View/Open - HPS Repository - Arizona State University

View/Open - HPS Repository - Arizona State University

View/Open - HPS Repository - Arizona State University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

R67<br />

In<br />

summary, was it a challenging year financially mainly<br />

The MBL's Balance Sheet Assets reflected this impact,<br />

the Letter of Credit supporting the MBL's Long Term Debt.<br />

declining by $7.1 million. The entire decline was concentrated<br />

due to the effect the third consecutive year of investment<br />

in Short Term Investments and Pledge Receivables. market declines had on MBL's philanthropic support and<br />

The Endowment held up due to the receipt of new<br />

investment portfolio. Coming out of our strategic<br />

permanently restricted gifts. Property, Plant & Equipment planning effort we have already started implementing<br />

also held steady as $2.4 million in<br />

improvements more steps that will position the Laboratory for a strong<br />

than offset the accrued depreciation. Liabilities declined rebound in our Government Grants and to ultimately<br />

by approximately $1 million, principally<br />

due to the relinquishment<br />

gear-up for a new capital campaign that should improve<br />

of a Unitrust to the benefit of the Laboratory. our philanthropic support. Our education, summer/<br />

visiting scientist, and conference activities remained<br />

Considering some financial performance ratios, our Return<br />

on Average Net Assets was a negative 6.7%, which is in<br />

strong and when combined with the expanded resident<br />

programs should help us continue to improve<br />

line with most non-profits during this period. The MBL's our operating results in the<br />

Leverage Ratio (Unrestricted & Temporarily<br />

Restricted Net near future.<br />

Assets/ Debt) remains sound at 4.48X. Also, both our Debt<br />

Service Coverage ratio of 1 .72X for 2002 and our nonpermanently<br />

Mary B. Conrad<br />

restricted Cash & Investments of $25.6 million<br />

at year-end are well in excess of the financial covenants<br />

of<br />

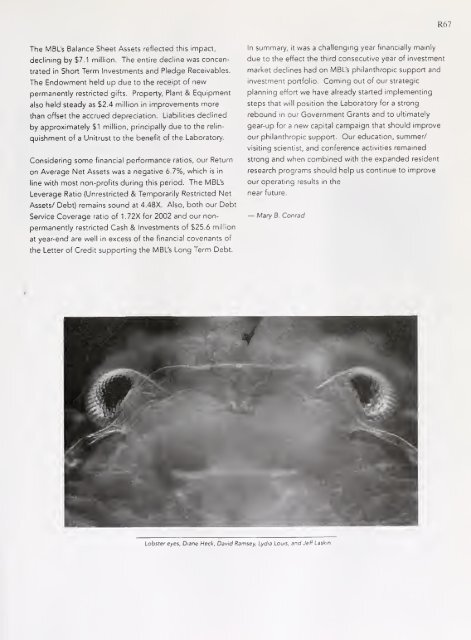

Lobster eyes, Diane Heck. David Ramsey, Lydia Louis, and Jeff Laskin