission<br />

• State funding relative other state located universities<br />

• Majority <strong>of</strong> students don't want to leave Hampton Road to pursue better career<br />

opportunities in other Metro areas.<br />

• Hampton Roads metropolitan area does not <strong>of</strong>fer the opportunities for<br />

pr<strong>of</strong>essional careers that other metropolitan areas such as Richmond,<br />

Washington, D.C., or Charlotte <strong>of</strong>fers.

Appendix 2 - <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Strategic Plan<br />

<strong>College</strong> <strong>of</strong> <strong>Business</strong> and Public Administration<br />

<strong>Department</strong> <strong>of</strong> <strong>Accounting</strong><br />

STRATEGIC PLAN<br />

(2007-2012)<br />

April 2005<br />

Revised November 2005<br />

Revised April 2007

VISION STATEMENT<br />

Our vision is to be recognized as a leader in pr<strong>of</strong>essional accounting education and to become<br />

one <strong>of</strong> the primary centers <strong>of</strong> excellence in education in Hampton Roads and beyond.<br />

MISSION STATEMENT<br />

Our mission within this vision is, through our teaching, research and service, to produce ethical<br />

accounting graduates who have the academic and pr<strong>of</strong>essional base <strong>of</strong> knowledge to meet the<br />

challenges posed by a dynamic global business environment.<br />

ACHIEVING OUR VISION AND MISSION<br />

We will achieve our vision and mission by continually pursuing:<br />

• An undergraduate curriculum that focuses on ideal knowledge, skills, and abilities for<br />

entry level accountants and provides motivation to become an accounting<br />

pr<strong>of</strong>essional.<br />

• Graduate programs that clearly extend the knowledge and enhance the development<br />

<strong>of</strong> pr<strong>of</strong>essional accountants.<br />

• <strong>Accounting</strong> courses with content that emphasize the highest level <strong>of</strong> pr<strong>of</strong>essional<br />

ethics and practice.<br />

• Meaningful intellectual contributions in accounting including the scholarship <strong>of</strong><br />

learning and pedagogical, discipline based and contributions to practice.<br />

• Continuous close communication, trust, and commitment to the accounting pr<strong>of</strong>ession<br />

that will foster cooperation and support in achieving our goals.<br />

• As we seek to fulfill this vision, we ask all constituent groups within and outside the<br />

<strong>College</strong> to join us in a mutual quest for enduring “Partners for Excellence in<br />

<strong>Accounting</strong> Education”

SHARED VALUES<br />

The following “Shared Values” are embodied in the <strong>Accounting</strong> Program’s Mission Statement:<br />

• Appreciation <strong>of</strong> diversity <strong>of</strong> people and perspectives<br />

• Commitment to excellence in teaching<br />

• Concern for students<br />

• High ethical values and behavior<br />

• Intellectual curiosity<br />

• Community outreach<br />

• Global orientation<br />

Strategic Planning Committee<br />

• Dr. Otto Martinson, Chairperson, Pr<strong>of</strong>essor<br />

• Dr. Douglas Ziegenfuss, Pr<strong>of</strong>essor<br />

• Dr. Laurie Henry, Associate Pr<strong>of</strong>essor<br />

• Timothy McKee, Associate Pr<strong>of</strong>essor<br />

• Dr. Chansog Kim, Associate Pr<strong>of</strong>essor<br />

• Dr. Mike Stein, Associate Pr<strong>of</strong>essor<br />

• Dr. Robert Pinsker, Assistant Pr<strong>of</strong>essor<br />

• Dr. Yin Xu, Assistant Pr<strong>of</strong>essor

GOALS and ACTION ITEMS TABLE<br />

PERSPECTIVES<br />

GOAL<br />

NUMBER<br />

GOAL<br />

ACTION ITEM<br />

NUMBER<br />

ACTION ITEM<br />

Student Perspective<br />

SP-1<br />

SP-2<br />

Improve<br />

qualifications <strong>of</strong><br />

incoming students<br />

in undergraduate<br />

and graduate<br />

programs. (Measures<br />

are GPA and GMAT)<br />

Improve numbers <strong>of</strong><br />

placements in jobs,<br />

MSA program, and<br />

other graduate<br />

programs. (Measures<br />

are job placement,<br />

entrants into our MSA<br />

program and other<br />

graduate programs,<br />

senior or graduate<br />

surveys, and feedback<br />

from recruiters and<br />

employers.)<br />

SP-1A<br />

SP-1B<br />

SP-1C<br />

SP-2A<br />

Maintain activities<br />

for, and interactions<br />

with, college<br />

alumni.<br />

Build relationships<br />

with area<br />

accounting firms<br />

and businesses<br />

through visits by<br />

Chair and Faculty.<br />

Work closely with<br />

development <strong>of</strong>fice<br />

and college Major<br />

Gifts Officer to<br />

seek funding for an<br />

Endowed Chair in<br />

<strong>Accounting</strong>.<br />

Continue<br />

curriculum<br />

assessment to<br />

ensure development<br />

<strong>of</strong> knowledge and<br />

skills desired by<br />

employers.

PERSPECTIVES<br />

GOAL<br />

NUMBER<br />

GOAL<br />

ACTION ITEM<br />

NUMBER<br />

ACTION ITEM<br />

Student Perspective<br />

SP-2B<br />

SP-2C<br />

SP-2D<br />

SP-2E<br />

SP-2F<br />

Encourage practical<br />

work experiences<br />

internships.<br />

Encourage qualified<br />

<strong>Accounting</strong> majors<br />

to enter our MSA<br />

program.<br />

Encourage tracking<br />

<strong>of</strong> graduate<br />

placements by the<br />

Office <strong>of</strong> Graduate<br />

Studies.<br />

Work with<br />

<strong>Accounting</strong><br />

Advisory Council to<br />

promote visibility<br />

<strong>of</strong> our programs and<br />

graduates.<br />

Work with MAAC<br />

and Beta Alpha Psi<br />

to help students be<br />

more proactive in<br />

developing<br />

themselves for<br />

pr<strong>of</strong>essional<br />

careers.

PERSPECTIVES<br />

Financial<br />

Perspective<br />

GOAL<br />

NUMBER<br />

FP-1<br />

FP-2<br />

GOAL<br />

Increase<br />

endowments and<br />

operating funds for<br />

faculty<br />

development, and<br />

scholarships.<br />

(Measure in dollars.)<br />

Increase revenues<br />

and surpluses from<br />

special accounting<br />

programs. (Measure<br />

in dollars.)<br />

ACTION ITEM<br />

NUMBER<br />

FP-1A<br />

FP-1B<br />

FP-1C<br />

FP-2A<br />

FP-2B<br />

ACTION ITEM<br />

Maintain activities<br />

for, and interactions<br />

with, college<br />

alumni.<br />

Build relationships<br />

with area<br />

accounting firms<br />

and businesses<br />

through visits by<br />

Chair and Faculty.<br />

Work closely with<br />

development <strong>of</strong>fice<br />

and college Major<br />

Gifts Officer to<br />

seek funding for an<br />

Endowed Chair in<br />

<strong>Accounting</strong>.<br />

Increase<br />

participation in<br />

CPA review<br />

programs.<br />

Continue <strong>of</strong>fering<br />

the mandatory CPA<br />

ethics training.<br />

FP-2C<br />

FP-2D<br />

Continue the annual<br />

DOA 5k Run.<br />

Develop other fundraising<br />

programs.

PERSPECTIVES<br />

Internal <strong>Business</strong><br />

Perspective<br />

GOAL<br />

NUMBER<br />

IBP-1<br />

GOAL<br />

Maintain or<br />

increase high<br />

quality <strong>of</strong> classroom<br />

instruction.<br />

(Measures are<br />

teaching awards,<br />

number <strong>of</strong> tenure<br />

track faculty, teaching<br />

portfolios, and<br />

allocations <strong>of</strong> faculty<br />

resources.)<br />

ACTION ITEM<br />

NUMBER<br />

IP-1A<br />

IP-1B<br />

IP-1C<br />

IP-1D<br />

IP-1E<br />

ACTION ITEM<br />

Continue<br />

curriculum<br />

assessment to<br />

ensure development<br />

<strong>of</strong> knowledge and<br />

skills desired by<br />

employers.<br />

Offer opportunities<br />

for faculty to attend<br />

workshops and<br />

conferences that are<br />

teaching-related.<br />

Encourage faculty<br />

to take advantage <strong>of</strong><br />

opportunities<br />

<strong>of</strong>fered by the<br />

Center for Learning<br />

Technologies and to<br />

adopt new<br />

technologies.<br />

Assign faculty<br />

schedules to best<br />

match expertise and<br />

training to<br />

appropriate<br />

curriculum levels.<br />

Ensure that<br />

performance<br />

evaluation system<br />

rewards high<br />

quality classroom<br />

instruction.

