HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

HSBC France ⬠20,000,000,000 Euro Medium Term Note Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

32<br />

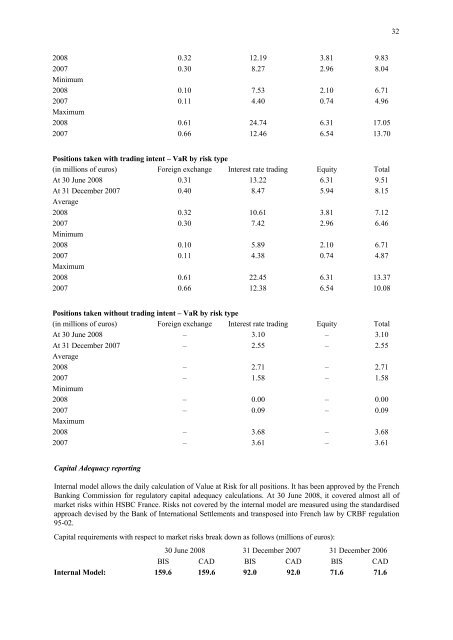

<strong>20</strong>08 0.32 12.19 3.81 9.83<br />

<strong>20</strong>07 0.30 8.27 2.96 8.04<br />

Minimum<br />

<strong>20</strong>08 0.10 7.53 2.10 6.71<br />

<strong>20</strong>07 0.11 4.40 0.74 4.96<br />

Maximum<br />

<strong>20</strong>08 0.61 24.74 6.31 17.05<br />

<strong>20</strong>07 0.66 12.46 6.54 13.70<br />

Positions taken with trading intent – VaR by risk type<br />

(in millions of euros) Foreign exchange Interest rate trading Equity Total<br />

At 30 June <strong>20</strong>08 0.31 13.22 6.31 9.51<br />

At 31 December <strong>20</strong>07 0.40 8.47 5.94 8.15<br />

Average<br />

<strong>20</strong>08 0.32 10.61 3.81 7.12<br />

<strong>20</strong>07 0.30 7.42 2.96 6.46<br />

Minimum<br />

<strong>20</strong>08 0.10 5.89 2.10 6.71<br />

<strong>20</strong>07 0.11 4.38 0.74 4.87<br />

Maximum<br />

<strong>20</strong>08 0.61 22.45 6.31 13.37<br />

<strong>20</strong>07 0.66 12.38 6.54 10.08<br />

Positions taken without trading intent – VaR by risk type<br />

(in millions of euros) Foreign exchange Interest rate trading Equity Total<br />

At 30 June <strong>20</strong>08 – 3.10 – 3.10<br />

At 31 December <strong>20</strong>07 – 2.55 – 2.55<br />

Average<br />

<strong>20</strong>08 – 2.71 – 2.71<br />

<strong>20</strong>07 – 1.58 – 1.58<br />

Minimum<br />

<strong>20</strong>08 – 0.00 – 0.00<br />

<strong>20</strong>07 – 0.09 – 0.09<br />

Maximum<br />

<strong>20</strong>08 – 3.68 – 3.68<br />

<strong>20</strong>07 – 3.61 – 3.61<br />

Capital Adequacy reporting<br />

Internal model allows the daily calculation of Value at Risk for all positions. It has been approved by the French<br />

Banking Commission for regulatory capital adequacy calculations. At 30 June <strong>20</strong>08, it covered almost all of<br />

market risks within <strong>HSBC</strong> <strong>France</strong>. Risks not covered by the internal model are measured using the standardised<br />

approach devised by the Bank of International Settlements and transposed into French law by CRBF regulation<br />

95-02.<br />

Capital requirements with respect to market risks break down as follows (millions of euros):<br />

30 June <strong>20</strong>08 31 December <strong>20</strong>07 31 December <strong>20</strong>06<br />

BIS CAD BIS CAD BIS CAD<br />

Internal Model: 159.6 159.6 92.0 92.0 71.6 71.6