Hurricane Katrina: Legal Issues - Columbus School of Law

Hurricane Katrina: Legal Issues - Columbus School of Law

Hurricane Katrina: Legal Issues - Columbus School of Law

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

employment) and to pay any taxes with an original or extended due date on or after August 29, 2005. If you are in an<br />

“individual assistance area, this relief will be automatic; if you are in an area where damage is more isolated, you<br />

will need to identify yourself as a hurricane victim by writing“<strong>Hurricane</strong> <strong>Katrina</strong>” in red ink at the top <strong>of</strong> any tax<br />

forms or documents. In Mississippi, residents <strong>of</strong> the following counties are eligible for automatic relief:Adams,<br />

Amite, Attala, Claiborne, Choctaw, Clarke, Copiah, Covington, Franklin, Forrest, George, Greene, Hancock,<br />

Harrison, Hinds, Jackson, Jasper, JeffersonDavis, Jones, Kemper, Lamar, Lauderdale, <strong>Law</strong>rence, Leake, Lincoln,<br />

Lowndes, Madison, Marion, Neshoba, Newton, Noxubee, Oktibbeha, Pearl River, Perry, Pike, Rankin, Scott,<br />

Simpson, Smith, Stone, Walthall, Warren, Wayne, Wilkinson, Winston, Yazoo. You will not be liable for any<br />

interest, late payment, late filing or failure to deposit penalties that would otherwise apply. This relief applies to<br />

returns, extended returns, estimated tax payments and Employment and excise tax deposits.<br />

Must I include assistance payments in my reported income?<br />

You are not required to report as income any qualified disaster relief payments from government agencies, from<br />

charitable organizations or from your employer for living, medical, transportation, food or other related expenses.<br />

Can I deduct my losses from <strong>Katrina</strong> on my tax return?<br />

You may deduct casualty losses on your income tax return. A casualty loss is one resulting in damage, destruction, or<br />

theft <strong>of</strong> property held for personal use, business, or investment purposes. While normally, to be deductible, a casualty<br />

loss must be at least $100 if personal property and exceed 10% <strong>of</strong> your adjusted gross income, these limits will not<br />

apply to <strong>Katrina</strong> losses. You determine the amount you may deduct by determining the decrease in the fair market<br />

value <strong>of</strong> your property because <strong>of</strong> <strong>Katrina</strong>; you may not deduct amounts reimbursed by insurance.<br />

Did <strong>Katrina</strong> affect my Earned Income Credit or Child Credit?<br />

Those with a principal place <strong>of</strong> residence in a <strong>Katrina</strong> disaster area may calculate both credits using their 2004 earned<br />

income.<br />

Appendix<br />

The Appendix includes information related to insurance claims. The Appendix will be expanded in the next week to<br />

include information on document replacement<br />

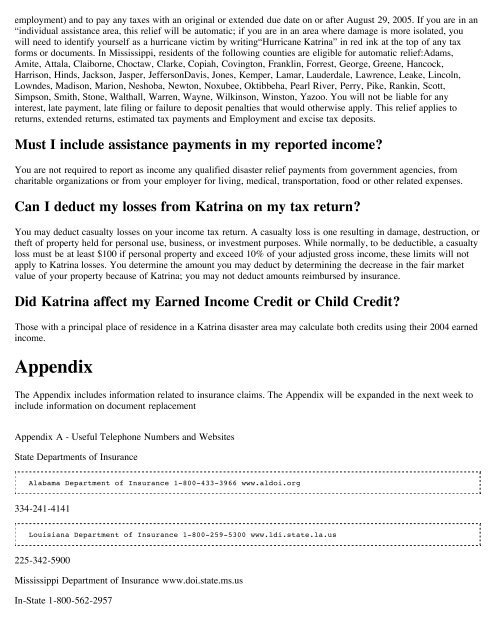

Appendix A - Useful Telephone Numbers and Websites<br />

State Departments <strong>of</strong> Insurance<br />

Alabama Department <strong>of</strong> Insurance 1-800-433-3966 www.aldoi.org<br />

334-241-4141<br />

Louisiana Department <strong>of</strong> Insurance 1-800-259-5300 www.ldi.state.la.us<br />

225-342-5900<br />

Mississippi Department <strong>of</strong> Insurance www.doi.state.ms.us<br />

In-State 1-800-562-2957