PERSPECTIVES<br />

Internal <strong>Business</strong><br />

Perspective<br />

GOAL<br />

NUMBER<br />

IBP-2<br />

IBP-3<br />

GOAL<br />

Increase high<br />

quality research.<br />

(Measures are<br />

research productivity<br />

in number <strong>of</strong><br />

publications in high<br />

quality outlets.)<br />

Increase service to<br />

pr<strong>of</strong>ession and<br />

community.<br />

(Measures are<br />

program <strong>of</strong>ferings<br />

and faculty<br />

participation/leadersh<br />

ip in organizations.)<br />

ACTION ITEM<br />

NUMBER<br />

IBP-2A<br />

IBP-2B<br />

IBP-2C<br />

IBP-3A<br />

ACTION ITEM<br />

Recruit and retain<br />

high quality<br />

research faculty.<br />

Provide research<br />

support through<br />

workload policy,<br />

travel funding,<br />

summer research<br />

grants, graduate<br />

assistant support,<br />

and acquisition <strong>of</strong><br />

databases.<br />

Participate in Dean's<br />

Research Seminar<br />

(Faculty, Chairs)<br />

Continue faculty<br />

involvement in<br />

pr<strong>of</strong>essional<br />

academic<br />

associations and in<br />

community<br />

pr<strong>of</strong>essional and<br />

social<br />

organizations.

PERSPECTIVES<br />

Innovation and<br />

Learning<br />

Perspective<br />

GOAL<br />

NUMBER<br />

ILP-1<br />

GOAL<br />

Increase<br />

opportunities for<br />

faculty and staff<br />

development.<br />

(Measures are<br />

funding for<br />

pr<strong>of</strong>essional<br />

development and<br />

numbers <strong>of</strong> faculty<br />

participation in<br />

development courses,<br />

programs, and<br />

conferences.<br />

ACTION ITEM<br />

NUMBER<br />

ILP-1A<br />

ILP1B<br />

ACTION ITEM<br />

Increase funding for<br />

faculty and staff<br />

travel and/or<br />

enrollment in<br />

training programs.<br />

Promote<br />

interactions among<br />

faculty to increase<br />

transfer <strong>of</strong><br />

knowledge between<br />

faculty members.

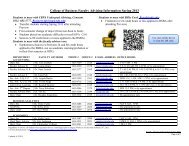

Appendix 3 - <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Financial Strategy Chart<br />

ACTION<br />

ITEM<br />

NUMBER<br />

SP-1A<br />

SP-1B<br />

SP-1C<br />

SP-2A<br />

SP-2B<br />

SP-2C<br />

SP-2D<br />

SP-2E<br />

ACTION ITEM<br />

Maintain activities for,<br />

and interactions with,<br />

college alumni.<br />

Build relationships with<br />

area accounting firms<br />

and businesses through<br />

visits by Chair and<br />

Faculty.<br />

Work closely with<br />

development <strong>of</strong>fice and<br />

college Major Gifts<br />

Officer to seek funding<br />

for an Endowed Chair in<br />

<strong>Accounting</strong>.<br />

Continue curriculum<br />

assessment to ensure<br />

development <strong>of</strong><br />

knowledge and skills<br />

desired by employers.<br />

Encourage practical work<br />

experiences internships.<br />

Encourage qualified<br />

<strong>Accounting</strong> majors to<br />

enter our MSA program.<br />

Encourage tracking <strong>of</strong><br />

graduate placements by<br />

the Office <strong>of</strong> Graduate<br />

Studies.<br />

Work with <strong>Accounting</strong><br />

Advisory Council to<br />

promote visibility <strong>of</strong> our<br />

programs and graduates.<br />

ACTIVITIES AND<br />

RESOURCES<br />

NEEDED<br />

Hold two social<br />

events and one<br />

annual meeting –<br />

Approximately<br />

$2500 annually<br />

Present Required<br />

Ethics CPE for<br />

Virginia CPAs – no<br />

actual funds<br />

required<br />

Dean and Major<br />

Gifts Officer - time<br />

and talent but goal<br />

is $1.5 million<br />

SOURCE<br />

<strong>Accounting</strong><br />

Alumni<br />

Chapter Funds<br />

Area<br />

<strong>Accounting</strong><br />

Firms and<br />

<strong>Business</strong>es<br />

CPA Firms<br />

STATUS AS<br />

OF 06/07<br />

Accomplished<br />

Accomplished<br />

Approximately<br />

$250,000<br />

raised to date<br />

Time and Talent by<br />

Acct. Faculty- no<br />

funds required Acct Faculty Accomplished<br />

Time and Talent by<br />

Undergraduate<br />

Internship Director<br />

and MSA Graduate<br />

Program Directorno<br />

funds required<br />

Undergraduate<br />

Internship<br />

Director and<br />

MSA Graduate<br />

Program<br />

Director<br />

Accomplished<br />

Time and Talent by<br />

Acct. Faculty- no<br />

funds required Acct Faculty Accomplished<br />

Office <strong>of</strong> Graduate<br />

Studies – no funds<br />

required<br />

Chair<br />

Have not<br />

accomplished<br />

this<br />

Chair and<br />

<strong>Accounting</strong><br />

Advisory Councilno<br />

funds required Chair Accomplished

ACTION<br />

ITEM<br />

NUMBER<br />

ACTION ITEM<br />

ACTIVITIES AND<br />

RESOURCES<br />

NEEDED<br />

SOURCE<br />

STATUS AS<br />

OF 06/07<br />

SP-2F<br />

FP-1A<br />

FP-1B<br />

FP-1C<br />

FP-2A<br />

FP-2B<br />

FP-2C<br />

Work with MAAC and<br />

Beta Alpha Psi to help<br />

students be more<br />

proactive in developing<br />

themselves for<br />

pr<strong>of</strong>essional careers.<br />

Maintain activities for,<br />

and interactions with,<br />

college alumni.<br />

Build relationships with<br />

area accounting firms<br />

and businesses through<br />

visits by Chair and<br />

Faculty.<br />

Work closely with<br />

development <strong>of</strong>fice and<br />

college Major Gifts<br />

Officer to seek funding<br />

for an Endowed Chair in<br />

<strong>Accounting</strong>.<br />

Increase participation in<br />

CPA review programs.<br />

Continue <strong>of</strong>fering the<br />

mandatory CPA ethics<br />

training.<br />

Continue the annual DOA<br />

5k Run.<br />

Time and Talent by<br />

Acct. Faculty and<br />

Student Leaders –<br />

Approximately<br />

$2500 annually S<strong>of</strong>t Funds Accomplished<br />

Hold two social<br />

events and one<br />

annual meeting –<br />

Approximately<br />

$2500 annually<br />

Present Required<br />

Ethics CPE for<br />

Virginia CPAs –<br />

source <strong>of</strong> funds<br />

Dean and Major<br />

Gifts Officer - time<br />

and talent also $1.5<br />

million<br />

<strong>Accounting</strong><br />

Alumni<br />

Chapter Funds<br />

Area<br />

<strong>Accounting</strong><br />

Firms and<br />

<strong>Business</strong>es<br />

CPA Firms<br />

Accomplished<br />

Accomplished<br />

$250,000<br />

raised to date<br />

Accomplished<br />

CPA Review<br />

Course Flyer widely<br />

distributed;<br />

presentations<br />

before BAP DACCT Funds Accomplished<br />

Chair – source <strong>of</strong><br />

funds<br />

Acct Faculty Time<br />

and Talent – source<br />

<strong>of</strong> funds<br />

Area<br />

<strong>Accounting</strong><br />

Firms and<br />

<strong>Business</strong>es<br />

Area<br />

<strong>Accounting</strong><br />

Firms and<br />

<strong>Business</strong>es<br />

Accomplished<br />

Accomplished

ACTION<br />

ITEM<br />

NUMBER<br />

FP-2D<br />

IP-1A<br />

IP-1B<br />

IP-1C<br />

IP-1D<br />

IP-1E<br />

IBP-2A<br />

IBP-2B<br />

IBP-2C<br />

ACTION ITEM<br />

Develop other fundraising<br />

programs.<br />

Continue curriculum<br />

assessment to ensure<br />

development <strong>of</strong><br />

knowledge and skills<br />

desired by employers.<br />

Offer opportunities for<br />

faculty to attend<br />

workshops and<br />

conferences that are<br />

teaching-related.<br />

Encourage faculty to take<br />

advantage <strong>of</strong><br />

opportunities <strong>of</strong>fered by<br />

the Center for Learning<br />

Technologies and to<br />

adopt new technologies.<br />

Assign faculty schedules<br />

to best match expertise<br />

and training to<br />

appropriate curriculum<br />

levels.<br />

Ensure that performance<br />

evaluation system<br />

rewards high quality<br />

classroom instruction.<br />

Recruit and retain high<br />

quality research faculty.<br />

Provide research support<br />

through workload policy,<br />

travel funding, summer<br />

research grants,<br />

graduate assistant<br />

support, and acquisition<br />

<strong>of</strong> databases.<br />

Participate in Dean's<br />

Research Seminar<br />

(Faculty, Chairs)<br />

ACTIVITIES AND<br />

RESOURCES<br />

NEEDED<br />

Chair and Dean, CBPA<br />

source <strong>of</strong> funds<br />

Time and Talent by<br />

Acct. Faculty – no<br />

funds required<br />

Acct. Faculty<br />

attendance at AAA<br />

national and regional<br />

meetings,<br />

SEINFORMS –<br />

Annually approximately<br />

$30,000<br />

E-mail by CLT directly<br />

to faculty – no funds<br />

required<br />

Chair and <strong>Accounting</strong><br />

Faculty – no funds<br />

required<br />

Annual Review by<br />

Chair and Dean – no<br />

funds required<br />

Time and Talent <strong>of</strong><br />

Chair and <strong>Accounting</strong><br />

Faculty – no funds<br />

required<br />

Chair and Dean, CBPA<br />

Time and Talent <strong>of</strong><br />

Chair and <strong>Accounting</strong><br />

Faculty – no funds<br />

required<br />

SOURCE<br />

Chair and<br />

Dean<br />

<strong>Accounting</strong><br />

<strong>Department</strong><br />

Faculty<br />

University<br />

and Dept.<br />

Travel<br />

funds<br />

University<br />

Resources<br />

Chair and<br />

<strong>Accounting</strong><br />

Faculty<br />

Chair and<br />

Dean<br />

University<br />

Funds<br />

<strong>College</strong><br />

and<br />

University<br />

Funds<br />

<strong>College</strong><br />

Funds<br />

STATUS AS<br />

OF 06/07<br />

Not<br />

Accomplished<br />

Accomplished<br />

Accomplished<br />

Accomplished<br />

Accomplished<br />

Accomplished<br />

Accomplished<br />

Accomplished<br />

Accomplished

ACTION<br />

ITEM<br />

NUMBER<br />

IBP-3A<br />

ILP-1A<br />

ILP1B<br />

ACTION ITEM<br />

Continue faculty<br />

involvement in<br />

pr<strong>of</strong>essional academic<br />

associations and in<br />

community pr<strong>of</strong>essional<br />

and social organizations.<br />

Increase funding for<br />

faculty and staff travel<br />

and/or enrollment in<br />

training programs.<br />

Promote interactions<br />

among faculty to increase<br />

transfer <strong>of</strong> knowledge<br />

between faculty<br />

members.<br />

ACTIVITIES AND<br />

RESOURCES<br />

NEEDED<br />

Time and Talent <strong>of</strong><br />

Chair and<br />

<strong>Accounting</strong> Faculty<br />

– approximately<br />

$30,000 annually<br />

Ethics CPE, DOA<br />

5k race, and annual<br />

giving –<br />

approximately<br />

$30,000 annually<br />

<strong>Department</strong><br />

Meetings – no funds<br />

required.<br />

SOURCE<br />

<strong>Department</strong><br />

funds for dues<br />

Area<br />

<strong>Accounting</strong><br />

Firms and<br />

<strong>Business</strong>es<br />

Time and<br />

Talent <strong>of</strong><br />

<strong>Accounting</strong><br />

Faculty<br />

STATUS AS<br />

OF 06/07<br />

Accomplished<br />

Accomplished<br />

Accomplished

Appendix 4 - <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Research Report<br />

<strong>Department</strong> <strong>of</strong> <strong>Accounting</strong><br />

Faculty Research<br />

Calendar Years 2004-2006<br />

Dr. Michael Stein<br />

with Burch Kealey and Ho Young Lee. The Association between Audit-Firm Tenure and Audit<br />

Fees Paid to Successor Auditors: Evidence from Arthur Andersen. Auditing: A Journal <strong>of</strong><br />

Practice & Theory (forthcoming).<br />

with J. Hans Blokdijk, Fred Drieenhuizen and Dan A. Simunic. An <strong>Analysis</strong> <strong>of</strong> Cross-Sectional<br />

Differences in Big 5 and Non Big-5 Audit Programs. Auditing: A Journal <strong>of</strong> Practice &<br />

Theory, Vol 22, No 1, May 2006:27-48.<br />

with Dan Simunic. Commentary on “Contingent Rents and Auditors’ Independence: Appearance<br />

vs. Fact”. Asian-Pacific Journal <strong>of</strong> <strong>Accounting</strong> and Economics, Vol. 11 No. 1, June,<br />

2004: 69-74.<br />

“A commentary on Competitive Crossovers and Knowledge Spillovers in Auditing,”<br />

Contemporary <strong>Accounting</strong> Research, Vol. 23 No. 2, Summer 2006: 555-564.<br />

Dr. Chansog Kim<br />

“Divergence <strong>of</strong> Opinion and Equity Returns” Coauthored with J. Doukas and C. Pantzalis, 2006,<br />

Journal <strong>of</strong> Financial and Quantitative <strong>Analysis</strong>, Volume 41, No. 3, 573-606.<br />

“Divergence <strong>of</strong> Opinion and Equity Returns under Different States <strong>of</strong> Earnings Expectations,”<br />

Coauthored with J. Doukas and C. Pantzalis, 2006, Journal <strong>of</strong> Financial Markets, Volume<br />

9, No. 3, 310-331.<br />

“Two Faces <strong>of</strong> Analyst Coverage,” Coauthored with J. Doukas and C. Pantzalis, 2005, Financial<br />

Management, Volume 34, No. 2, 99-125.<br />

“Divergent Opinions and the Performance <strong>of</strong> Value Stocks,” Coauthored with J. Doukas and C.<br />

Pantzalis, 2004, Financial Analyst Journal, Volume 60, No. 6, pp. 55-64.<br />

“Chaebols and Corporate Governance in South Korea,” Coauthored with C. K. Min and C.<br />

Maden, 2004, pp. 177-198, Chapter 9 <strong>of</strong> “The Governance <strong>of</strong> East Asian Corporations:<br />

Post Asian Financial Crisis,” Edited by F. A. Gul and J. S. L. Tsui.

Dr. Yin Xu<br />

Xu, Y., and X. Xu. Social actors, cultural capital, and the state: The standardization <strong>of</strong> bank<br />

accounting classification and terminology in early twentieth century China. <strong>Accounting</strong>,<br />

Organization and Society (In Press).<br />

Xu, Y., and K. Wang. 2006. An examination <strong>of</strong> managers’ effort on product quality: An<br />

Expectancy theory perspective. Review <strong>of</strong> <strong>Business</strong> Research 6(2): 224-232.<br />

Bepristis, M., and Y. Xu. 2006 Defined benefit pension fund accounting: Relevancy, clarity, and<br />

consistency. The Journal <strong>of</strong> American Academy <strong>of</strong> <strong>Business</strong> 9(2): 294-299.<br />

Xu. Y., and B. Tuttle. The role <strong>of</strong> social influence in using accounting performance information<br />

to evaluate subordinates: a causal attribution approach. Behavioral Research in<br />

<strong>Accounting</strong> 17:191-210.<br />

Xu, Y. 2005. The effect <strong>of</strong> graphic disclosures on users’ perceptions: An experiment. Journal<br />

<strong>of</strong> <strong>Accounting</strong> and Finance Research 13.<br />

Xu. Y., and B. Tuttle. 2004. Performance evaluations with or without data from a formal<br />

accounting reporting system. Advances in <strong>Accounting</strong> Behavioral Research 7: 151-167.<br />

Xu, Y. 2004. The effect <strong>of</strong> economic incentives and ethical reasoning on internal auditors'<br />

perceptions <strong>of</strong> whistle-blowing behavior: An experiment. Ethics and Critical Thinking<br />

Journal (March): 116-146.<br />

“The Reverse Effect <strong>of</strong> Financial Incentives: A Study <strong>of</strong> Internal Auditor Objectivity,” (with K.<br />

Wang). Proceedings <strong>of</strong> <strong>Accounting</strong>, Behavior, and Organization Research Conference<br />

(Chicago, IL, 2004).<br />

“A New Adaptor-Innovator Problem Solving Measure for the Workplace,” (with B. Tuttle).<br />

Proceedings <strong>of</strong> The Fourth International Conference on Performance Measurement and<br />

Management (Edinburgh, UK, 2004).<br />

“Whither the Public <strong>Accounting</strong> as a Pr<strong>of</strong>ession: Auditor Independence and Non-Audit<br />

Services,” (with K. Wang). Proceedings <strong>of</strong> American <strong>Accounting</strong> Association Annual<br />

Conference (Orlando, FL, 2004).<br />

Dr. Robert Pinsker<br />

R. Pinsker. “Using Longer Series <strong>of</strong> Consistent Direction and Direction Reversal Information to<br />

Examine the Effects <strong>of</strong> Different Disclosure Patterns on Non-Pr<strong>of</strong>essional Individual<br />

Investors.” Behavioral Research in <strong>Accounting</strong>, In Press.<br />

S. Gara, R. Pinsker, and K. Karim. “Benefits <strong>of</strong> XML Implementation For Tax Filing and<br />

Compliance.” The CPA Journal, In Press.

S. Li and R. Pinsker. 2005. “Modeling RBRT Adoption and its Effects on Cost <strong>of</strong> Capital.”<br />

International Journal <strong>of</strong> <strong>Accounting</strong> Information Systems 6: 196-215.<br />

R. Pinsker, S. Gara, and K. Karim. 2005. “XBRL Usage: A Socio-Economic Perspective.”<br />

Review <strong>of</strong> <strong>Business</strong> Information Systems 9 (4): 59-72.<br />

J. Kahle, R. Pinsker, and R. Pennington. 2005. “Belief Revision in <strong>Accounting</strong>: A Literature<br />

Review <strong>of</strong> the Belief-Adjustment Model.” Advances in <strong>Accounting</strong> Behavioral Research<br />

8: 1-40.<br />

S. Farewell and R. Pinsker. 2005. “XBRL: What Does it Mean for You and Your Firm?” The<br />

CPA Journal (May) 75 (5): 68-9.<br />

R. Pinsker. 2004. “Teaching XBRL to Graduate <strong>Business</strong> Students: A Hands-on Approach.” The<br />

Journal <strong>of</strong> STEM Education 5 (1 & 2): 1-13.<br />

K. Palmer, D. Ziegenfuss, and R. Pinsker. 2004. “International Knowledge,<br />

Skills, and Abilities Required <strong>of</strong> Auditors: Evidence from Recent Competency Studies.”<br />

Managerial Auditing Journal 19 (7): 889-96.<br />

Dr. Otto Martinson<br />

“An Empirical Investigation <strong>of</strong> the Minority Interest and Marketability Discount in Valuation <strong>of</strong><br />

Closely Held Stock for Estate and Gift Tax Purposes,” with Englebrecht and Anderson,<br />

Journal <strong>of</strong> Applied <strong>Business</strong> Research, Volume XXII, Winter 2006.<br />

“Empirical Study <strong>of</strong> the Planning and Control Process for Performance Measurement as Applied<br />

in the Management <strong>of</strong> a Major Russian Oil Company” the Annual Meeting <strong>of</strong> Southeast<br />

INFORMS, Proceedings Southeast Annual Meeting <strong>of</strong> INFORMS, October 2006.<br />

“A look at the Organizational Structure <strong>of</strong> the CFO’s Function in Corporate America ” the<br />

Annual Meeting <strong>of</strong> Southeast INFORMS, Proceedings Southeast Annual Meeting <strong>of</strong><br />

INFORMS, October 2005.<br />

“Evolution <strong>of</strong> the Role <strong>of</strong> the Chief Financial Officer” the Annual Meeting <strong>of</strong> Southeast<br />

INFORMS, Proceedings Southeast Annual Meeting <strong>of</strong> INFORMS, October 2004.<br />

Dr. Laurie Henry<br />

“Choosing and Using Sarbanes-Oxley S<strong>of</strong>tware.” With Nancy Bagran<strong>of</strong>f. Information Systems<br />

Control Journal. (Vol 2, 2005): 49-51; also at www.isaca.org .<br />

Dr. Douglas Ziegenfuss

With Patricia M. Meyers, “Audit Committee Pre-Enron Efforts to Increase the Effectiveness <strong>of</strong><br />

Corporate Governance,” Corporate Governance: An International Journal <strong>of</strong> <strong>Business</strong> in<br />

Society, 2006, Volume 6, No. 1. pp. 49-63.<br />

Co-authored with L. Crumbley and Z. Rezaee, U.S. Master Auditing Guide 3 nd . Edition,<br />

Chicago, Illinois: CCH Incorporated, 2004, pp. 1-955.<br />

Co-authored with M. Dittenh<strong>of</strong>er, Ethics and the Internal Auditor: 20 Years Later, Altamonte<br />

Springs, Florida: The Institute <strong>of</strong> Internal Auditors Research Foundation, 2004, pp. 1-<br />

153.<br />

Co-authored with K. Palmer, and R. Pinsker, “International knowledge, skills, and abilities <strong>of</strong><br />

auditors/accountants: evidence from recent competency studies,” in Managerial Auditing<br />

Journal, 2004, Volume 19, No. 7. pp. 889-896.<br />

Co-authored with A. Kokkinos, 2005 Salary Survey <strong>of</strong> Hampton Roads <strong>Accounting</strong> Positions,<br />

Norfolk, Virginia: <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong>, Old Dominion University and Don<br />

Richard Associates, 2005, pp. 1-51.<br />

With Tan Xu, and Mohammad Najand, “Intra-Industry Effects <strong>of</strong> Earnings Restatements Due to<br />

<strong>Accounting</strong> Irregularities,” Journal <strong>of</strong> <strong>Business</strong>, Finance and <strong>Accounting</strong>, 2006, Volume<br />

33, Issue 5-6 (June/July) pp. 696-714.

Appendix 5:<br />

<strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Advisory Council (AAC)<br />

Mr. Anthony Markun, President, HR Chapter, ACFE<br />

Ms. Barbara L. Smith, Partner, Cherry Bekaert & Holland<br />

Mr. Colin Barton, Director Corporate <strong>Accounting</strong>, Norfolk Southern<br />

Mr. Ed Greene, President, Don Richard Associates<br />

Ms. Elizabeth M. Weller, , Gold Key Resorts<br />

Mr. Gerald L. Sullivan, President, Sullivan, Andrews & Taylor<br />

Mr. Glenn R. Wilson, President, Tidewater Chapter, IIA, Old Dominion University<br />

Ms. Joyce C. Anderson, President, Hampton Roads Chapter, IMA, Palms Associates, B&B<br />

Associates <strong>of</strong> VA<br />

Mr. Lyndon S. Remias, Internal Auditor, EVMS<br />

Mr. Matthew Hewes, Managing Partner, Matthew S. Hewes, CPA, PC<br />

Mr. Vernon T. Turner, Corporate Tax Director, Smithfield Foods Inc.<br />

Mr. Andre A. Evans, Partner, KPMG Peat Marwick<br />

Mr. Andy P. Weddle, Manager, Sentara Healthcare<br />

Mr. Dennis Ryan, Senior Vice President for Finance, Children's Hospital <strong>of</strong> the Kings Daughters<br />

Mr. Ed Blair, Partner, Witt, Mares & Co., P.L.C.<br />

Mr. George J. Walker, Partner, Goodman & Co., L.L.P<br />

Mr. James V. Strickland, Jr., Partner, Strickland & Jones P.C.<br />

Mr. Joseph Kersey, President <strong>Accounting</strong> Alumni, Mortgage Consultant, Atlantic Bay Mortgage<br />

Group<br />

Mr. Marty Ridout, Partner, McPhillips, Roberts & Deans, PLC<br />

Mr. Robert Fuqua, President DOAAC, Consultant, formally CFO, Tarmac USA<br />

Ms. Vivian J. Paige, President, Vivian J. Paige, CPA, PC<br />

Ms. Cherie A. James, Shareholder, Wall, Einhorn & Chernitzer, PC<br />

Capt. Larry R. White, Commanding Office, USCG Finance Center

Appendix 6 - <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Maintenance Report<br />

AY 2002/2003<br />

AACSB Annual Maintenance <strong>of</strong> Accreditation Report -<br />

AY 2002/03<br />

<strong>Department</strong> <strong>of</strong> <strong>Accounting</strong><br />

<strong>College</strong> <strong>of</strong> <strong>Business</strong> and Public Administration<br />

Old Dominion University<br />

Submitted by:<br />

Douglas E. Ziegenfuss<br />

Chair and Pr<strong>of</strong>essor<br />

July 31, 2003<br />

Progress Update<br />

The <strong>Department</strong> has the following action items listed by the AACSB International in its<br />

May 31, 2001 letter:<br />

1. The adequacy <strong>of</strong> the resources available to support faculty appears to still need<br />

improvement. $40,000 over three years is not a great deal <strong>of</strong> money for<br />

developmental and research needs.<br />

2. While research productivity in the aggregate increased, it was concentrated in<br />

two individuals. A broader cross-section <strong>of</strong> the faculty should be involved<br />

regularly in scholarship. If one or both productive faculty should leave, the<br />

situation would dramatically change.<br />

3. Little or no evidence was supplied on how the assessment procedures were used<br />

to provide continuous improvement. In addition, what additional measures are<br />

being currently used or planned for the future?<br />

4. The Grade Forgiveness program study has not been completed and, therefore,<br />

cannot be evaluated.<br />

The <strong>Department</strong> responded to these issues in a letter dated May 28, 2003. The follow-up<br />

letter forms the basis for this annual maintenance report.<br />

Situational <strong>Analysis</strong><br />

The <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> (The <strong>Department</strong>) is part <strong>of</strong> the <strong>College</strong> <strong>of</strong> <strong>Business</strong> and<br />

Public Administration (The <strong>College</strong>) at Old Dominion University (The University). Dean<br />

Bagran<strong>of</strong>f and Associate Dean Ardalan have produced a separate <strong>College</strong> maintenance<br />

report that will be referenced in this report when its material is relevant to the<br />

<strong>Department</strong>’s activities. For instance the <strong>College</strong> has no action items outstanding from its<br />

last accreditation and the <strong>Department</strong> has four items.

Dr. Douglas E. Ziegenfuss continues to serve as <strong>Department</strong> Chair. Likewise, Dr. Otto<br />

Martinson serves as Graduate Program Director (GPD) for the Masters <strong>of</strong> Science in<br />

<strong>Accounting</strong> (MSA) program and Ms. Terry Kubichan serves as the Undergraduate<br />

Student Advisor. These individuals have served in their respective positions for three<br />

years providing much needed leadership continuity over the <strong>Department</strong>’s operations.<br />

The <strong>Department</strong> continued to focus on the action items during the 03 Academic Year<br />

(AY03). The <strong>Department</strong> was successful in raising more funds for research than in the<br />

Academic Year 03 (AY03) due to increases in annual contributions and the DOA 5k race<br />

surpluses.<br />

Several faculty members attended continuing education programs sponsored by KPMG,<br />

Price Waterhouse Coopers, and the Virginia Society <strong>of</strong> Certified Public Accountants.<br />

Two faculty members joined the <strong>Department</strong> faculty during AY03.<br />

Research productivity is more broadly based during AY03 than AY02. Newer hired<br />

faculty members are starting to produce quality journal articles while longer serving<br />

faculty members are maintaining their productivity at an acceptable level.<br />

Concerning assessment, the <strong>Department</strong> tried to identify methods for continuous<br />

improvement. The <strong>Department</strong> developed an undergraduate assessment exam composed<br />

<strong>of</strong> 100 multiple-choice questions (25 from each section) chosen at random from a CPA<br />

Review Course database. In addition, the <strong>Department</strong> used the results <strong>of</strong> competency<br />

studies by the AICPA, IIA, and IMA to evaluate course content and curriculum.<br />

1. The adequacy <strong>of</strong> the resources available to support faculty appears to still need<br />

improvement. $40,000 over three years is not a great deal <strong>of</strong> money for<br />

developmental and research needs.<br />

<strong>Department</strong> Actions: During the past two years, the <strong>Department</strong> has increased its outreach to<br />

alumni by on-site visits, and participation in local chapters <strong>of</strong> pr<strong>of</strong>essional organizations. Annual<br />

contributions to the <strong>Department</strong> have grown to $17,000 during the 2003 fiscal year. Likewise,<br />

the surplus from the <strong>Department</strong>’s annual 5K race grew to approximately $5,000 resulting in<br />

total contributions to the <strong>Department</strong> <strong>of</strong> $22,000 versus the previous annual average <strong>of</strong> $13,333.<br />

This represents a 65% increase.<br />

In addition, the <strong>Department</strong> is working with the <strong>College</strong> Research center in sponsoring a CPA<br />

review course that is projected to add $5,000 in additional funds each year. The <strong>Accounting</strong><br />

Alumni Chapter has also been reactivated and its activities should result in additional annual<br />

contributions to the <strong>Department</strong>.<br />

The <strong>Department</strong>’s share <strong>of</strong> college and university resources has also increased. For example,<br />

during the 2003 Fiscal Year, the <strong>College</strong> transferred $5,000 in travel funds to the <strong>Department</strong>. In

addition, the <strong>College</strong> and University have awarded newly hired faculty members four summer<br />

grants <strong>of</strong> $5,000 each.<br />

2. While research productivity in the aggregate increased, it was concentrated in two<br />

individuals. A broader cross-section <strong>of</strong> the faculty should be involved regularly in<br />

scholarship. If one or both productive faculty should leave, the situation would<br />

dramatically change.<br />

A broader cross section <strong>of</strong> the faculty is regularly involved in scholarship. Though one faculty<br />

member, Dr. Ted Englebrecht, who was responsible for much <strong>of</strong> the <strong>Department</strong>’s scholarship,<br />

left since the interim report, the <strong>Department</strong>’s research output was maintained because other<br />

faculty increased their scholarship.<br />

For the two year period, 2001-2002, faculty scholarship was distributed in the following manner:<br />

Tenured Faculty<br />

Refereed<br />

Publications<br />

National<br />

Proceedings<br />

Regional<br />

Proceedings<br />

Abdel Agami 4 2 8<br />

Doug Ziegenfuss 6 1 4<br />

Otto Martinson 6 0 2<br />

Tim Mckee 2 0 2<br />

Laurie Henry 1 1 2<br />

Untenured Faculty:<br />

Stephen Gara, 1 st yr. 2 0 2<br />

Yin Xu, 2 nd yr. 0 1 2<br />

Robert Pinsker, 1 st yr. 1 0 2<br />

= = =<br />

<strong>Department</strong> Totals: 22 5 24<br />

Some additional points need to be made concerning the broadening <strong>of</strong> the research output among<br />

faculty members:<br />

• Each untenured faculty member came from a sound research orientated Ph.D. program<br />

(University <strong>of</strong> Memphis, University <strong>of</strong> South Carolina, and University <strong>of</strong> Southern<br />

Florida).<br />

• The newly hired faculty’s scholarship will benefit from improvements in the <strong>College</strong><br />

research infrastructure. For example, all three untenured faculty members are given a<br />

reduced teaching load for their first two years and a $5,000 summer grant for one summer<br />

after their first full year <strong>of</strong> teaching.<br />

• Each untenured faculty member is supplied with graduate assistant resources and given<br />

reduced responsibility for service.<br />

• Two <strong>of</strong> the three untenured faculty members have won university summer grants <strong>of</strong><br />

$5,000.

• The preliminary evidence is encouraging as each untenured faculty member has several<br />

manuscripts under review at academic journals.<br />

• The Dean’s <strong>of</strong>fice also provides additional funds for travel and faculty development as<br />

well as a series <strong>of</strong> research seminars. All three untenured faculty members have presented<br />

their research at the college research seminar.<br />

• Dr. Yin Xu won The Academy <strong>of</strong> <strong>Accounting</strong> Historians’ 2002 Vangemeersch Award,<br />

which recognizes the achievement <strong>of</strong> newly hired faculty in researching the development<br />

<strong>of</strong> the accounting field.<br />

• Dr. Otto B. Martinson won The Institute <strong>of</strong> Management Accountants (IMA) 2002 R. Lee<br />

Brummet Award as the organization’s outstanding educator.<br />

3. Little or no evidence was supplied on how the assessment procedures were used to<br />

provide continuous improvement. In addition, what additional measures are being<br />

currently used or planned for the future?<br />

In the interim report, the <strong>Department</strong> listed its assessment procedures for its academic programs<br />

as:<br />

• A standardized test for the undergraduate program<br />

• Pass rates on the CPA exam and the post graduation questionnaire for the Masters<br />

<strong>of</strong> Science in <strong>Accounting</strong> program.<br />

The <strong>Department</strong> has administered these assessment tools continuously over the past two years.<br />

The results have been fairly consistent but have not revealed any trends that require changes to<br />

the <strong>Accounting</strong> programs. For instance, the completed post graduation questionnaires have all<br />

been extremely favorable. Likewise, the scores on the comprehensive exams and pass rates on<br />

the CPA exam have been consistently positive. The pass rate for all four parts <strong>of</strong> the May 2001<br />

and November 2001 CPA Exam were 25% and 37.5% respectively, well above the national and<br />

state averages.<br />

The <strong>Department</strong> has been trying to identify methods for continuous improvement. For instance,<br />

during 2001, the <strong>Department</strong> changed the content <strong>of</strong> the standardized exam given to graduating<br />

undergraduate students. Instead <strong>of</strong> the standardized AICPA Form II Exam, the <strong>Department</strong><br />

developed an exam composed <strong>of</strong> 100 multiple-choice questions (25 from each section) chosen at<br />

random from a CPA Review Course database. The new format has only been given four times<br />

(Spring 03, Fall 02, Summer 02, and Spring 02). Approximately, 95% <strong>of</strong> graduating accounting<br />

students has taken the exam. Grades have remained constant and have not revealed any trends<br />

that warrant changes to the undergraduate program.<br />

In addition, the <strong>Department</strong> has attempted to use the results <strong>of</strong> competency studies by the<br />

AICPA, IIA, and IMA to evaluate course content and curriculum. One result <strong>of</strong> this effort was<br />

the decision to <strong>of</strong>fer tracks in the Masters <strong>of</strong> Science in <strong>Accounting</strong> program. Currently, the<br />

following tracks exist: Public Accountancy, Managerial <strong>Accounting</strong>, <strong>Business</strong> Assurance<br />

Services, <strong>Accounting</strong> Information Technology, and Taxation. Student and employer response to<br />

the tracks has been positive. The <strong>Department</strong> has aggressively marketed the Masters <strong>of</strong> Science<br />

in <strong>Accounting</strong> program and hopes to significantly increase enrollments as the Commonwealth <strong>of</strong><br />

Virginia implements the 150-hour program.

The <strong>Department</strong> is still exploring the possibility <strong>of</strong> using questions from the Certified<br />

Management Accountant (CMA) and Certified Financial Manager (CFM) exams to develop<br />

assessment exams for the Masters <strong>of</strong> Science in <strong>Accounting</strong> program. Another technique that has<br />

been suggested is focus groups. The <strong>Department</strong> will experiment with focus groups following the<br />

Fall 03 semester.<br />

4. The Grade Forgiveness program study has not been completed and, therefore,<br />

cannot be evaluated.<br />

The University Senate studied this issue during 2002 and revised it to allow students to retake<br />

any course only one time. The new policy went into effect during the 2003 academic year and<br />

insufficient time has elapsed to evaluate the impact <strong>of</strong> the new policy.

Appendix 7 - <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Maintenance Report<br />

AY 2003/2004<br />

AACSB Annual Maintenance <strong>of</strong> Accreditation Report -<br />

AY 2003/04<br />

<strong>Department</strong> <strong>of</strong> <strong>Accounting</strong><br />

<strong>College</strong> <strong>of</strong> <strong>Business</strong> and Public Administration<br />

Old Dominion University<br />

Submitted by:<br />

Douglas E. Ziegenfuss<br />

Chair and Pr<strong>of</strong>essor<br />

August 31, 2004<br />

Progress Update<br />

The <strong>Department</strong> has the following action items listed by the AACSB International in its<br />

December 31, 2003 letter:<br />

5. Evidence <strong>of</strong> progress obtaining additional resources to support research.<br />

6. Evidence <strong>of</strong> progress to broaden the quality and quantity <strong>of</strong> intellectual<br />

contributions among the faculty.<br />

7. Evidence <strong>of</strong> progress in the area <strong>of</strong> assessment and how the assessment<br />

procedures are used to promote continuous improvement.<br />

A follow-up report is due by January 15, 2005.<br />

Situational <strong>Analysis</strong><br />

The <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> (The <strong>Department</strong>) is part <strong>of</strong> the <strong>College</strong> <strong>of</strong> <strong>Business</strong> and<br />

Public Administration (The <strong>College</strong>) at Old Dominion University (The University). Dean<br />

Bagran<strong>of</strong>f and Associate Dean Ardalan have produced a separate <strong>College</strong> maintenance<br />

report that will be referenced in this report when its material is relevant to the<br />

<strong>Department</strong>’s activities. For instance the <strong>College</strong> has no action items outstanding from its<br />

last accreditation and the <strong>Department</strong> has three items.<br />

Dr. Douglas E. Ziegenfuss continues to serve as <strong>Department</strong> Chair. Likewise, Dr. Otto<br />

Martinson serves as Graduate Program Director (GPD) for the Masters <strong>of</strong> Science in<br />

<strong>Accounting</strong> (MSA) program and Ms. Terry Kubichan serves as the Undergraduate<br />

Student Advisor. These individuals have served in their respective positions for four<br />

years providing much needed leadership continuity over the <strong>Department</strong>’s operations.<br />

The <strong>Department</strong> continued to focus on the action items and on strategic planning issues<br />

during the 04 Academic Year (AY04). The <strong>Department</strong> was successful in raising more<br />

funds for research than in the Academic Year 03 (AY03) due to the success <strong>of</strong> its CPA

Review Course and the delivery <strong>of</strong> Ethics Courses to local CPAs. The <strong>Department</strong><br />

successfully endowed a scholarship for $25,000 during AY04.<br />

Several faculty members attended continuing education programs put on by KPMG, Price<br />

Waterhouse Coopers, and the Virginia Society <strong>of</strong> Certified Public Accountants. In<br />

addition, the University has given the <strong>Department</strong> the authority to hire one tenure-track<br />

faculty member for AY06. However, accomplishing this meant consolidating two nontenure<br />

track instructor positions into the one tenured track position.<br />

Research productivity is more broadly based during AY04 than AY03. Newer hired<br />

faculty members are starting to produce quality journal articles while longer serving<br />

faculty members are maintaining their productivity at an acceptable level.<br />

Concerning assessment, the <strong>Department</strong> analyzed students’ performance in its first<br />

Intermediate <strong>Accounting</strong> course and benchmarked its MBA Core Course during AY04.<br />

In addition, plans are underway to implement focus groups <strong>of</strong> recent graduates and<br />

alumni to use as an output measure. Finally, the <strong>Department</strong> uses a local business<br />

magazine to track alumni’s career events.<br />

The <strong>Department</strong> waited during AY04 for the <strong>College</strong> to revise its strategic plan before<br />

revising its strategic plan to bring it in line with the <strong>College</strong> strategic plan. The<br />

<strong>Department</strong> will accomplish this through faculty and advisory council meetings.<br />

Fundraising<br />

The <strong>Department</strong> raised $34,500 in “s<strong>of</strong>t” funds from the following sources during AY04:<br />

• $21,500 in contributions on the <strong>Department</strong>’s behalf to the University Education<br />

Foundation (up from $17,000 in AY03 and $13,333 average during AY00-02).<br />

• $8,000 in funds from the <strong>Department</strong>’s annual DOA 5k race (up from $5,000 in<br />

AY03).<br />

• $4,000 in funds from the CPA Review Course (a new source <strong>of</strong> funds)<br />

• $1,000 in funds from <strong>of</strong>fering mandatory Ethics Training for CPAs (a new source<br />

<strong>of</strong> funds).<br />

Funds from the University education foundation have three sources: General <strong>Department</strong><br />

Contributions, Internal Auditing Program Support, and <strong>Accounting</strong> Faculty Development<br />

Support. The latter is a new category and accounts for nearly all <strong>of</strong> the increase in funds<br />

raised through the education foundation.<br />

In addition to these funds, two additional sources <strong>of</strong> funds were developed during AY04.<br />

The first represents surpluses from the <strong>Department</strong>’s CPA Review Program.<br />

Administered by Timothy Mckee and aided by Walter Berry and Randall Spurrier, the<br />

program saw increased participation and netted approximately $4,000.<br />

The <strong>Department</strong> also developed a version <strong>of</strong> the Virginia Mandatory Ethics Course for<br />

CPAs. This two-hour training session is required for all CPAs registered in the<br />

Commonwealth <strong>of</strong> Virginia. The <strong>Department</strong> began <strong>of</strong>fering sessions <strong>of</strong> the course during

the last two months <strong>of</strong> AY04 and planned on <strong>of</strong>fering many more during AY05. The<br />

<strong>Department</strong> and the Tidewater Chapter, Virginia Society <strong>of</strong> Certified Public Accountants<br />

(TCVSCPA) agreed that the <strong>Department</strong> would <strong>of</strong>fer the courses at University facilities,<br />

TCVSCPA members could attend these events for free, while the department could<br />

charge nonmembers $25 to attend. In addition, the <strong>Department</strong> could <strong>of</strong>fer the courses to<br />

other groups for a flat $500 honorarium. Although only $1,000 was raised during AY04,<br />

scheduled <strong>of</strong>ferings should raise $5,000 during AY05.<br />

<strong>College</strong> support for faculty travel remained constant in AY04 but is expected to increase<br />

during AY05.<br />

Research Productivity<br />

Faculty scholarship as measured by refereed journal articles was distributed in the following<br />

manner during AY04 as compared to AY03:<br />

Tenured Faculty: AY03 AY04<br />

Abdel Agami 2 1<br />

Douglas Ziegenfuss 1 0<br />

Otto Martinson 1 0<br />

Timothy Mckee 0 0<br />

Laurie Henry 0 1<br />

Untenured Faculty:<br />

Stephen Gara 1 1<br />

Yin Xu 0 2<br />

Robert Pinsker 1 1<br />

<strong>Department</strong> Totals: 6 6<br />

The University has given the <strong>Department</strong> authority to hire one tenure track position for AY06<br />

in exchange for eliminating two full time instructor positions. The <strong>Department</strong> plans to hire a<br />

faculty member with a solid academic research record. This will increase the number <strong>of</strong><br />

tenured and tenure-track faculty to nine and reduce the number <strong>of</strong> non-tenure track faculty to<br />

four from six.<br />

Assessment Tools and Procedures<br />

The <strong>Department</strong> continues to rely on University and <strong>College</strong> assessment tools and<br />

procedures. However several assessment tools and techniques are unique to the <strong>Department</strong>:<br />

tracking alumni performance on the CPA Exam, gathering alumni and recent graduate<br />

perceptions using a unique questionnaire, giving students in the final required accounting

class an assessment exam and, new during AY04, assessing student performance in the first<br />

intermediate accounting course.<br />

Information concerning alumni performance on the CPA Exam has not been released for<br />

AY04. The <strong>Department</strong> did distribute questionnaires to all students graduating with an<br />

<strong>Accounting</strong> degree in AY04. The results were generally very favorable but no change from<br />

previous years. Consequentially, the <strong>Department</strong> will be relying on focus groups composed<br />

<strong>of</strong> recent graduates and alumni to gather assessment information. Likewise, student<br />

performance on the assessment exam given during the final required accounting class was<br />

not statistically significant from previous years.<br />

During AY04 the <strong>Department</strong> analyzed the performance <strong>of</strong> students in its first Intermediate<br />

<strong>Accounting</strong> course. This course was chosen because it is the first upper division course that<br />

the vast majority <strong>of</strong> students majoring in <strong>Accounting</strong> must take. It provides the first<br />

opportunity to measure and control access to the <strong>Accounting</strong> program. Students may take<br />

Principles <strong>of</strong> <strong>Accounting</strong> at a community college or another four-year college but generally<br />

take their first Intermediate <strong>Accounting</strong> course at Old Dominion University. Therefore, the<br />

first Intermediate <strong>Accounting</strong> course is an excellent point to measure and control student<br />

quality entering the undergraduate program.<br />

During AY04, approximately 322 students registered for seven sections <strong>of</strong> the class. Fifty<br />

percent <strong>of</strong> the students took Principles <strong>of</strong> <strong>Accounting</strong> at Old Dominion University, fortyseven<br />

percent took Principles <strong>of</strong> <strong>Accounting</strong> at a community college, and the remainder took<br />

Principles <strong>of</strong> <strong>Accounting</strong> at another four-year college.<br />

The average GPA for the course was 1.69; fourteen percent <strong>of</strong> the students earned an A,<br />

eighteen percent earned a B; twenty-three percent earned a C, and forty-five percent earned a<br />

D or F or withdrew from the course.<br />

Twenty-nine percent <strong>of</strong> the students took the class over the University’s distance education<br />

closed-circuit television network called, “Teletechnet.”<br />

Three different instructors taught various sections <strong>of</strong> the class. Sixty-four percent <strong>of</strong> the<br />

students were female.<br />

On average, students were approximately 28 years old.<br />

Sixty-one percent <strong>of</strong> the students were white, twenty-six percent were African-American and<br />

thirteen percent were members <strong>of</strong> other ethnic groups.<br />

Regression analyses were run with each student’s score as the dependent variable and<br />

semester, teacher, manner <strong>of</strong> delivery, and demographic variables as independent variables.<br />

The only variable statistically related to student score was race with African American<br />

students performing significantly lower than students <strong>of</strong> other races or ethnic backgrounds.<br />

Conclusions that can be drawn from these results:

• The instructors teaching the course appear to uniformly assign rigorous grades to<br />

filter students entering the accounting program.<br />

• Students entering the <strong>Accounting</strong> program exhibit much diversity in terms <strong>of</strong> gender<br />

and race. The issue <strong>of</strong> poorer performing African American students must be studied<br />

and evaluated further to improve their performance relative to students from other<br />

races and ethnic backgrounds.<br />

• The students by and large are non-traditional (28 years old and twenty-nine percent in<br />

distance education).<br />

• Transfer students performed as well as Old Dominion University students.<br />

The <strong>Department</strong> plans to continue this assessment technique in AY05 and maybe analyze<br />

student performance in <strong>Accounting</strong> 311, Managerial <strong>Accounting</strong>, (another entry level<br />

course), and <strong>Accounting</strong> 411, Financial Auditing (the final required accounting course).<br />

The <strong>Department</strong> also benchmarked its MBA Core Course. The benchmarking study indicated<br />

that MBA programs requiring fewer than 50 hours to complete required only one core<br />

accounting course that was 66% financial accounting and 34% managerial. Consequently, the<br />

department has revised the course syllabus to reflect this result.

Appendix 8 - <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> Maintenance Report<br />

AY 2004/2005<br />

AACSB Annual Maintenance <strong>of</strong> Accreditation Report -<br />

AY 2004/05<br />

<strong>Department</strong> <strong>of</strong> <strong>Accounting</strong><br />

<strong>College</strong> <strong>of</strong> <strong>Business</strong> and Public Administration<br />

Old Dominion University<br />

Progress Update<br />

Submitted by:<br />

Douglas E. Ziegenfuss<br />

Chair and Pr<strong>of</strong>essor<br />

June 11, 2005<br />

Academic Year (AY) 05 was very good for the <strong>Department</strong>. First, the <strong>Department</strong><br />

addressed all outstanding issues from its last accreditation visit in a letter to AACSB<br />

dated January 15, 2005.<br />

Situational <strong>Analysis</strong><br />

The <strong>Department</strong> <strong>of</strong> <strong>Accounting</strong> (The <strong>Department</strong>) is part <strong>of</strong> the <strong>College</strong> <strong>of</strong> <strong>Business</strong> and<br />

Public Administration (The <strong>College</strong>) at Old Dominion University (The University). Dean<br />

Bagran<strong>of</strong>f and Associate Dean Ardalan have produced a separate <strong>College</strong> maintenance<br />

report that will be referenced in this report when its material is relevant to the<br />

<strong>Department</strong>’s activities.<br />

Dr. Douglas E. Ziegenfuss continues to serve as <strong>Department</strong> Chair. Likewise, Dr. Otto<br />

Martinson serves as Graduate Program Director (GPD) for the Masters <strong>of</strong> Science in<br />

<strong>Accounting</strong> (MSA) program and Ms. Terry Kubichan serves as the Undergraduate<br />

Student Advisor. These individuals have served in their respective positions for five years<br />

providing much needed leadership continuity over the <strong>Department</strong>’s operations.<br />

The <strong>Department</strong> continued to focus on the action items and on strategic planning issues<br />

during the 05 Academic Year (AY05). The <strong>Department</strong> was successful in raising more<br />

funds for research than in the Academic Year 04 (AY04) due to the success <strong>of</strong> its CPA<br />

Review Course and the delivery <strong>of</strong> Ethics Courses to local CPAs.<br />

Several faculty members attended continuing education programs put on by AACSB,<br />

<strong>Accounting</strong> Program Leadership Group (APLG)/Federation <strong>of</strong> Schools <strong>of</strong> Accountancy<br />

(FSA), PricewaterhouseCoopers, and the Virginia Society <strong>of</strong> Certified Public

Accountants. In addition, the University has given the <strong>Department</strong> the authority to hire<br />

two experienced tenure-track faculty members for AY07. However, one tenured<br />

Pr<strong>of</strong>essor retired and a tenure track Associate Pr<strong>of</strong>essor resigned during AY05 after being<br />

given a terminal contract.<br />

Research productivity increased slightly from AY04. Newer hired faculty members are<br />

starting to produce quality journal articles while longer serving faculty members are<br />

maintaining their productivity at an acceptable level.<br />

Concerning assessment, the <strong>Department</strong>, working with the <strong>College</strong>, adopted learning<br />

goals and measures for all <strong>of</strong> its programs and collected assessment data during the<br />

Spring 05 semester. The <strong>Department</strong> will analyze students’ performance in its first<br />

Intermediate <strong>Accounting</strong> and Managerial <strong>Accounting</strong> courses during the Summer 05<br />

term. In addition, a focus group composed <strong>of</strong> <strong>Accounting</strong> Advisory Council members<br />

was conducted for the first time in April 2005. Finally, the <strong>Department</strong> used a local<br />

business magazine to track alumni’s career events.<br />

The <strong>Department</strong> revised its strategic plan during AY05 by working with the <strong>Department</strong><br />

faculty and <strong>Accounting</strong> Advisory Council members. Due to the information from several<br />

sources, the <strong>Department</strong> decided to drop the Taxation track in the MS in <strong>Accounting</strong><br />

program during the next revision <strong>of</strong> the University Catalog.<br />

Fundraising<br />

The <strong>Department</strong> raised $40,000 in “s<strong>of</strong>t” funds from the following sources during AY04:<br />

• $17,500 in contributions on the <strong>Department</strong>’s behalf to the University Education<br />

Foundation (compared to $21,500 in AY04, $17,000 in AY03 and $13,333<br />

average during AY00-02)<br />

• $8,000 in funds from the <strong>Department</strong>’s annual DOA 5k race (compared to $8,000<br />

in AY04 and $5,000 in AY03)<br />

• $5,000 in funds from the CPA Review Course (compared to $4,000 in FY04)<br />

• $9,500 in funds from <strong>of</strong>fering mandatory Ethics Training for CPAs (compared to<br />

$1,000 in FY04).<br />

<strong>College</strong> support for faculty travel increased in AY05 to $900 per tenure track faculty<br />

from $750 during AY04.<br />

The biggest fundraising news <strong>of</strong> AY05 dealt with the announcement by Dean Bagran<strong>of</strong>f<br />

that a $1.5 million Endowed Pr<strong>of</strong>essorship in <strong>Accounting</strong> was being added to the<br />

University’s Capital Campaign. Dean Bagran<strong>of</strong>f, Chair Ziegenfuss, and the <strong>College</strong>’s<br />

Major Gifts Coordinator, Michael Walker, have begun the task <strong>of</strong> forming a steering<br />

committee to coordinate the Endowed <strong>Accounting</strong> Pr<strong>of</strong>essorship drive.<br />

Research Productivity<br />

Faculty scholarship as measured by refereed journal articles was distributed in the following<br />

manner during AY05 as compared to AY04:

Tenured Faculty: AY04 AY05<br />

Abdel Agami 1 0<br />

Douglas Ziegenfuss 0 1<br />

Otto Martinson 0 0<br />

Timothy Mckee 0 0<br />

Laurie Henry 1 1<br />

Untenured Faculty:<br />

Stephen Gara 1 2<br />

Yin Xu 2 2<br />

Robert Pinsker 1 2<br />

<strong>Department</strong> Totals: 6 8<br />

The University has given the <strong>Department</strong> authority to hire two tenure track positions for<br />

AY07 to fill vacancies left by a full pr<strong>of</strong>essor and untenured associate pr<strong>of</strong>essor. The<br />

<strong>Department</strong> plans to hire two established academic researchers to further the <strong>Department</strong>’s<br />

academic research. This will keep the number <strong>of</strong> tenured and tenure-track faculty at 8.<br />

Assessment Tools and Procedures<br />

The <strong>College</strong> and <strong>Department</strong> established learning goals and measures for all its programs<br />

(BSBA in <strong>Accounting</strong> and MS in <strong>Accounting</strong>) during AY05 (See attachments 1 and 2). The<br />

<strong>Department</strong> collected data on these measures for the first time during the Spring 05 semester.<br />

The <strong>Department</strong> also conducted its first focus group composed <strong>of</strong> Advisory Council members<br />

during the Spring 05 semesters. During the Summer 2005 semester, the <strong>Department</strong> plans to<br />

continue the following assessments:<br />

• tracking alumni performance on the CPA Exam,<br />

• gathering alumni and recent graduate perceptions using a unique questionnaire, and,<br />

• assessing student performance in the first Intermediate <strong>Accounting</strong> and Managerial<br />

<strong>Accounting</strong> courses.<br />

This report will be updated as these assessments are performed and the information produced<br />

is reviewed.

ATTACHMENT 1 (to Appendix 8) - BSBA ACCOUNTING LEARNING<br />

OBJECTIVES FOR PROGRAM ASSESSMENT – AACSB & SACS<br />

1<br />

Learning Goal<br />

Ethics<br />

Students will have the<br />

capability to recognize<br />

ethical issues in<br />

business.<br />

Learning Goal<br />

Objective<br />

Students can recognize<br />

and analyze ethical<br />

dilemmas and select a<br />

resolution for practical<br />

accounting situations.<br />

Assessment<br />

Direct<br />

ACCT 301 graded homework<br />

case study including at least<br />

one ethical issue. At least<br />

75% <strong>of</strong> students will receive<br />

a grade <strong>of</strong> 70% on the<br />

resolution.<br />

ACCT 411/511 graded case<br />

study including at least one<br />

ethical issue. At least 75%<br />

<strong>of</strong> students will receive a<br />

grade <strong>of</strong> 70% on the<br />

resolution.<br />

Method<br />

Indirect<br />

Employer<br />

Surveys<br />

Alumni Surveys<br />

2<br />

Written<br />

Communication<br />

Students will be effective<br />

communicators.<br />

Students can communicate<br />

an issue in a coherent<br />

written presentation.<br />

Students will be able to<br />

write clearly using proper<br />

grammar and spelling.<br />

Undergraduates<br />

ACCT 302 paper graded for<br />

punctuation, spelling,<br />

vocabulary, argument,<br />

grammar. At least 75% <strong>of</strong><br />

students will achieve a grade<br />

<strong>of</strong> 70%.<br />

Employer<br />

Surveys<br />

ACCT 317 group systems<br />

design project graded for<br />

punctuation, spelling,<br />

vocabulary, argument,<br />

grammar. Uses a rubric. At<br />

least 75% <strong>of</strong> students will<br />

achieve a grade <strong>of</strong> 70%.<br />

3<br />

Analytical<br />

Problem Solving<br />

Students can apply<br />

methods from a variety<br />

<strong>of</strong> disciplines to solve<br />

business problems.<br />

Students will be able to use<br />

statistical and management<br />

science models to solve<br />

business problems.<br />

Students will be able to<br />

apply concepts related to<br />

the production and<br />

distribution <strong>of</strong> goods and<br />

services<br />

Students will be able to<br />

identify basic<br />

organizational<br />

management issues.<br />

ACCT 301 and 302 case<br />

studies graded for choice <strong>of</strong><br />

accounting theories,<br />

quantitative analysis, and<br />

logical reasoning. At least<br />

75% <strong>of</strong> students will achieve<br />

a grade <strong>of</strong> 70%.<br />